Norway Real House Price Per M2 We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved with some global savings glut concocted by theoretical economists, but have rather been a process whereby the US leveraged up its economy-wide asset base allowing the Chinese to print ‘dollars’ with abandon. China, being a top-down system favoured fix asset investments as a means to grow their economy; the newly minted ‘dollars’ were thus used to bid on international commodities. That this increased the nominal values of tangibles, especially commodities with a direct Chinese bid, should come as no surprise. However, now that the Chinese economy is trying to move away from a system based on slave labour, foreign direct investment and exports to an overleveraged world, fixed asset investment growth is slowing down. That this has negatively affected Perth and Calgary is clearly visible in property data. However, one stalwart bubble remain resolute in all of this.

Topics:

Eugen von Böhm Bawerk considers the following as important: Bawerk, Central Banks, China, commodities, Crude Oil, Economics, Europe, Featured, housing, newsletter, Norway

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

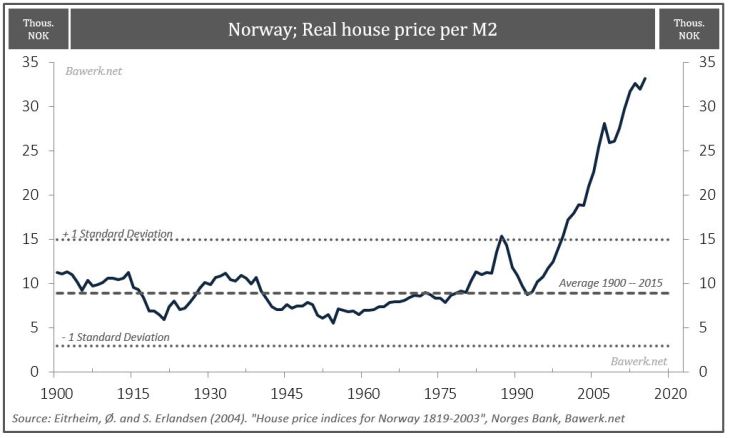

Norway Real House Price Per M2We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades. The road toward such outsized gains in property is not paved with some global savings glut concocted by theoretical economists, but have rather been a process whereby the US leveraged up its economy-wide asset base allowing the Chinese to print ‘dollars’ with abandon. China, being a top-down system favoured fix asset investments as a means to grow their economy; the newly minted ‘dollars’ were thus used to bid on international commodities. That this increased the nominal values of tangibles, especially commodities with a direct Chinese bid, should come as no surprise. However, now that the Chinese economy is trying to move away from a system based on slave labour, foreign direct investment and exports to an overleveraged world, fixed asset investment growth is slowing down. That this has negatively affected Perth and Calgary is clearly visible in property data. However, one stalwart bubble remain resolute in all of this. A bubble like few before it and which will inevitably burst spectacularly with dire consequences for the small community. If you look to the prosperous fringe of northern Europe, you will note a small resource-based economy that has gone completely haywire. A population befuddled by surging commodity prices in a world where monetary policy is a foreign import. Remember the Impossible Trinity; a country cannot have free capital flows, a fixed exchange rate and a sovereign monetary policy all at the same time. While exchange rates were supposedly freely floating, they were in practice partly managed because a too strong exchange rate would crowd out the non-commodity export based part of the economy. Capital was certainly free to flow across the border, but to dampen the effect on the exchange rate the central bank set its monetary policy with diktat from the Eccles Building in Washington DC via Frankfurt. The result of such folly? We present exhibit A, a gargantuan housing bubble equal to none before it. |

|

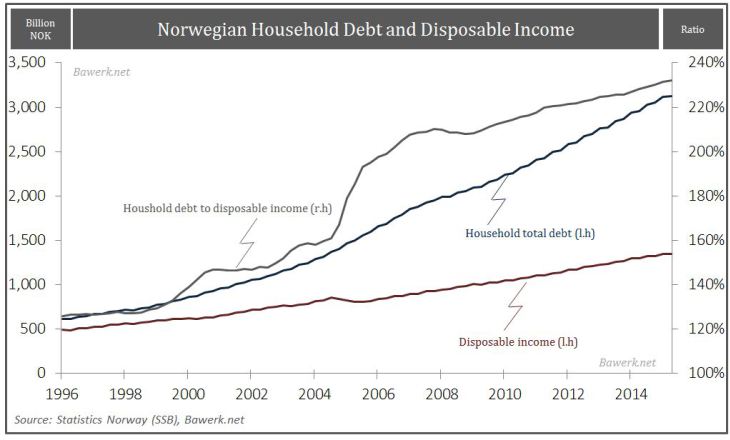

Norwegian Household Debt and Siposable IncomeNote the blip in the 1980s which pulled down the whole Norwegian banking sector; the peak of that bubble traded at one standard deviation from its long-term mean. Norwegian residential property is currently trading at more than four standard deviations from its mean and we have already started to see scant evidence in the most exposed oil towns that this is now coming to an end. The story is a familiar one, but worth telling nonetheless. Incomes did not follow property prices upwards, so the Norwegian household had to take on increasing amounts of debt to enter the housing market. |

|

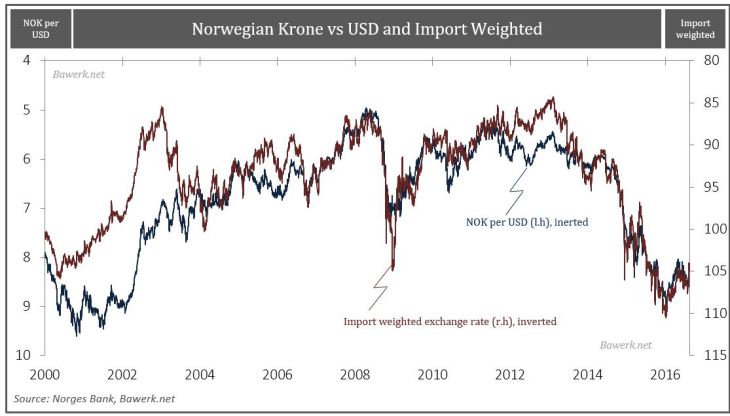

Norwegian Krone vs USD and Import WeightedSince the first quarter of 2000 household debt has grown by an average annual rate of 9.2 per cent, while disposable income has only increased by an annual rate of 5.3 per cent. This is clearly not sustainable as the debt to income ratio is moving higher and higher. In addition, a materially weaker exchange rate have made life more expensive for the average Norwegian. As a country that import most of its consumer goods, a weaker exchange rate does far more harm than good. |

|

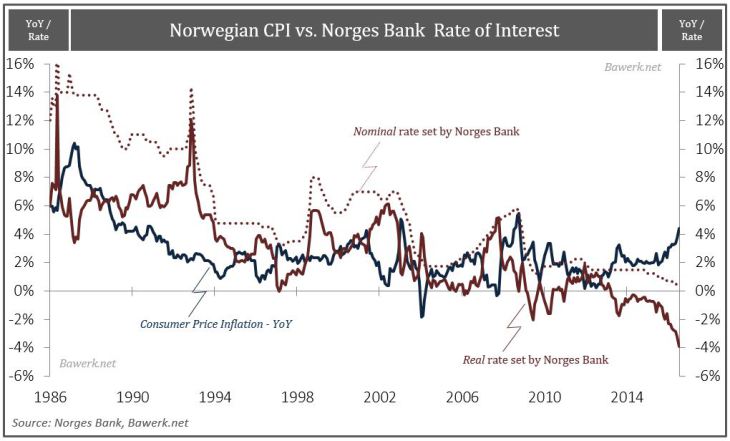

Norwegian CPI vs Norges Bank Rate of InterestOn an import-weighted basis, the Norwegian Kroner is down almost 24 per cent since its peak in February 2013 with an expected impact on domestic consumer prices. However, as consumer price inflation is moving higher, the Norges Bank have been lowering its target rate. As a matter of fact, negative real interest rates have been instrumental in goosing the housing market after its near-death experience in 2009 (see first chart). As consumer price inflation is now running close to 4.5 per cent annual rate the Norges Bank decided to lower rates to only 0.5 per cent as economic activity is plunging. Please note that Norway is heading straight into stagflation and at some point Norges Bank will be forced to tighten monetary policy into a weakening economy. The world should take note, because the real end game for central banks will come when they are constrained by rising inflation in a weakening economy. We all know what happened after the 1970s stagflation; and hiking rates to 20 per cent in an overleveraged world is a lot harder than it was back then. |

The small vulnerable economies will go down this route first, with the likes of Norway, Australia and Canada already struggling. While they are still on the side of monetary accommodation, that could change abruptly as exchange rates depreciate and inflation takes hold, just as their commodity dependent housing bubbles bursts and drags economic activity down with it; larger, more diversified, economies will be next.