Swiss Franc EUR/CHF - Euro Swiss Franc, March 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which...

Read More »Why Silver Went Down – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Rumor-Mongering vs. Data The question on the lips of everyone who plans to exchange his metal for dollars—widely thought to be money—is why did silver go down? The price of silver in dollar terms dropped from about 18 bucks to about 17, or about 5 percent. The facile answer is manipulation. With no need of evidence —...

Read More »Gold and the Fed’s Looming Rate Hike in March

Long Term Technical Backdrop Constructive After a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold. From a...

Read More »Trump Administration Modifying Stance on Way to G20

Summary: Confrontation with China has been dialed down. Criticism of the Fed has been walked back. There is less talk about the dollar. Employment data has been embraced. As a candidate, Trump took a hardline. China is manipulating its currency. The Federal Reserve is acting to help Clinton get elected. The jobs data is fake. Over the past week, the each of these three positions has been considerably softened. It is...

Read More »Boosting Stock Market Returns With A Simple Trick

Systematic Trading Based on Statistics Trading methods based on statistics represent an unusual approach for many investors. Evaluation of a security’s fundamental merits is not of concern, even though it can of course be done additionally. Rather, the only important criterion consists of typical price patterns determined by statistical examination of past trends. Systematic trading on the basis of statistical...

Read More »Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

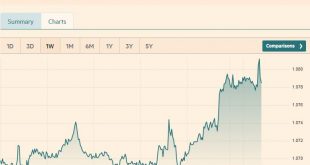

Headlines Week March 13, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand, as also visible in the GDP release. Speculators increase their dollar shorts against Euro and reduce them against CHF. Point 3 was not fulfilled last week. FX Last week: The EUR/CHF suddenly appreciated with the ECB meeting...

Read More »Weekly Speculative Position: Less dovish ECB not include yet

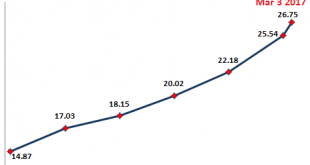

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

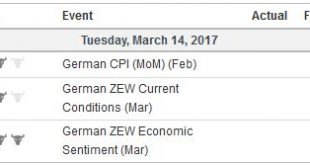

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration’s presence will be...

Read More »Emerging Markets: Preview of the Week Ahead

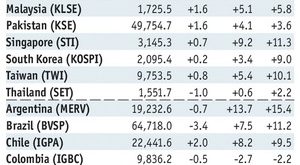

Stock Markets EM FX ended last week on a firm note despite the strong US jobs data, with the dollar succumbing to some “buy the rumor, sell the fact” price action. We think the dollar should recover as the week begins, as it seems risky to be short/underweight dollars going into the FOMC meeting. With the Fed poised to hike 3 or perhaps 4 times this year, we don’t think EM FX can continue to rally the way it has so far...

Read More »FX Weekly Review, March 06 – March 11: CHF loses against the euro

Swiss Franc Currency Index The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by “real money” (investments in cash, bonds, stocks) will be visible in Monday’s sight deposits release. Trade-weighted index Swiss Franc, March 11(see more posts on Swiss Franc Index, ) Source: markets.ft.com...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org