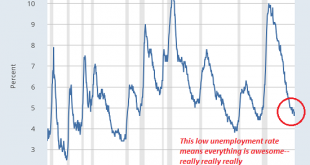

United States There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic...

Read More »Emerging Markets: Preview of the Week Ahead

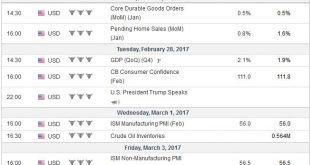

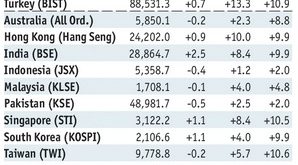

Stock Markets EM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC...

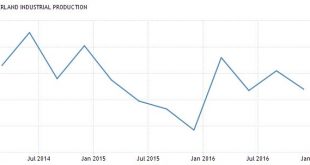

Read More »Swiss Industrial Production Q4: Minus 0.8 percent YoY, Construction: Minus 2.1 percent YoY

Construction Industry Production, Orders and Turnover Statistics in 4th quarter 2016 Neuchâtel, 23.02.2017 (FSO) – Secondary sector production declined 0.8% in 4th quarter 2016 in comparison with the same quarter a year earlier. Turnover fell by 2.1%. This is shown by provisional results from the Federal Statistical Office (FSO). Industrial Production In comparison with the previous year, industrial production...

Read More »Emerging Markets: What has Changed

Summary PBOC tweaked its process for determining the yuan reference rate. Singapore is reportedly studying measures to boost revenue, including higher taxes. Moody’s upgraded the outlook on Russia’s Ba1 rating from negative to stable. Nigerian President Buhari extended his stay abroad. Nigerian central bank tweaked its FX restrictions, but was aimed at retail demand. Brazil political risk is back on the table. Brazil’s...

Read More »There’s a Difference: Fake News and Junk News

Media junkies on the tragic path to extinction believe the junk news, non-junkies see through the manipulation. The mainstream media continues peddling its “fake news” narrative like a desperate pusher whose junkies are dying from his toxic dope. It’s slowly dawning on the media-consuming public that the MSM is the primary purveyor of “fake news”– self-referential narratives that support a blatantly slanted agenda with...

Read More »Not Recession, Systemic Rupture – Again

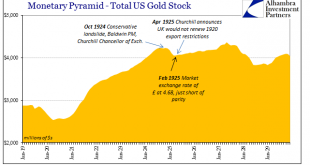

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

Read More »Not Recession, Systemic Rupture – Again

For the very few in the mainstream of economics who venture further back in history than October 1929, they typically still don’t go much last April 1925. And when they do, it is only to further bash the gold standard for its presumed role in creating the conditions for 1929. The Brits under guidance of Winston Churchill made a grave mistake, one from which gold advocates could never recover given what followed. There...

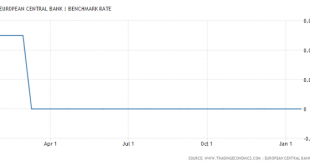

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

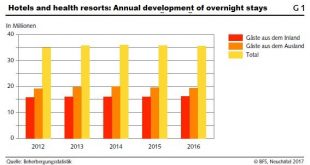

Read More »Statistics on tourist accommodation in December and year 2016: Overnight stays declined by 0.3percent in 2016 in Switzerland

Neuchâtel, 21.02.2017 (FSO) – The hotel sector registered 35.5 million overnight stays in Switzerland in 2016, representing a moderate decline of 0.3% (-96,000 overnight stays) compared with 2015. Foreign visitors registered 19.3 million overnight stays, a decline of 1.5% (-288,000). The number of overnight stays by domestic visitors (16.2 million) showed an increase of 1.2% (+192,000) and thus registering a positive...

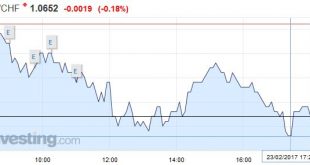

Read More »FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

Swiss Franc EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF This week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org