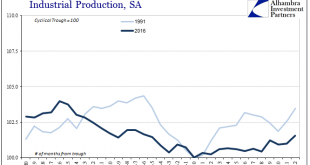

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in...

Read More »Close to a fifth of Swiss workers think corruption widespread, says survey

© Mudretsov Oleksandr | Dreamstime.com A survey conducted by the advisory firm EY shows a rise in perceived corruption in the workplace in Switzerland. 18% of workers surveyed by the firm in Switzerland now think bribery and corruption are widespread in the country. While high this figure is well below the 33% average for Western Europe and the 51% average across all of the 41 countries in Europe, Africa, the Middle...

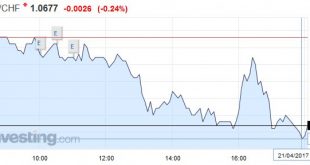

Read More »FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Swiss Franc EUR/CHF - Euro Swiss Franc, April 21(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen’s hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has...

Read More »Trump To “Bully” Fed Into Printing Money – Negative for Stocks, Positive for Gold

David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s. This would be...

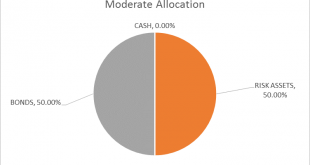

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but...

Read More »India – Is Kashmir Gone?

Everything Gets Worse (Part XII) – Pakistan vs. India After 70 years of so-called independence, one has to be a professional victim not to look within oneself for the reasons for starvation, unnatural deaths, utter backwardness, drudgery, disease, and misery in India. Intellectual capital accumulated in the West over the last 2,500 years — available for free in real-time via the internet — can be downloaded by a...

Read More »Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Bern, 20.04.2017 – Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer...

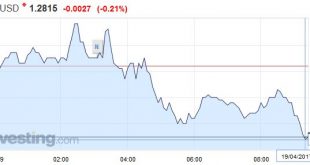

Read More »FX Daily, April 20: Dollar and Yen Push Lower

Swiss Franc EUR/CHF - Euro Swiss Franc, April 20(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates With the exception of the yen, the US dollar is lower against all the major currencies. US Treasury yields are firm, extending yesterday’s rise a little. This may help keep the dollar straddling JPY109, but unwinding long yen cross positions is helping underpin the other major...

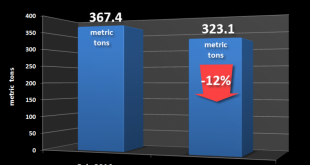

Read More »Silver Production Has “Huge Decline” In 2nd Largest Producer Peru

– Silver production sees “huge decline” in Peru – Production -12% in one month in 2nd largest producer – Silver decline is due to ‘exhaustion of reserves’ in Peru – GFMS recognise that ‘Peak Silver’ was reached in 2015 – Global silver market had large net supply deficit in 2016 – Silver rallied 13.5% in Q1 in 2017 – Base metal production accounts for 56% of silver mining – Base metal demand under threat from global...

Read More »May’s Early Election Bid Sends Sterling on Roller Coaster

Summary: May calls snap election for June 8. Tories running 20 percent point lead over Labour. Next election would be in 2022, after the Brexit negotiations conclude. UK Prime Minister May surprised investors by calling for a snap election on June 8. The Tory Party is ahead of Labour by over 20 percentage points. It currently enjoys a 17-seat majority in the House of Commons. The early election would put the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-310x165.jpg)