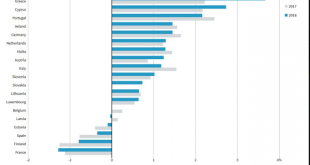

Summary: Greece debt has rallied as a repeat of the 2015 crisis seems less likely. The EC may turn its attention to Italy’s structural deficit. There are several countries, including France that is forecast to have a larger primary deficit in 2018 than 2017. With the official creditors on their way back shortly to Athens, there is a sense that a repeat of 2015 crisis can be avoided. There is a collective sigh...

Read More »The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense. This divergence has sown a great deal of doubt and sometimes apathy...

Read More »How to Outperform Hedge Funds with Just a Few Trades

A Simple Way In their efforts to beat the market, many investors are spending a lot of time searching for rare undiscovered gems or sophisticated trading rules. There is actually a simpler way. I will show below how one could have beaten the market by a sizable margin over approximately the past 90 years – with only two trades per month, while being invested only one third of the time and without employing any...

Read More »The Problem with Gold-Backed Currencies

Any currency is only truly “backed by gold” if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency -money backed by the tangible value of gold, i.e. “the gold standard.” Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be “hard currency”, i.e. sound money, because it would be convertible to...

Read More »FX Daily, February 20: Marking Time on Monday

Swiss Franc EUR/CHF - Euro Swiss Franc, February 20(see more posts on EUR/CHF, ) - Click to enlarge FX Rates US markets are closed for the Presidents’ Day holiday, but it hasn’t prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today. The...

Read More »Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Headlines Week February 20, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan “I view gold as the primary global currency” said Greenspan “Significant increases in inflation will ultimately increase the price of gold” “Investment in gold now is insurance…” Alan Greenspan, the former head of the Federal Reserve has warned that the euro may collapse, saying that he has “grave concerns” about its future. The imbalances in the economic strength of euro...

Read More »Weekly Speculative Position: Rising EUR shorts and falling CHF shorts point to weaker EUR/CHF

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Number One Rule of the Game is Stay in the Game

Summary: Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia’s outlook was upgraded by Moody’s before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps. The week ahead is...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy. We believe markets are underestimating the Fed’s capacity to tighten...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org