Asian stocks rose lifted by commodity names; European equities trade mostly lower but with little in the way of conviction or firm direction while the Italian banking index is at the highest level in a year following domestic earnings; S&P index futures are modestly in the red after the cash market closed at a record high Wednesday and investors prepared for earnings from retailers; we expect the now general vol selling program to promptly lift the S&P into new all time highs minutes...

Read More »Noose Or Ratchet

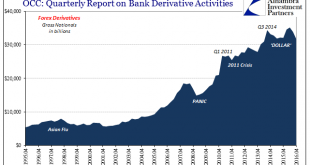

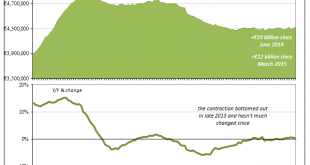

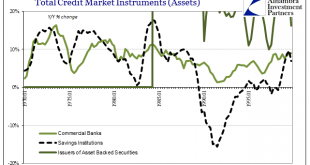

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

Read More »Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to...

Read More »DSGE Models for Monetary Policy Analysis

In a VoxEU eBook, Refet Gürkaynak and Cédric Tille collect the views of central bank and academic economists on DSGE models. In the introduction to the eBook, Gürkaynak and Tille summarize these views as follows: … there is agreement on the place of DSGE models in policy analysis. All see these models as part of the policymaker tool kit, while understanding their limitations and perceiving a similar road ahead.

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

Read More »To The Asian ‘Dollar’, And Then What?

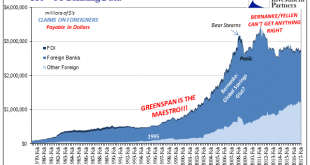

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »Optimal Lunacy

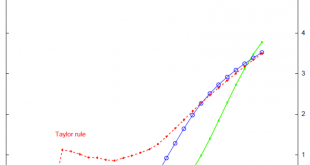

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »US Jobs: Who Carries The Burden of Proof?

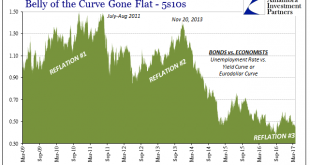

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed...

Read More »Ultra-Loose Terminology, Not Policy

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction. They initially settled on the Fed’s rate hike, where terminating “ultra-loose” policies was...

Read More »We Need To Define The ‘Shadows’, And All Parts of Them; or, ‘Rising Dollar’ Kills Another Recovery Narrative

JP Morgan’s CEO Jamie Dimon caused a stir yesterday with his 45-page annual letter to shareholders. The phrase that gained him so much widespread attention was, “there is something wrong with the US.” Dimon mentioned secular stagnation and correctly surmised it was the right idea if for the wrong reasons. He then gave his own which included a litany of globalist agenda items, including not enough access to mortgages. I...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org