The Fed's new forecasts show a third rate hike in 2017 for the second half of the year and three more in 2018. As expected, the US Federal Reserve raised the target range for the policy rate by 25 basis points to 1.00 percent – 1.25 percent. It also updated its policy normalization principles with...

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

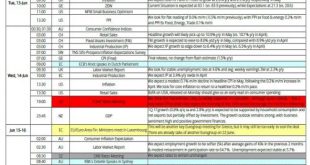

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

Read More »ECB Collateral Framework

In an ECB occasional paper, Ulrich Bindseil, Marco Corsi, Benjamin Sahel, and Ad Visser review the European Central Banks’s collateral framework. From the executive summary, on misconceptions: … differences e.g. with interbank repo markets: first, central banks are not subject to liquidity risk in the way “normal” market participants are, and can therefore accept less liquid collateral. Second, as the central bank has a zero default probability in its domestic market operations,...

Read More »Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden...

Read More »The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen – as he told CNBC two days ago – is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt....

Read More »Less Than Nothing

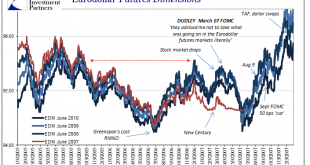

As I so often write, we still talk about 2008 because we aren’t yet done with 2008. It doesn’t seem possible to be stuck in a time warp of such immense proportions, but such are the mistakes of the last decade carrying with them just these kinds of enormous costs. It has been this way from the beginning, even before the beginning as if that was possible. The Great Financial Crisis has no official start date, but we...

Read More »Credit Suisse Economic Outlook: Fed Likely to Raise Rates in June

The global economy remains robust. Nevertheless, the Fed is still the only major central bank that is tightening its monetary policy. The world economy looks to be in very robust shape in the current quarter too; after a significant recovery in the last six months, however, global business...

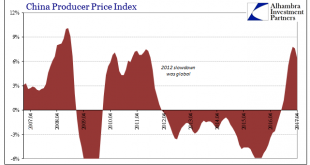

Read More »China Inflation Now, Too

We can add China to the list of locations where the near euphoria about inflation rates is rapidly falling apart. This is an important blow, as the Chinese economy has been counted on to lead the world out of this slump if through nothing other than its own sheer recklessness. “Stimulus” was all the rage one year ago, and for a time it seemed to be producing all the right effects. This was “reflation”, after all....

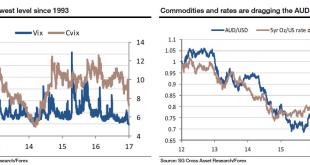

Read More »SocGen: Beware The Ghost Of 1993

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org