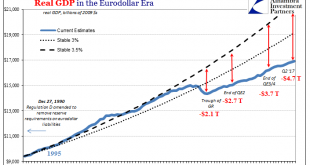

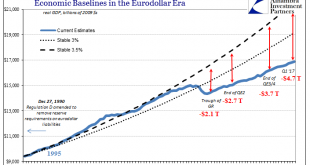

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004. It doesn’t even come close to the routine 4-5% year over year growth rates we saw in the late 90s....

Read More »Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions. Therefore, if inflation behaves as it is supposed to after so many...

Read More »Can Switzerland Survive Today’s Assault On Cash And Sound Money?

Authored by Marcia Christoff-Kurapovna via The Mises Institute, “Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world...

Read More »Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook. On the campaign trail, candidate Trump was very harsh on Janet Yellen. Now six months into his...

Read More »“Makroökonomie hat nicht versagt (It’s Not Macroeconomics That Let Us Down),” FuW, 2017

Finanz und Wirtschaft, August 2, 2017. PDF. Macroeconomists are neither forecasters nor economic policy makers. They devise models. Economic policy makers are in charge of applying them.

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

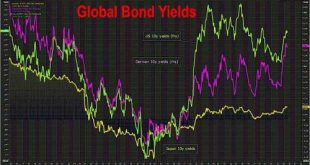

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »“Monetary Economic Issues Today,” Panel, 2017

Panel discussion with Ernst Baltensperger, Otmar Issing, Fritz Zurbrügg and Mark Dittli (moderator) on the occasion of the publication of the Festschrift in honour of Ernst Baltensperger, Bern, June 16, 2017. SNB press release. Video (SNB Forschungs-TV).

Read More »Global Inflation: Low for Longer

Inflation rates in the advanced and developing economies are showing little upside pressure. Global inflation trends remain quite benign. In most of the major advanced economies, headline inflation peaked in the first quarter once the positive base effects from energy price developments had faded....

Read More »“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

Authored by Kevin Muir via The Macro Tourist blog, After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside. I am willing to take that chance. It would be just like me to pound the table on the long side,...

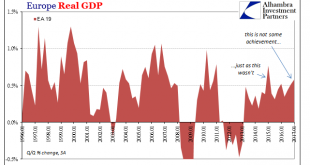

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org