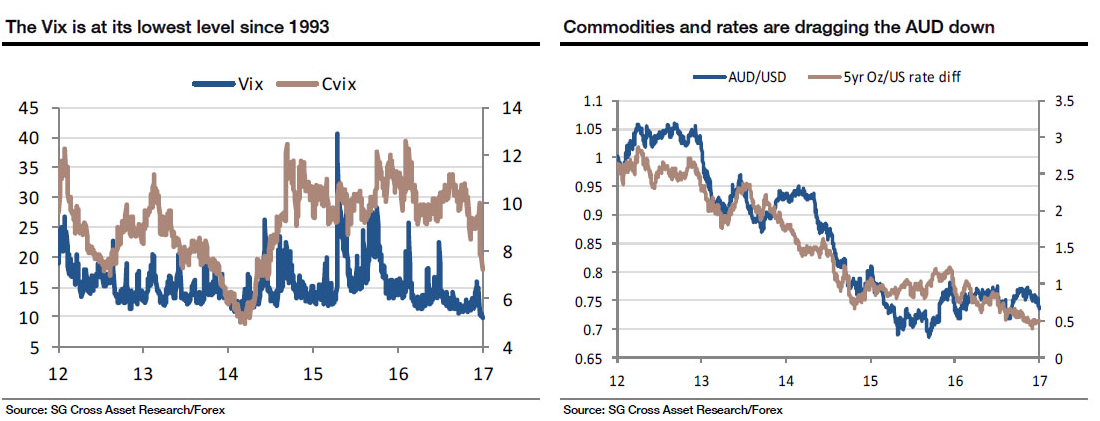

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note, “The ghost of 1993” The ghost of 1993 First things first: Collapsing vol is bad for the yen (and possibly worse for the Swiss franc, in this context) and good for yieldier currencies generally. It’s an invitation to add risk and yield to a portfolio if volatility-adjusted returns are expected to be higher as a result of the low vol. We’re happy to stay short JPY vs EUR, SEK, or indeed HUF and PLN. And SEK, HUF and PLN are all likely to remain supported for a while longer against the Swiss franc as the SNB finally gets the relief they crave, albeit with the caveat that it wouldn’t be at all surprising if the SNB were to use the rise in EUR/CHF to reduce its FX reserve mountain a bit. Beyond the immediate reaction though, too little vol is too much of a good thing. Is it evidence of a quiet, news-free world? Not really.

Topics:

Tyler Durden considers the following as important: Bank of International Settlements, Bond, Business, CPI, economy, Featured, Finance, Financial economics, inflation, inflation targeting, KGB, Larry Summers, Mathematical finance, Monetary Policy, Money, newslettersent, SocGen, Swiss Franc, Swiss National Bank, Technical Analysis, Unemployment, US Federal Reserve, VIX, Volatility, Yen, Zerohedge on CHF

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

With Monday’s financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen’s Kit Juckes with his overnight note, “The ghost of 1993”

The ghost of 1993

First things first: Collapsing vol is bad for the yen (and possibly worse for the Swiss franc, in this context) and good for yieldier currencies generally. It’s an invitation to add risk and yield to a portfolio if volatility-adjusted returns are expected to be higher as a result of the low vol. We’re happy to stay short JPY vs EUR, SEK, or indeed HUF and PLN. And SEK, HUF and PLN are all likely to remain supported for a while longer against the Swiss franc as the SNB finally gets the relief they crave, albeit with the caveat that it wouldn’t be at all surprising if the SNB were to use the rise in EUR/CHF to reduce its FX reserve mountain a bit.

Beyond the immediate reaction though, too little vol is too much of a good thing. Is it evidence of a quiet, news-free world? Not really. It’s mostly evidence that the Fed is predictable and steady, but you can have too much of that. For steady, read slow and for predictable read complacent. The debate about what the Fed should do when faced with a broken Philips curve and a combination of 4.4% unemployment and 2.5% wage growth rages on.

Some (Larry Summers in the FT yesterday) think the Fed should err on the side of easy money or even, raise the inflation target. Others (the BIS, perhaps) point to the rise of dollar-denominated debt globally, worry about financial sector imbalances and would have the Fed normalise policy faster even if CPI inflation and wage growth are low.

As for those of us trying to figure out what it means for markets, while we’ve been pointing out than this tightening cycle is even more tortoise-like than the 2005-2007 one, the comparison with 1993 is worthwhile too – both ended badly for asset markets, after all. Whether the Fed should worry about over-frequent excursions to the zero lower bound, or focus on financial sector stability, the risk is plain – super-easy monetary policy is creating artificially low volatility and driving money into trades and investments that are mispriced as a result.

The Vix is at its lowest level since 1993, Commodities and rates are dragging the AUD down

And to think that just a few years back the last bolded sentence was considered “fake news” planted by some KGB agent…

Tags: Bank of international Settlements,Bond,Business,CPI,economy,Featured,Finance,Financial economics,inflation,inflation targeting,KGB,Larry Summers,Mathematical finance,Monetary Policy,money,newslettersent,SocGen,Swiss Franc,Swiss National Bank,Technical Analysis,Unemployment,US Federal Reserve,VIX,Volatility,Yen