The Treasury Borrowing Advisory Committee (TBAC) was established a long time ago in the maelstrom of World War II budgetary as well as wartime conflagration. That made sense. To fight all over the world, the government required creative help in figuring out how to sell an amount of bonds it hadn’t needed (in proportional terms) since the Civil War. A twenty-person committee made up of money dealer bank professionals...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »FX Daily, December 13: Greenback Quiet Ahead of Five Central Bank Meetings

Swiss Franc The Euro has fallen by 0.06% to 1.1633 CHF. EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP / CHF Since the end of August the pound has been making inroads against the Swiss Franc and recovering from the dramatic drop in exchange rates since the Brexit vote over 18 months ago. GBPCHF has gained 8 cents in 4 months. To put this into...

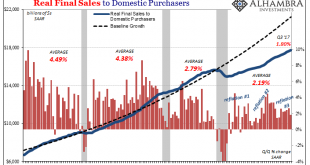

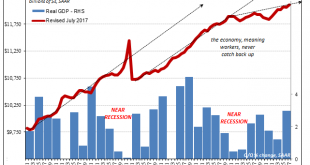

Read More »Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up...

Read More »Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that...

Read More »The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal...

Read More »FX Daily, September 20: Shrinkage and Beyond

Swiss Franc The Euro has fallen by 0.01% to 1.1541 CHF. EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to...

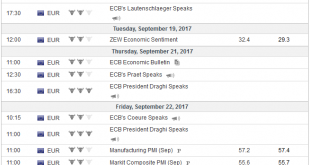

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being...

Read More »FX Weekly Preview: FOMC Highlights Big Week

New Zealand holds elections at end the of next week as well. While the German contest does not appear close and the odds on the most likely scenario are a return of the Grand Coalition, in New Zealand, the center-right’s decade-long rule is being seriously challenged by a resurgent Labour Party. The New Zealand dollar fell by around 5.7% in August. The pullback was twice as deep and lasted twice as long the as the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org