There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.” It may be that was the real reason, for Fischer was no spring chicken. But even in public there is a noticeable and growing rift on the topic of inflation. For some policymakers, there is every reason to suspect the Fed has it all wrong. Others figure that something may be off, but that it

Topics:

Jeffrey P. Snider considers the following as important: bill dudley, CPI, currencies, economy, EuroDollar, Featured, Federal Reserve, Federal Reserve/Monetary Policy, FOMC, inflation, Janet Yellen, Markets, Monetary Policy, Money, newsletter, Stanley Fischer, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.”

It may be that was the real reason, for Fischer was no spring chicken. But even in public there is a noticeable and growing rift on the topic of inflation. For some policymakers, there is every reason to suspect the Fed has it all wrong. Others figure that something may be off, but that it won’t be off forever. The latter category includes influential members like current FRBNY President Bill Dudley. The former head of the Open Market Desk, the Fed’s monetary frontier, is holding fast to “transitory.”

|

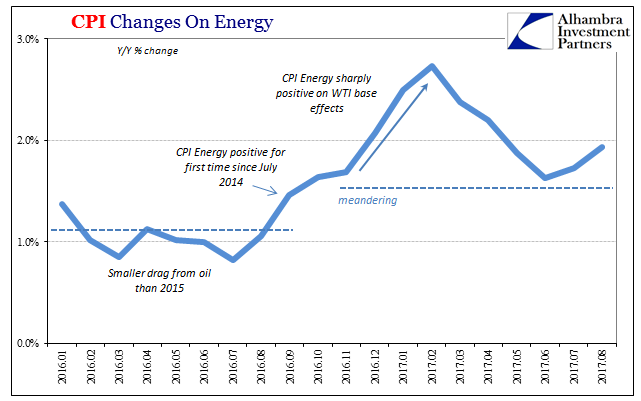

US Consumer Price Index, Jan 2016 - Aug 2017(see more posts on U.S. Consumer Price Index, ) |

| Apologies to Mr. Dudley, but that’s utter nonsense. The word “transient” like “transitory” has lost all meaning in this context, so overused and persistently applied to how nothing ever goes as it is supposed to. Nothing can be temporary if it is so year after year after year. The Fed has missed its inflation target, an explicit target, for more than five years running. By definition that cannot be transitory (first it was oil that was going to be a boost for consumers, then overseas turmoil, and now supposedly Verizon’s unlimited data plans), and it matters far more than semantics.The latest CPI update despite another monthly “gift” in rising oil prices remains underneath 2%. Since the Fed prefers the more understated PCE Deflator as its standard, because the CPI so often exhibits a higher beta (more so why it does), the 2% target is in CPI terms more like 2.75% or 3%. Though gasoline prices were up 10.4% year-over-year in August, the index rose in total by only 1.9%. |

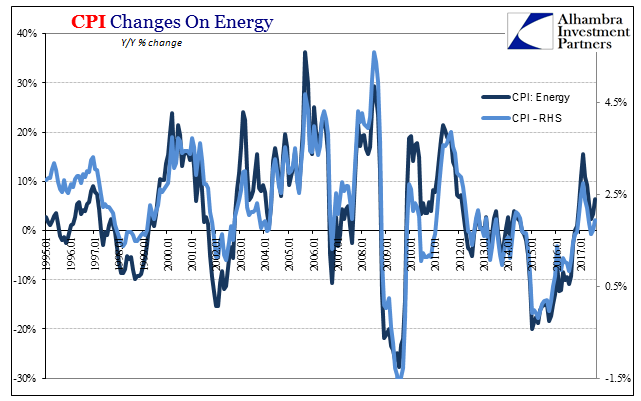

US Consumer Price Index, Jan 1995 - 2017(see more posts on U.S. Consumer Price Index, ) |

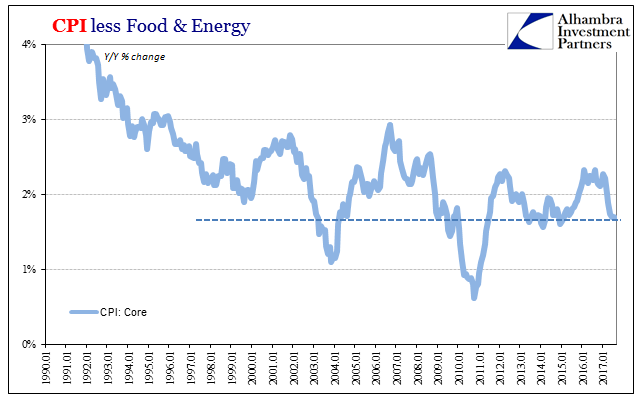

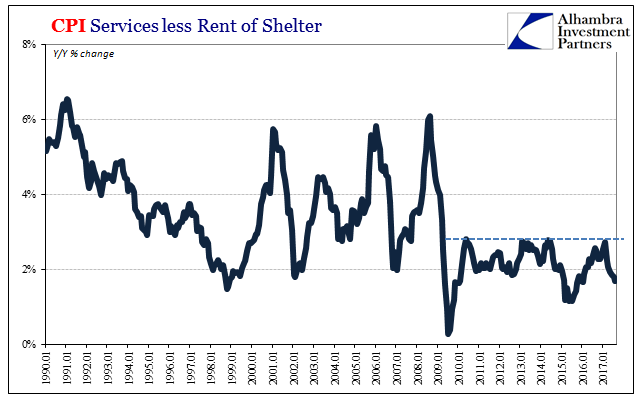

| Outside of Hurricane Harvey, there is no indicated economic momentum, certainly none of the kind consistent with what Bill Dudley still expects for whenever transitory factors stop being transitory one after another after another. In fact, in core measures like the CPI stripped of energy, or services less rent, inflation has exhibited the exact wrong direction. |

US Consumer Price Index, Jan 1990 - 2017(see more posts on U.S. Consumer Price Index, ) |

One Bloomberg article characterized this dilemma recently as:

That’s the problem with this interpretation right there in the last sentence. There actually isn’t any evidence whatsoever the labor market is tight, or might be close to tightening, apart from an unemployment rate that is utterly alone in both its description of the economy as well as its inability to calculate the whole labor market. On the second point, global growth, well that’s proving just as difficult as it was in 2014, 2011, 2007, etc.; all the times similarly “global growth” was believed to be a positive factor in individual economic circumstances – but never really was. |

US Consumer Price Index, Jan 1990 - 2017(see more posts on U.S. Consumer Price Index, ) |

It is significant in these terms that the CPI thwarts Dudley yet again on the same day Chinese economic statistics relatedly and so thoroughly disappoint. This is not really about inflation; there is gravity to the situation that goes way beyond it. Inflation is money, and if it isn’t conforming then we know very well where the problem lies. It has taken a very long time, far too long, but it may finally be reaching the doorstep of the Federal Reserve.

In a perfect world central bankers would have found this out before anyone else, exemplars of knowledge and wisdom about the subject with which they have been charged. In the real world Economics has little to do with the economy. Instead, we might have to make do with Economists whose grasp of monetary reality is almost always transitory.

Tags: bill dudley,CPI,currencies,economy,EuroDollar,Featured,Federal Reserve,Federal Reserve/Monetary Policy,FOMC,inflation,Janet Yellen,Markets,Monetary Policy,money,newsletter,Stanley Fischer