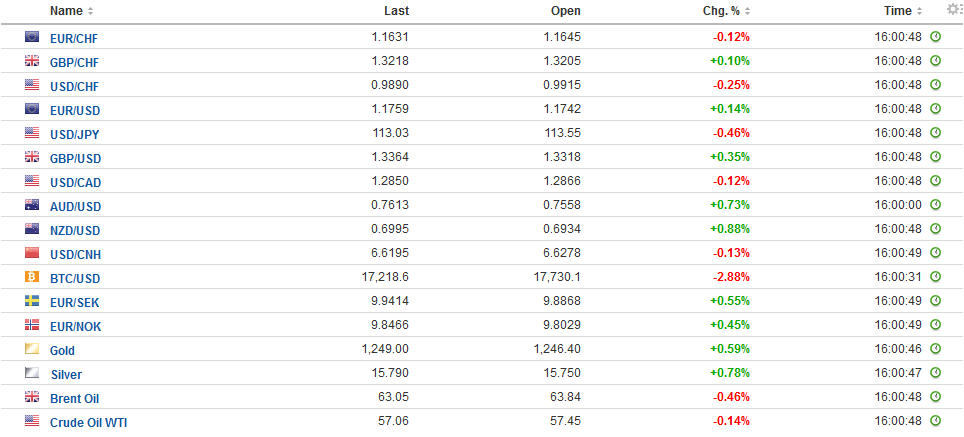

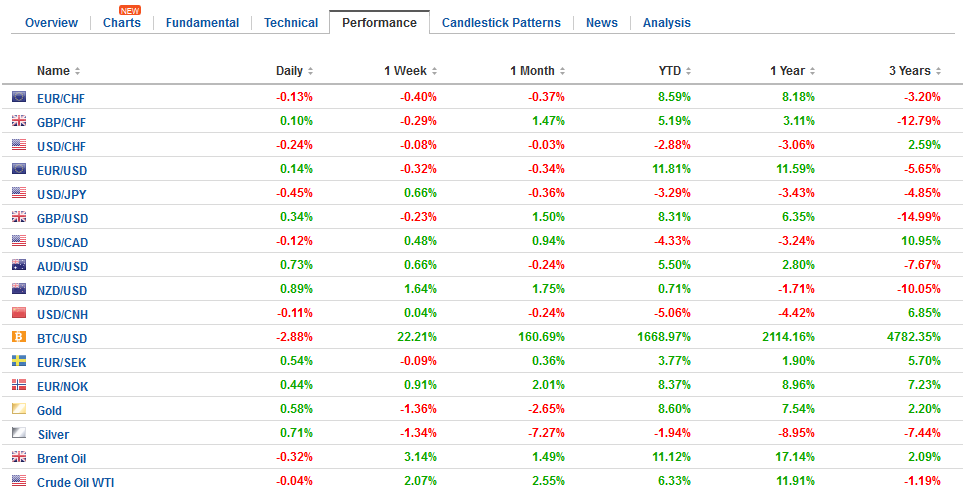

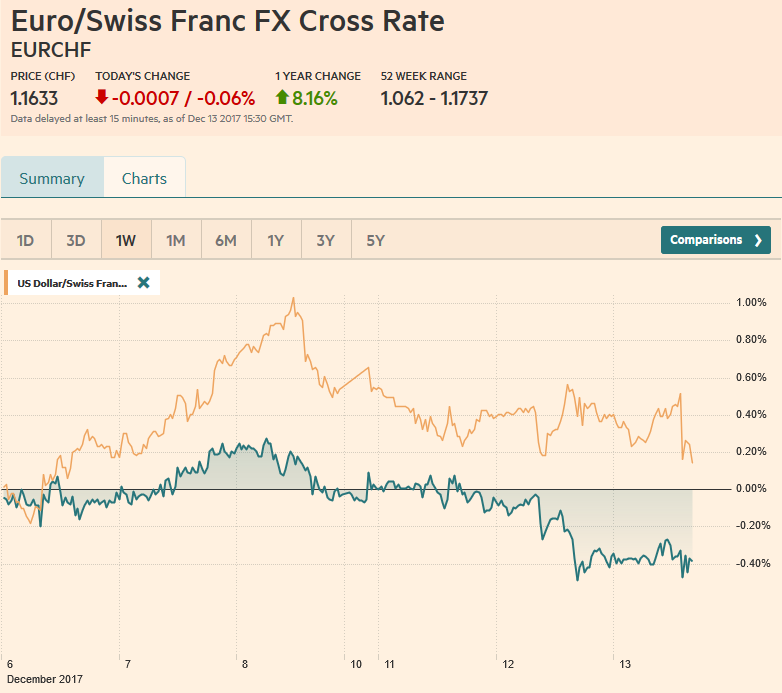

Swiss Franc The Euro has fallen by 0.06% to 1.1633 CHF. EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP / CHF Since the end of August the pound has been making inroads against the Swiss Franc and recovering from the dramatic drop in exchange rates since the Brexit vote over 18 months ago. GBPCHF has gained 8 cents in 4 months. To put this into monetary value, clients converting £200,000 into CHF now compared to 4 months ago will achieve an additional CHF16,000. This week EU officials will meet in Brussels to discuss Brexit at the EU summit. In recent weeks the Brexit negotiations have been fairly successful as both parties have to an

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Eurozone Employment Change, Eurozone Industrial Production, Featured, FOMC, FX Trends, GBP, Germany Consumer Price Index, Japan Core Machinery Orders, JPY, newslettersent, TLT, U.K. Unemployment Rate, U.S. Consumer Price index, U.S. Core Consumer Price Index, U.S. Crude Oil Inventories, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.06% to 1.1633 CHF. |

EUR/CHF and USD/CHF, December 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

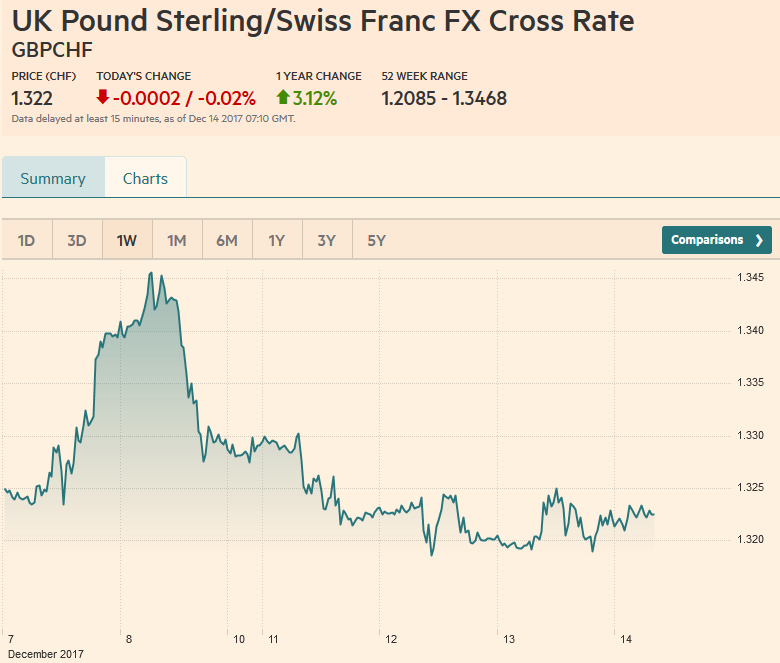

GBP / CHFSince the end of August the pound has been making inroads against the Swiss Franc and recovering from the dramatic drop in exchange rates since the Brexit vote over 18 months ago. GBPCHF has gained 8 cents in 4 months. To put this into monetary value, clients converting £200,000 into CHF now compared to 4 months ago will achieve an additional CHF16,000. This week EU officials will meet in Brussels to discuss Brexit at the EU summit. In recent weeks the Brexit negotiations have been fairly successful as both parties have to an agreement in regards to the Irish border, EU citizens rights and the divorce settlement. Personally I expect that EU officials will continue to paint a positive picture for the time being which will cause the pound to continue to rally against the Swiss Franc. For the time being I expect GBPCHF to remain above 1.30. In other news the Bank of England will meet tomorrow to give the latest interest rate decision. No change is expected however with inflation continuing to rise, the minutes could give further indication to future monetary policy. I believe the reaction will be muted from the Bank of England however keep a close eye as this release has the potential to impact rates. |

GBP/CHF, December 13(see more posts on GBP/CHF, ) Source: markets.ft.com/ - Click to enlarge |

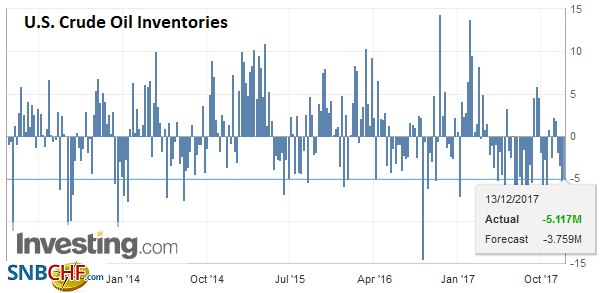

FX TrendsThe Federal Reserve gets the balling rolling today with the FOMC meeting, which is most likely to deliver the third hike of the year. Tomorrow, four European central banks meet: Norway, Switzerland, the UK, and the ECB. The MSCI Asia Pacific Index rose nearly 0.3%, though Japanese and Indian shares were lower. In Europe, the Down Jones Stoxx 600 is paring yesterday’s gains (-0.2%) led by utilities and telecom. Consumer discretion and financials are firmer. The MSCI Emerging Markets Index is up 0.3% taking back half of yesterday’s loss. US 10-year yields are pushing higher after finishing at 2.40% yesterday. European bonds yields are firmer, with Italy and France bearing the brunt. Oil prices are rebounding after yesterday’s drop comes on the heels of the US industry report that showed another large drop in US inventory, part of which is being shifted toward gasoline and heating oil. In emerging markets, the Russian ruble and South African rand are doing best (0.3% and 0.2% respectively.) |

FX Daily Rates, December 13 |

| As North American operators return to their desks, the greenback is little changed. It did slip to the low for the week against the yen, when it became clear that the Republicans were going to lose the Senate seat in Alabama. This reduced the Republican majority to one in the Senate. Owing the fissures in the party, this is putting at risk other parts of Trump’s agenda, which Treasury Secretary Mnuchin acknowledged earlier this week is necessary to achieve the kind of growth levels that the tax bill assumes.

However, the Republicans anticipate finalizing the tax bill in the next few days, while it still has a two-seat majority. The tentative plans call for the Senate vote next Tuesday followed by House vote Wednesday. Still, the plan appears fluid. The latest talk is that the corporate rate may be set at 21%, even though both versions of the bill specified 20%. While the Senate had been considering the bill, a Republican-sponsored amendment say to cut the corporate rate to 20.94% and use the revenue to provide payroll tax relief to parents of young children. It was rejected as anti-growth may the majority. The new version reportedly will use the revenue to fund lower taxes for singles’ making more than $500k and couples earning more than $1 mln. We continue to worry that the delicate compromises that made passage of the Senate bill will be thrown off by the reconciliation process, and could stymie the tax bill at the last minute. President Trump is scheduled to make a public statement on the tax changes at 3:00 PM ET today, which would overlap with Yellen’s last press conference which begins at 2:30 ET. |

FX Performance, December 13 |

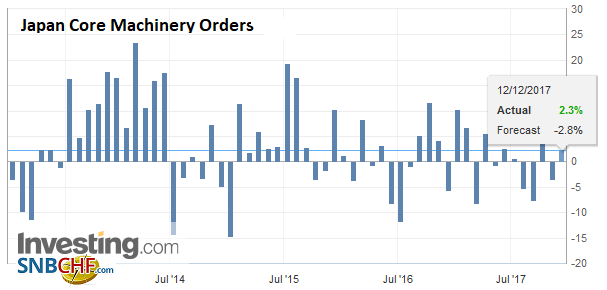

JapanEconomic developments have been modest. There are three economic reports of note. First, Japan reported core machine orders jumped 5% in October, well above the 3% expected. It follows an 8.1% drop in September. It lifts the year-over-year rate to 2.3% from -3.5%. It did not seem to impact the markets. |

Japan Core Machinery Orders YoY, Oct 2017(see more posts on Japan Core Machinery Orders, ) Source: Investing.com - Click to enlarge |

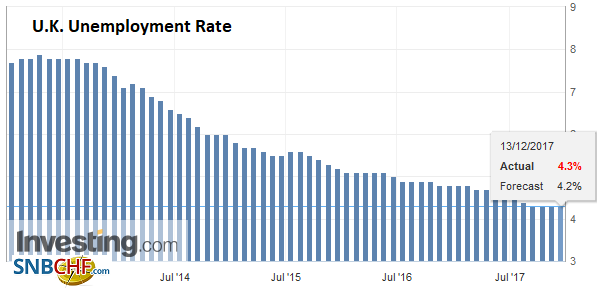

United KingdomThe second report was UK employment. It was mixed. While earnings rose, the employment continues to fall. Specifically, average weekly earnings in the three months through October rose 2.5% from the year ago, period, up from a revised 2.3% in September (from 2.2%). This was in line with expectations. Average weekly earnings rose 2.3%, excluding bonus payments, up from 2.2%. Earnings growth continues to lag inflation, and may continue to do so through at least the first half of next year. Meanwhile the three-month change in employment is a loss of 56k jobs, which is the most in a couple of years. Consider the deterioration. It is the three-month period through September showed a 14k loss, but through August the average for the year was +118k. |

U.K. Unemployment Rate, Oct 2017(see more posts on U.K. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

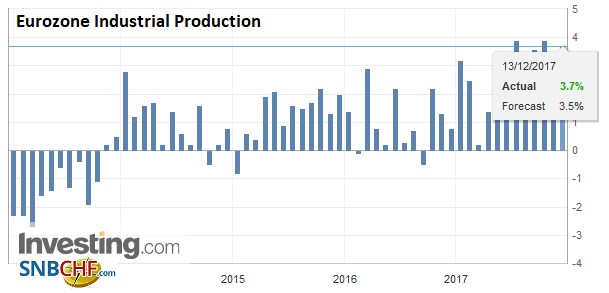

EurozoneThe third report was the eurozone’s industrial production figures for October. The weakness in Germany was more than offset by gains elsewhere, including France, Italy and Spain. The aggregate figure rose 0.2% for a 3.7% year-over-year pace. The previous average for the year was 2.6%. |

Eurozone Industrial Production YoY, Oct 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

| The euro barely responded. It has been confined to a less than a third of a cent range. It briefly traded below last week’s low (~$1.1730) yesterday but closed above it and remains above it today. We suspect short-term participants will sell into gains that could carry the single currency into the $1.1780 area. |

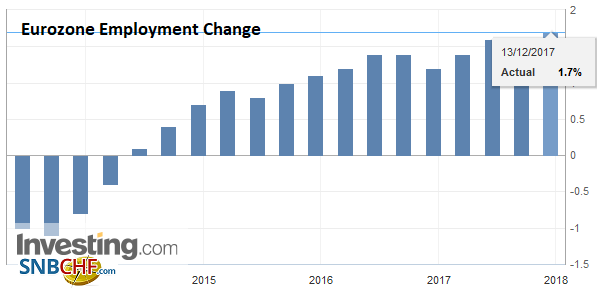

Eurozone Employment Change YoY, Q3 2017(see more posts on Eurozone Employment Change, ) Source: Investing.com - Click to enlarge |

United States

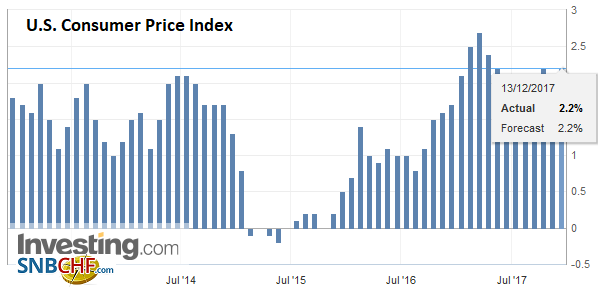

Before getting to the highlight of the day, the FOMC meeting, investors will see November CPI figures. |

U.S. Consumer Price Index (CPI) YoY, Nov 2017(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| A headline rise of 0.4% is expected. However, owing to the base effect, this would produce only a 0.2% rise in the year-over-year pace to 2.2%. |

U.S. Crude Oil Inventories, Dec 2017(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

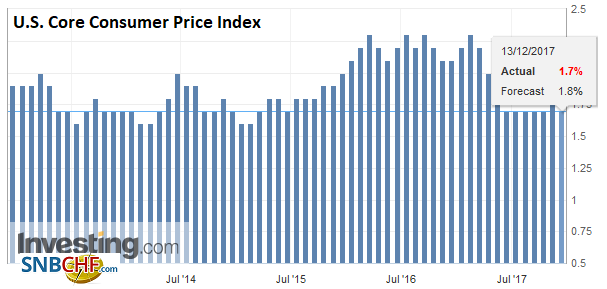

| A 0.2% rise in the core rate is necessary to keep its year-over-year rate steady at 1.8%. Last November the core rate stood at 2.2%. |

U.S. Core Consumer Price Index (CPI) YoY, Nov 2017(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

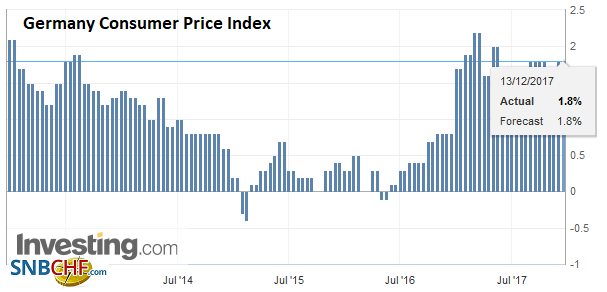

Germany |

Germany Consumer Price Index (CPI) YoY, Dec 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Sterling traded quietly in Asia near the trough seen in North America yesterday near $1.33. Sterling was better bid before the employment data when it made the session high near $1.3370. It chopped around the highs after the data. The intraday technicals suggest that is the high is not in place for the day, it was approached. Resistance is pegged in the $1.3380-$1.3400 area.

A rate hike today has long been anticipated. The lack of a move would catch the market by surprise, and would likely produce a quick steepening of the yield curve and a dollar sell-off. Barring such a destabilizing surprise, the market may be more interested in the new forecasts than the rate move itself. We expected little change in the forecasts (dot plot), but could see a small rise in the median GDP forecast. The September dots showed a median expectation for three hikes next year (two in 2019 and one in 2020). We do not expect much of a change in this, with officials likely to prefer waiting for the tax bill to be seen.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Employment Change,Eurozone Industrial Production,Featured,FOMC,Germany Consumer Price Index,Japan Core Machinery Orders,newslettersent,U.K. Unemployment Rate,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Crude Oil Inventories,USD/CHF