In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »US Jobs: Who Carries The Burden of Proof?

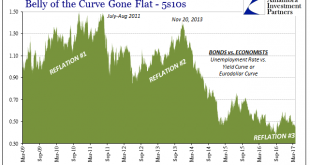

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen. When Mohamed...

Read More »FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it...

Read More »Further Unanchoring Is Not Strictly About Inflation

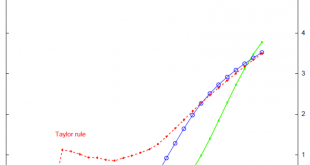

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

Read More »Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

Read More »FX Daily, February 22: Euro Meltdown Continues

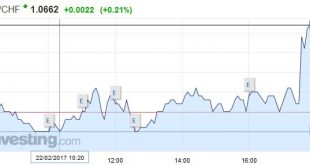

Swiss Franc EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a...

Read More »Their Gap Is Closed, Ours Still Needs To Be

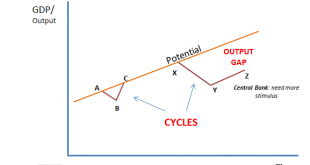

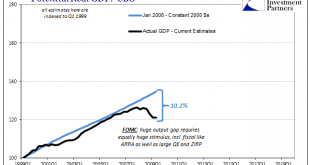

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More »Fed Hikes, Sees Three More in 2017–A Year Ago it Saw Four in 2016

Summary: Biggest change is that Fed sees three instead of two hikes next year. Minor tweaks in the forecasts. Fiscal policy could raise the long-run growth potential, which would be a net good but not needed to reach full employment. As has been tipped since at September the Federal Reserve increased the Fed funds target range by 25 bp to 50-75 bp. The market’s understanding of the Fed reaction function and the...

Read More »FOMC Says Little New, December Hike Remains Likely Scenario

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Fed does not expand much on Sept. statement. Bar to December hike seems low. There were two rather than three dissents. FOMC - Click to enlarge The FOMC did not break new ground and the statement was as widely expected. It indicated that the case for...

Read More »Quick Look at Why the September Jobs Data will Likely Be Strong

Summary: There are several economic data points that suggest a healthy gain in jobs in September. College educated unemployment is 2.5% with high school graduate unemployment at 5.5%. The jobs report we expect is consistent with a Fed hike in December. Let’s admit that the monthly non-farm payroll report is among the most difficult for economists to forecast. The are not many reliable inputs as it is the first...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org