Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small role in the payment system‘ Gold Spot, December 2017(see more posts on Gold, ) - Click to enlarge There were few surprises yesterday when the Federal Reserve decided to hike rates for the third time this year, by 0.25% to 1.5%. Gold responded with a climb of over 1%. The statement accompanying the

Topics:

Jan Skoyles considers the following as important: Alan Greenspan, Alternative currencies, Bitcoin, Bond, Business, Central Banks, China, Cryptocurrencies, economy, Economy of the United Kingdom, European Central Bank, European Union, Featured, Federal Open Market Committee, Federal Reserve, Federal Reserve system, Finance, FOMC, Gold, Gold and Bitcoin, inflation, Janet Yellen, Macroeconomics, Monetary Policy, newslettersent, North Korea, Reuters, Russian central bank, Sovereigns, stagflation, Switzerland, U.S. Treasuries, Unemployment, US Federal Reserve, USDJPY, Volatility

This could be interesting, too:

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

investrends.ch writes Bitcoin zieht deutlich an

| Year-end rate hike once again proves to be launchpad for gold price

– FOMC follows through on much anticipated rate-hike of 0.25% |

Gold Spot, December 2017(see more posts on Gold, ) |

| There were few surprises yesterday when the Federal Reserve decided to hike rates for the third time this year, by 0.25% to 1.5%. Gold responded with a climb of over 1%.

The statement accompanying the announcement was cautiously optimistic. Two FOMC members dissented whilst Yellen gave comments on Trump’s much lauded tax package and bitcoin. This was Yellen’s last FOMC announcement as Federal Reserve Chair. As has become her style she was communicative of the Fed’s upcoming plans in terms of normalising monetary policy and the three rate hikes intended for 2018. Overall Yellen and co are feeling good about how the current Chair is leaving things: “…the committee expects the labor market to remain strong, with sustained job creation, ample opportunities for workers and rising wages,” However concern and perhaps surprise was expressed when inflation data came in lower than expected. The reading of 1.7% in the year to November did not hold back the FOMC from increasing their growth projection from 2.1% to 2.5% for 2018. Gold, defying expectations? Gold is generally expected to stumble when a rate-hike is announced, or at least do nothing at all given how far in advance these things are telegraphed to the market these days. Once again however gold went against conventional opinion and popped up. |

Gold, US Treasuries, S&P 500 and USD/JPY(see more posts on Gold, S&P 500, U.S. Treasuries, USD/JPY, ) |

| In the aftermath of the announcement gold was the biggest gainer whilst dollar stopped its longest winning streak since 2016. Meanwhile bitcoin tumbled as gold surged on ahead.

Gold’s performance shouldn’t really come as much surprise. In the last two years a Federal Reserve rate hike has proven to be something of a launchpad for the price of gold. We have frequently seen double-digit percentage increases in gold prices following an increase in interest rates. This may well be down not to the decision to hike up rates but the language that surrounded it. Often rate hikes come with a hawkish tone, warning of risks to the economy. Instead this latest one was optimistic with some caution. The FOMC, despite boosting economic growth forecasts, has expressed confusion over the stubbornly low inflation rates and therefore, given itself plenty of room for manoeuvring around rate hikes. Gold investors be warned, a rate hike is not likely to be bad news for the yellow metal for some time to come. |

Gold and Bitcoin, December 2017(see more posts on Bitcoin, Gold, ) |

| Naive to ignore bitcoin bubble?

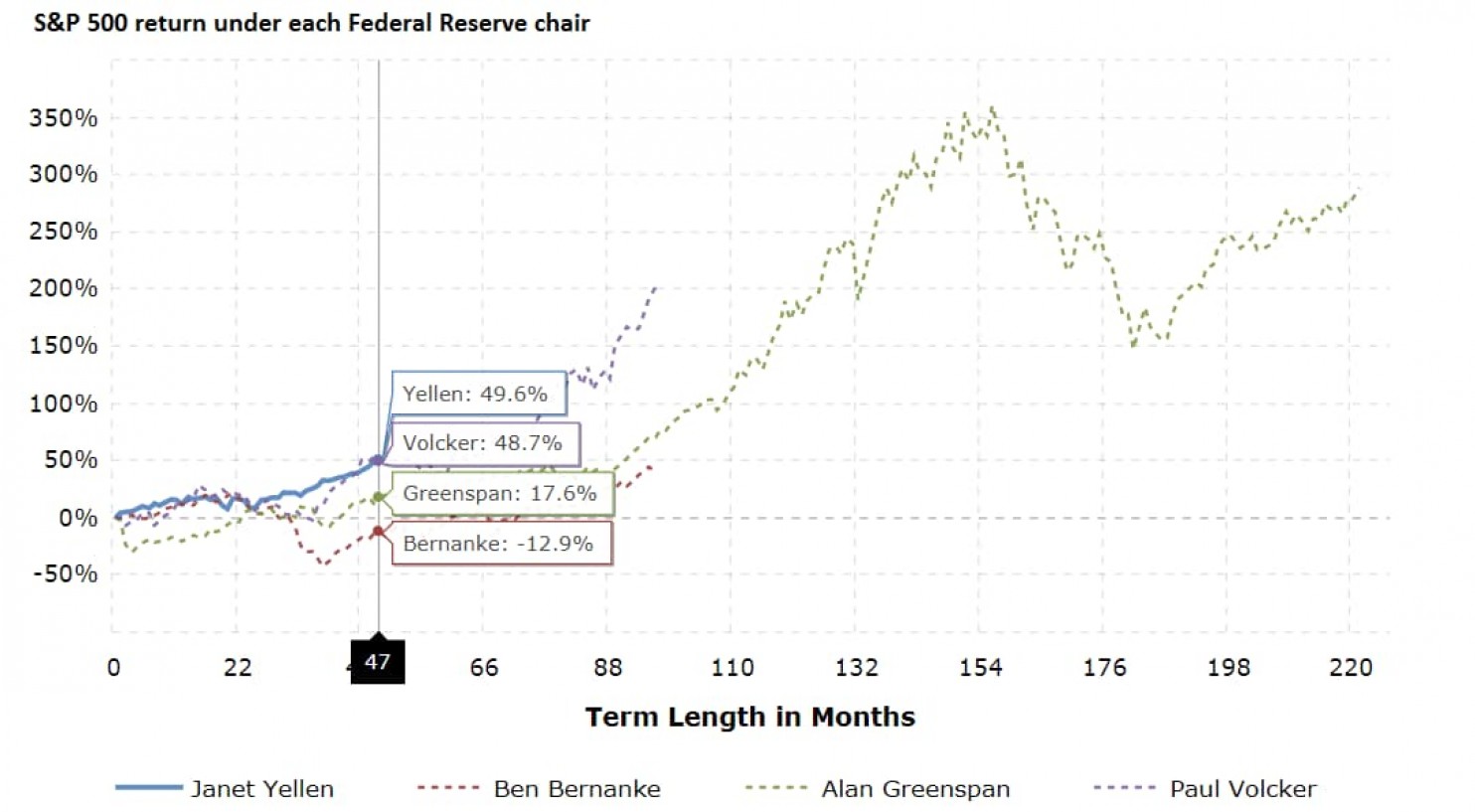

Bitcoin’s rise this year (currently at around $17,000) has grabbed the attention of many. It has almost been promoted to ‘acceptable’ status thanks to the launch of bitcoin futures and Wall Street’s apparent enthusiasm for it. One area where it is hoped that it will quietly go away is at the Federal Reserve. When Powell was questioned about the impact of bitcoin, at his confirmation hearing, he responded that it just wasn’t big enough right now. Yellen was asked about it once again yesterday. She called the cryptocurrency (which has a market cap of $300 billion) a “highly speculative asset” and “not a stable store of value.” What both Yellen and Powell seem to be missing is that bitcoin, like gold, is proving to be a measure for how people feel about the state of fiat currencies and the economy. For sure it is mainly a speculative asset at present, but it still making a significant contribution to the commentary regarding the sentiment in the economy. One of the biggest debates about bitcoin at the moment is whether or not it is the finest example of a bubble. This might be the reason Yellen doesn’t want to draw too much attention to it, after all it is not the only asset experiencing bubblenomics. Currently global asset prices are rising rapidly above their underlying value. Looking at today and ten years ago bubbles are more pervasive now than we saw then. But they have one thing in common – the economists and decision makers are keeping shtum. Even former Fed Chair Alan Greenspan has felt the need to point and shout ‘they’re behind you’. He recently warned that years of unconventional monetary policy by major central banks a global government bond bubble has formed. It’s not just in the sovereign bond market, one just needs to glance at the stock market or housing markets in various leading economies to see that we are one pin prick away from a big ‘pop’. What will be the pin prick? The winding down of money printing and upping of interest rates could well be it, all whilst fault lines are appearing in major economies of the world. This is something Yellen’s successor will have to manage on a fine tightrope, but needless to say he cannot ignore bitcoin or other bubbles for much longer. Yellen, over and out Yesterday was most likely Janet Yellen’s final press conference. She was sent off with a standing ovation, so impressed are Wall Street by her record at navigating America out of the financial crisis. Yellen’s situation is a rare one. She is the first Fed chair not to be reappointed after serving a first full term. President Trump has instead chosen Jeremy Powell. Powell is thought by many to be similar to Janet Yellen and is even known in some circles as Janet-lite. How Wall Street reacts to Powell (or any Yellen-predecessor) will be interesting to see. Whilst he is known to be light on banking regulation (yay, for the swamp) he is also expected to be more tight-lipped about his plans for the Fed. Yellen has made it a hallmark of her tenure to communicate with the markets. Yellen’s departure will also be met with some apprehension given no other recent Fed chair has seen the market climb as far as fast as it did under the first female Chair of the central bank. |

S&P 500(see more posts on S&P 500, ) |

Of course Powell won’t be able to just pick up Yellen’s baton and run with it. There’s a fairly large elephant in the room which cannot be ignored for much longer – inflation. The FOMC tracks various signals for inflation and currently they just aren’t picking up on any strong ones.

Unemployment is at barely 4 percent this plus strong job-growth numbers should arguably be pushing up wages and prices. Yet there is very little inflation…yet. Yesterday’s FOMC statement acknowledged this.

It will be interesting to see how Powell approaches this issue. He may be forced to face it sooner rather than later when Trump’s new tax package might bring an unexpected stimulus to the economy. Whilst the Fed doesn’t expect much benefit from the tax package past 2018, it may well be the catalyst inflation needs in order to start showing its face on FOMC statistics.

Nothing to see here: keep buying gold and carry on

Ultimately what is this post all about? Nothing has changed. As expected, the FOMC has increased interest rates. As expected, gold was pleased and posted gains well above other asset classes. As expected, Yellen’s successor agree with the decision. As expected, little concern was shown for the looking bubble rapidly darkening all four corners of the earth.

So if little has changed, what can be done? Quite simply do not change your approach to keeping a diversified portfolio that is well protected from fumbling central bankers and questionable economic statistics. By all accounts we appear to be heading for the main course of the global financial crisis with 2008 a mere starter by comparison.

Physical gold that is allocated and segregated in your name is the most obvious and historically proven way to insure your personal wealth. The best way to protect yourself from fiat currency debasement and damaging interest rates is to invest in gold. This is exactly the approach taken by a number of central banks. They know that gold cannot be devalued by the US Federal Reserve and will only benefit from Trump’s dangerous, Wall St approach to economic and monetary management.

Tags: Alan Greenspan,Alternative currencies,Bitcoin,Bond,Business,central banks,China,Cryptocurrencies,economy,Economy of the United Kingdom,European central bank,European Union,Featured,Federal Open Market Committee,Federal Reserve,Federal Reserve System,Finance,FOMC,Gold,inflation,Janet Yellen,Macroeconomics,Monetary Policy,newslettersent,North Korea,Reuters,Russian central bank,Sovereigns,stagflation,Switzerland,U.S. Treasuries,Unemployment,US Federal Reserve,USD/JPY,Volatility