In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being different in each and every one. The intent of the Board was to coordinate rather than dictate. It all changed in 1935 with the Banking Act. Somehow the Fed after making massive monetary mistakes for more than just the crash was given more authority. Politics is a powerful force, even for the

Topics:

Jeffrey P. Snider considers the following as important: banking act of 1935, Board of Governors, currencies, Dollar, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, FOMC, inflation, Janet Yellen, Lael Brainard, Markets, Money, newslettersent, recovery, The United States, U.S. Personal Income

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC.

In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being different in each and every one. The intent of the Board was to coordinate rather than dictate.

It all changed in 1935 with the Banking Act. Somehow the Fed after making massive monetary mistakes for more than just the crash was given more authority. Politics is a powerful force, even for the otherwise “independent.” The Act formalized the Board’s role in centralizing monetary policy consistent with government consolidation everywhere else in the wake of the Great Depression.

Before then, there were seven members of the Federal Reserve Board with five appointed by the President and confirmed by the Senate. The other two were ex officio members, the Secretary of the Treasury and the Comptroller of the Currency.

On February 1, 1936, the Treasury Secretary’s and Comptroller’s roles in what was now called the Board of Governors of the Federal Reserve System simply expired. They were replaced by two additional Governors appointed by the President and confirmed by the Senate, each given a term of 14 years. The Banking Act also carved out the specific roles of Chairman and Vice Chairman, both for a four year term.

No Board member who completes a full 14 years may be re-appointed; only those who are brought in to fill an unexpired term may be. The Banking Act contemplated a central bank structure more like that of the judiciary, at least more so in independence and free from politics national as well as local. One of the main contemporary criticisms of the Federal Reserve in its branch affiliations was that it was too close to the banks.

It was this latter structure that over time turned away from banking and toward Economists. Arthur Burns was added to the Board as Chairman on January 31, 1970, remaining in that post until 1978 during the worst of the Great Inflation. Burns was an Economist trained where else but in the Ivy League (Columbia). He replaced the long serving (1951-1970) William McChesney Martin who before his term had made a career in bank examination (at the Fed, no less) and brokerage (at AG Edwards he became that firm’s rep at the NYSE).

Since then, the policy of the central bank has shifted more and more to economic aggregates in place of money and banking. The transformation was made whole under Greenspan. Econometrics became the tool of the central bank, not money. The Fed’s internal structure allowed it to be this way, even encouraged the Ivory Tower of distant enlightened philosopher kings free from all accounting and reckoning.

The Board itself has undertaken several changes since 1936, though too often simply moving its center of gravity further in the direction of Economists. The most recent, however, and one I am sure no one has ever heard of, was an attempt to change that. In 2015, Congress passed a law, signed by President Obama, amending the original 1913 Federal Reserve Act to insert the following requirement upon its Board of Directors:

In selecting members of the Board, the President shall appoint at least 1 member with demonstrated primary experience working in or supervising community banks having less than $10,000,000,000 in total assets.

Obama had in January 2015 nominated former Bank of Hawaii CEO Allan Landon to serve on the Board before the requirement became law. It was expected that Landon’s experience in “community banking” would satisfy the statute upon its legal enforcement. Though there were questions at the time as to whether that was actually true (leave it to the government to make the otherwise simple abstruse and arcane), his nomination was effectively killed by the politics of the 2016 Presidential campaign.

As of now, the Board of Directors remains two short of its full complement (Obama also nominated Economist Kathryn Dominguez whose candidacy suffered the same fate as Landon’s). The last Board member to be added was poignantly in mid-June 2014 with acceptance of Lael Brainard. Dr. Brainard was appointed to fill an unexpired term that runs until January 31, 2026.

The irony of that last appointment was its proximity to the start of the full “rising dollar.” It was mid-June 2014 when repo fails suddenly spiked, oil prices peaked, and the global economy was off to its (so far) latest ebb. The outbreak of what metastasized in a “dollar shortage” left policymakers in a daze, especially given the more beautiful projections for how things were supposed to go past 2014.

Brainard, however, has been one of the few who has come closest to “getting it.” In a speech given in early June 2015, just as the consequences of the “rising dollar” were really starting to be felt worldwide, she worried openly to an audience in DC that maybe weakness wasn’t “transitory” to be easily overcome by the consumer spending boost most Economists expected crashing oil to provide:

Second, it would not be the first time this recovery has proceeded in fits and starts. The underlying momentum of the recovery has proven relatively susceptible to successive headwinds, which have kept overall economic growth well below the average pace of previous upturns.

My own reading is that earlier, more optimistic growth projections may have placed too much weight on the boost to spending from lower energy prices and too little weight on the negative implications for aggregate demand of the significant increase in the foreign exchange value of the dollar and large decline in the price of crude oil.

The Fed has been talking “headwinds” since 2007, never once getting around to truly identifying them especially as they might relate to these “fits and starts.” Brainard out of all the rest of them came tantalizingly close in a second speech delivered less than a month after. The topic for this later talk was liquidity, with at least this one Fed official trying to address its lacking elements rather than, as Yellen, pay lip service to “resilience.”

Of course, other developments may be affecting liquidity in financial markets. For example, market participants have indicated that changes in participants’ risk-management practices may be contributing to reduced market liquidity. In particular, the experience of the financial crisis may have led many participants to reevaluate the risk of their market-making activities and either reduce their exposure to that risk, become more selective, or charge more for it, thereby reducing liquidity.

And finally in a recent speech from last week, Dr. Brainard signals her growing discomfort with the Phillips Curve and lack of inflation acceleration.

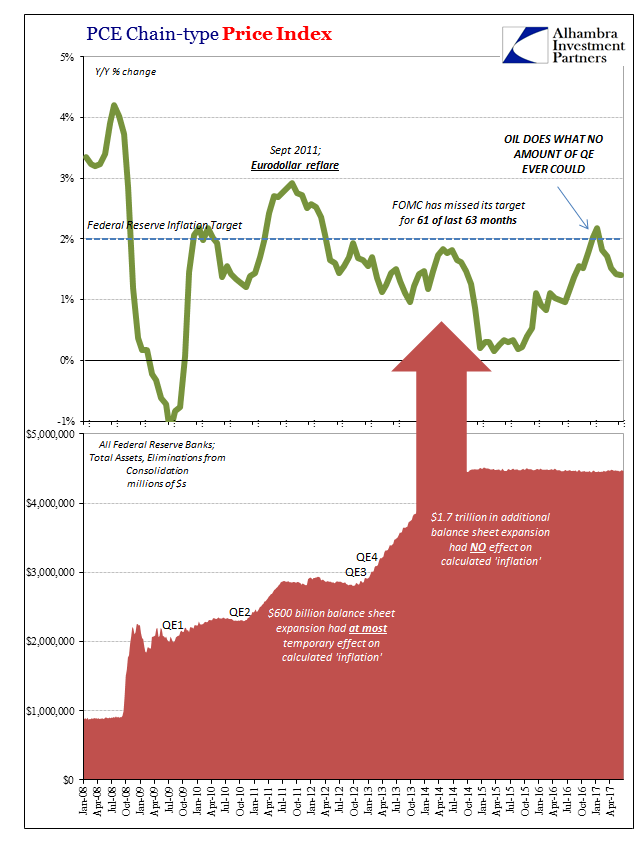

Nonetheless, there is a notable disconnect between signs that the economy is in the neighborhood of full employment and a string of lower-than-projected inflation readings, especially since inflation has come in stubbornly below target for five years…In contrast, what is troubling is five straight years in which inflation fell short of our target despite a sharp improvement in resource utilization.

One key factor that may have played a role in the past three years is the decline in import prices, reflecting the dollar’s surge, especially in 2015.

| To recap these small pieces in Brainard’s speech catalog: headwinds create recovery in fits and starts; market liquidity may be negatively affected by risk perceptions reducing balance sheet capacity; and inflation has missed for five years despite assumed resource utilization due to largely the dollar’s surge. |

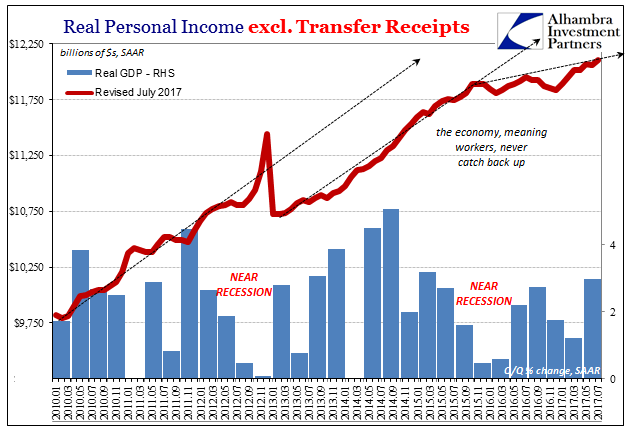

US Real Personal Income, Jan 2010 - Jul 2017(see more posts on U.S. Personal Income, ) |

| She has all the dots assembled, but is unable to connect them: dollar surge as a result of shrinking balance sheet capacity that limits economic momentum at best while at worst actively depressing it (2008, 2011, 2014), the fits and starts of uneven economic “growth.” |

Chain-type Price Index, Jan 2008 - Apr 2017 |

I can’t speak for what might be in Dr. Brainard’s mind, but I can offer what I believe is a qualified opinion about all this. As an Economist, she is trained not to fit these pieces together. In fact, the orthodox paradigm completely depends upon their distance and nonrelation. She can see the problem in distinct images, prevented by ideology from witnessing the horror movie of the last lost decade.

If even Congress can act in a way that teases this problem, you just know there is an intuitive feel amongst the public for the deeply troubling way Economists have managed things. On some level, people know Economics doesn’t have the answers; hell, it didn’t even have the problem until recently. You can’t call the last ten years a recovery and expect a majority to have much respect for what you do.

The inflation debate of 2017 has only served to sharpen these distinctions. Economists like Lael Brainard seem able to understand the position and what it might mean. Janet Yellen, like Ben Bernanke, does not. Does that propose Brainard should replace Yellen? No, it advises the whole paradigm should be scrapped in a new Banking Act that recognizes the full explanation for where we are and more so why.

Tags: banking act of 1935,Board of Governors,currencies,dollar,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,FOMC,inflation,Janet Yellen,Lael Brainard,Markets,money,newslettersent,recovery,U.S. Personal Income