This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA ...

Topics:

Tyler Durden considers the following as important: Bank of Canada, Bank of England, Bank of Japan, Business, Conference Board, Continuing Claims, CPI, Dallas Fed, Deutsche Bank, economy, European Central Bank, European Union, Eurozone, Federal Open Market Committee, Federal Reserve, Federal Reserve system, Finance, flash, Florida, FOMC, France, Germany, Headline inflation, Housing Market, Housing Starts, Hungary, inflation, Initial Jobless Claims, International Monetary Fund, Japan, John Williams, Kansas City Fed, Kansas City Federal Reserve, Labor, Markit, Monetary Policy, Money, NAHB, New Zealand, Organization of Petroleum-Exporting Countries, Philadelphia Fed, Philadelphia Fed business, Philadelphia Fed manufacturing, Philly Fed, San Francisco Fed, SocGen, Swiss National Bank, Trade Balance, United Nations, US Federal Reserve, Zurich

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes DWS mit neuem Vertriebsleiter für Institutionelle

investrends.ch writes Deutsche Bank mit Gewinnsprung – Aktie steigt

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines.

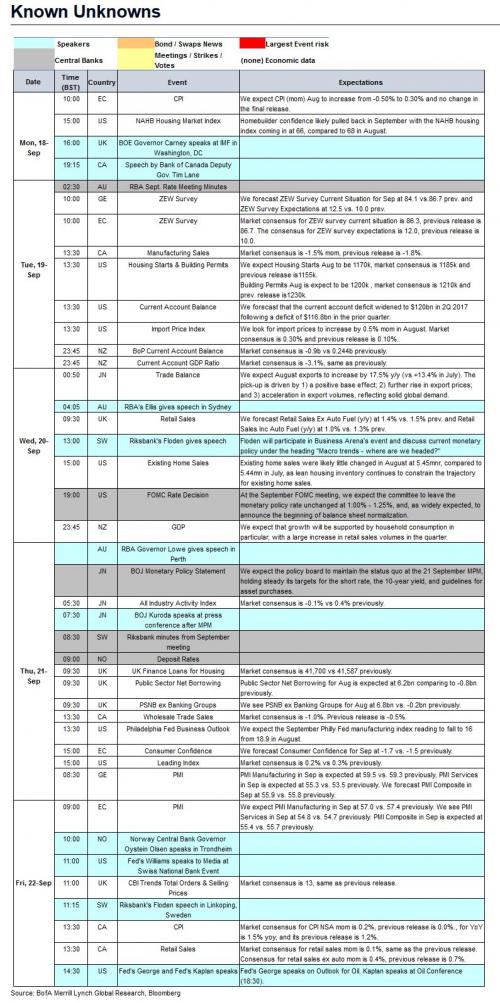

BofA highlights the week's key global events:

- Central bank meetings: US FOMC and BoJ

The Fed will make policy announcement on Wednesday. Balance sheet normalization is unlikely to be the main event given its advance notice. The focus will be on dot plot, economic forecasts and Chair Yellen's press conference. Forecasts for this year may reflect higher growth and headline inflation but lower core inflation. Most forecasters do not expect the dots to move, maintaining the expectation of a December hike, even though the market violently disagrees. According to SocGen, in the September 20 FOMC meeting, the Fed will announce an October start to its balance sheet normalization plan. Meanwhile, the statement will acknowledge that the impact of the hurricanes will depress the data in the near term but also emphasize that the softness will be temporary, which should keep a December rate hike in play, especially after last week's solid CPI report.

The BoJ policy board is likely to maintain status quo on Thursday, holding short rate target, 10-year yield, and asset purchase guidelines steady. The two new board members (Suzuki and Kataoka) are expected to vote in line with the rest of the board, restoring unanimity in BoJ policy decisions.

- Elections ahead in Germany and New Zealand

German elections will take place this Sunday. Polls are consistent with a parliamentary composition supporting another four-year mandate for Chancellor Merkel. Because this would be her fourth in a row, the next administration's government style may be seen as more predictable.

Elsewhere, New Zealand goes to the polls this Saturday. A change to the RBNZ policy framework with broader policy mandate has been proposed by Labor and NZ First parties. Following a surge in polling support for new Labor leader, polls suggest a prospect of change, with a coalition government as the most likely outcome. A Labor win would likely mean a higher hurdle to rate hikes and a looser fiscal policy.

- May on Brexit

The highlight of the week should be the prime minister's speech in Florence on Brexit on Friday. This is being billed by the government as a major speech which should help to move the Brexit talks forward. As such, the next round of talks has been pushed back one week to start on 25 September. Many analysts, however, are fearful of yet another disappointment in that the UK proposals might fall well short of what the EU hopes for and expects.

* * *

Aside from the FOMC, in the US it is a relatively quiet week, with housing starts on Tuesday and Philly Fed manufacturing index on Thursday. The statement following the July FOMC meeting will be released on Wednesday. There are a few speaking engagements by Fed officials on Friday.

Deutsche Bank breaks down the week's key data events on a daily basis:

- Monday starts with the final reading of the Eurozone’s August inflation along with Italy’s trade balance. Over in the US, there is the NAHB Housing market index and total net TIC flows for July.

- Onto Tuesday, the Eurozone’s current account and construction output stats are due. There is also the ZEW survey on economic growth for Germany and the Eurozone. Over in the US, there are housing starts, building permits, current account balance and the import / export price index.

- Turning to Wednesday, Germany’s August PPI along with the Japanese trade balance and exports & imports stats will be out early in the morning. In the UK, there is the retail sales release for August. Over in the US, the main event is the FOMC rate decision along with data on MBA mortgage applications and existing home sales.

- For Thursday,Japan’s all industry activity index will be due early in the morning along with the BOJ policy rate decision later on. Then the Eurozone’s confidence index and ECB’s economic bulletin is also due. In the UK, data on the Finance loans for housing, private sector and public sector borrowing are due. Over in the US, there are numerous data, including: Conference board leading index, Philadelphia Fed business index, FHFA house price index, initial jobless claims and continuing claims.

- Finally on Friday, Japan will release data on the buying of Japanese bonds and stocks early in the morning. In France, there is the final reading of 2Q GDP and wages. Over in Canada, there is the August inflation and retail sales. Elsewhere, the Markit PMIs Deutsche on services, manufacturing and Composite will be available for the US, Eurozone, Germany and France

Onto other events:

- On Monday, US’s lead negotiator on the NAFTA talks will speak and lay out the US’s priorities. There are also other speakers, including: i) BOE’s governor Mark Carney giving a lecture at IMF’s headquarters, ii) Bank of Canada’s deputy governor Timothy Lane, iii) ECB’s supervisory board member Angeloni speaking at an Italian banking conference, as well as iv) Germany’s Merkel and EC President Juncker speaking at the 75th birthday of Germany’s longest serving finance minister.

- On Tuesday, there is the general debate of the UN general assembly and Germany’s Merkel will give a preelection interview to RTL television.

- Turning to Wednesday, there is the FOMC rate decision in the US, followed by Yellen’s speech at 14:30 EDT. Elsewhere, EU’s Chief Brexit negotiator Michael Barnier will speak and the OPEC’s panel of technical representatives will meet to discuss production cuts.

- Then onto Thursday, there is the BOJ rate decision. Back in Europe, the ECB’s Mario Draghi will give a welcome address at the European systemic risk board’s annual conference in Frankfurt and the ECB’s Frank Smets will also speak.

- Finally, on Friday, we have three Fed speakers, including John Williams, Esther George and Robert Kaplan. Over in Europe, the ECB’s Vice President Constancio will speak and the EU foreign ministers will also hold an informal meeting. In the UK, PM Theresa May will give her big speech updating her government’s position on Brexit.

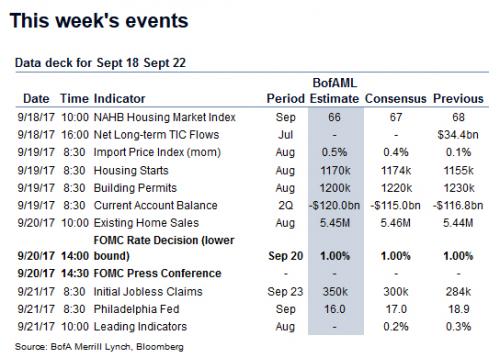

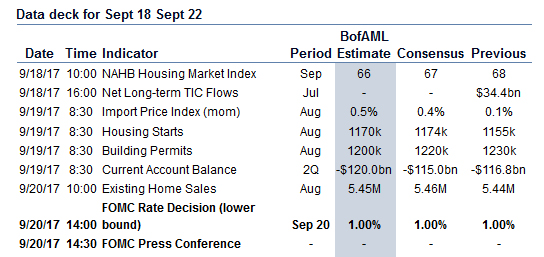

Finally here is Goldman's weekly preview with a full breakdown of estimates:

The key economic releases this week is housing starts on Tuesday and Philly Fed manufacturing index on Thursday. The statement following the July FOMC meeting will be released on Wednesday. There are a few speaking engagements by Fed officials on Friday.

Monday, September 18

- 10:00 AM NAHB housing market index, September (consensus +67, last +68)

- 04:00 PM Total Net TIC Flows, July (last $7.7bn)

Tuesday, September 19

- 08:30 AM Housing starts, August (GS -2.5%, consensus +1.7%, last -4.8%): Building permits, August (consensus -0.8%, last -3.5%): We estimate housing starts declined 2.5% in August, reflecting disruptions related to Hurricane Harvey. However, we expect stable or higher housing starts outside of the South region. While the impact of higher mortgage rates has likely weighed on single family demand and construction this year, we suspect this drag is now waning (particularly given the pullback in mortgage rates since March).

- 08:30 AM Import Price Index, August (consensus +0.4%, last +0.1%)

Wednesday, September 20

- 10:00 AM Existing home sales, August (GS flat, consensus +0.4%, last -1.3%): We estimate existing home sales were flat in August, following a 1.3% decline in the prior month. Regional housing data released so far were mixed, suggesting relatively stable closed homes sales. We also note that the Hurricane effects are likely to be modest or negligible in this report, as August homes sales mostly reflect contracts signed in previous months. Existing home sales are an input into the brokers' commissions component of residential investment in the GDP report.

- 02:00 PM FOMC statement, September 19-20 meeting: We expect the FOMC to announce that balance sheet runoff will begin in October. As several Fed officials have expressed reduced confidence in the inflation outlook, we expect the “dot plot” to show a decline in the average projected funds rate path. However, we think the median projection will continue to show a third rate hike this year, 3 hikes in 2018 and a longer-run funds rate at 3%. We expect only minor dovish changes as several influential FOMC members have highlighted that there is not yet enough data in hand to abandon the view that diminishing spare capacity will gradually push inflation back up to the target.

Thursday, September 21

- 08:30 AM Initial jobless claims, week ended September 16 (GS 300k, consensus 302k, last 284k); Continuing jobless claims, week ended September 9 (consensus 1,975k, last 1,944k): We estimate initial jobless claims rose 16k to 300k in the week ended September 16, reflecting a meaningful rise in Florida filings related to Hurricane Irma, partially offset by a second gradual drop in Texas claims. Continuing claims – the number of persons receiving benefits through standard programs – edged lower in the week ending September 1 but could rebound in this report due to Hurricane effects.

- 08:30 AM Philadelphia Fed manufacturing index, September (GS 15.0, consensus 17.0, last 18.9): We estimate the Philadelphia Fed manufacturing index fell 3.9pt to 15.0 in September. We anticipate the news around Hurricane Harvey and Irma will weigh on survey responses. However, the index is likely to remain at expansionary levels, consistent with the Empire manufacturing report released last week.

- 09:00 AM FHFA house price index, July (consensus +0.3%, last +0.1%)

Friday, September 22

- 06:00 AM San Francisco Fed President Williams (FOMC non-voter) speaks: San Francisco Fed President John Williams will give a speech at the Swiss National Bank’s research conference on “Monetary Policy Design, Conduct and Effects” in Zurich. Media Q&A is expected.

- 09:30 AM Kansas City Fed President George (FOMC non-voter) speaks: Kansas City Fed President Esther George will give the keynote speech at a joint conference organized by the Dallas and Kansas City Federal Reserve Banks on “Global Oil Supply & Demand”. Audience and media Q&A is expected.

- 09:45 Markit Flash US manufacturing PMI, September preliminary (consensus 53.0, last 52.8)

- 09:45 Markit Flash US services PMI, September preliminary (consensus 55.8, last 56.0)

- 01:30 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will take part in a moderated Q&A session at a joint conference organized by the Dallas and Kansas City Federal Reserve Banks on “Global Oil Supply & Demand”. Audience and media Q&A is expected.

Source: BOfA, SocGen, DB, Goldman