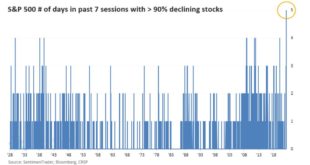

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets. Stocks are now down 10 of the last 11 weeks but the pain was concentrated in the last two weeks. 5 of the last 8 trading days...

Read More »Musical Chairs in Washington, D.C.

Republicans are licking their chops over the Federal Reserve’s ostensible plans to raise interest rates aggressively in the months ahead to combat soaring prices. They view a coming big recession as a grand opportunity to win control over Congress in the upcoming November elections. Of course, we have gone through this political musical-chairs nonsense for decades. If the Fed is filling the balloon with newly printed money, the economy appears prosperous. Whoever is...

Read More »Alpine rail tunnel and suburban train services to get boost

The first tube of the Lötschberg base railway tunnel was built between 1999 and 2007. Keystone/ Martin Ruetschi The government has presented plans for an upgrade of the country’s railway network, including an additional Alpine tunnel in western Switzerland. About CHF720 million ($745 million) have been set aside to upgrade the Lötschberg base tunnel and other regional projects near Zürich and Geneva in the next decade. The Lötschberg tunnel, linking the Bernese...

Read More »Gold Vs Bitcoin – Keith Weiner | Real Talk with Zuby #211

Keith Weiner is the founder and CEO of Monetary Metals, an investment firm that is unlocking the productivity of gold. Most people regard gold as a dry asset, to lock away in a vault, incurring storage fees. Many are waiting for it to rise in price. Keith and Monetary Metals are on a mission to change this. Follow Zuby - https://twitter.com/zubymusic Follow Oliver - https://twitter.com/theoliveranwar Subscribe to the 'Real Talk With Zuby' podcast on Apple Podcasts, Spotify & more -...

Read More »Tether wird neuen Stablecoin rausbringen

Tether hat bekanntgegeben, dass man schon im Juli einen neuen Stablecoin launchen wird. Dieser wird mit Britischen Pfund gedeckt sein. Damit folgt man der Strategie, die Tether bereits zuvor dazu veranlasste, einen Cryptocoin namens MXNT herauszubringen – dieser wird durch Mexikanische Pesos gedeckt. Crypto News: Tether wird neuen Stablecoin rausbringenEine Innovation wird es jedoch bei diesem Projekt geben. Der GBPT, so der aktuelle Name des neuen Stablecoins, wird...

Read More »Johnson’s Ability to Lead Tories into Victory at Risk with Today’s By-Elections

Overview: Asia Pacific equities were mixed. Gains were recorded in China, Hong Kong, Australia, and India, among the large markets, while Japan was mostly flat and South Korea and Taiwan shares fell. Europe's Stoxx 600 is off about 0.7%, the same as yesterday. US futures are slightly firmer. The rally in bonds continues. After falling nearly a dozen basis points yesterday, the US 10-year yield is off another 5 bp today around 3.10% it is near two-and-a-half week...

Read More »Switzerland to ease exchange of Ukrainian currency in line with EU

Keystone/Georgios Kefalas Refugees with a special legal status will be able to exchange a limited amount of Ukranian banknotes for Swiss francs. The Swiss government on Wednesday announced that adults with a protection S status may exchange one amount of up to 10,000 hryvnia – the equivalent of CHF300 ($310.50) at selected branches of the two main Swiss banks, UBS and Credit Suisse. The regulation is due to come into force next Monday, according to the State...

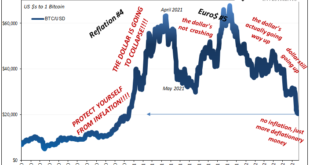

Read More »Everything Hitting The Global (eurodollar) Wall

Over the weekend, Bitcoin tumbled again. Reaching an ultra-ugly low of $17,641 (before retracing back above $20k), even the self-styled premier digital “store of value” has thrown in the towel. As I wrote last week, winter isn’t coming it is here. One crucial reason why, the Japan’s Ministry of Finance reported last week how imports into that country during the tumultuous month of April surged by a frankly ridiculous 48.9% year-over-year. It was the biggest annual...

Read More »SNB-Entscheid treibt Hypozinsen auf Zehnjahreshoch

Hypotheken sind bereits massiv teurer geworden. (Bild: Shutterstock.com/Michael Dechev) Die Inflation und die Leitzins-Erhöhung durch die Schweizerische Nationalbank (SNB) am 16. Juni 2022 (investrends.ch berichtete) haben Auswirkungen auf den Hypothekarmarkt. Die Richtzinssätze für Schweizer Festhypotheken sind seit Anfang des Jahres beispiellos angestiegen. Seit Juli 2011 notierten die Festhypotheken laut moneyland.ch nicht mehr so hoch. Obwohl sich die...

Read More »Personalbestand in der Bankbranche nimmt zu

Die Zahl der bei Banken in der Schweiz beschäftigten Mitarbeitenden stieg im vergangenen Jahr gemäss der Bankenstatistik der SNB um 0,7 Prozent auf 90’577. Trotz anspruchsvollem Umfeld und der Pandemie-Situation ist das zum zweiten Mal in Folge ein leichter Anstieg. Der Anteil der weiblichen Beschäftigten in der Schweizer Bankbranche bleibt mit knapp 38% im Vergleich zum Vojahr unverändert. (Bild: Shutterstock.com/Fizkes) Wie die am Donnerstag veröffentlichte...

Read More » SNB & CHF

SNB & CHF