Switzerland, home to many big multinationals, has an average corporation tax rate of just under 15%, but some of its individual low-tax cantons such as Zug (in photo) have lower rates again. Keystone / Alessandro Della Bella Switzerland will implement from 2024 the minimum tax rate for large multinational firms under a global tax deal. The federal government will get a quarter and regional and local authorities three-quarters of revenue, it said on Thursday,...

Read More »US Household Saving Rate Vanishes, Credit Card Debt Soars

The United States consumption figure seems robust. An 0.9 percent rise in personal spending in April looks good on paper, especially considering the challenges that the economy faces. This apparently strong figure is supporting an average consensus estimate for the second-quarter gross domestic product (GDP) of 3 percent, according to Blue Chip Financial Forecasts. However, the Atlanta Fed GDP nowcast for the second quarter stands at a very low 1.9 percent. If this...

Read More »Quarterly Bulletin 2/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 16 June 2022’) is an excerpt from the press release published following...

Read More »True Story Award 2020/21

On Friday, June 24 2022, the winners of the True Story Award 2020/21 will be announced at the Kornhausforum Bern. Tune in here at 7pm CET (UTC +2) to find out who has won. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »Guest Appearance: ReSolve Asset Management & Jeff Snider [Ep. 252, Eurodollar University]

Jeff Snider explains how the global currency and monetary systems actually work, the origins of the Eurodollar system, Triffin’s Paradox and the breakdown of the Bretton Woods System, the stampede towards prime collateral at all costs, the importance of sentiment and why the main role of central banks is theatrical, how vast swathes of the real economy have been deprived of credit since 2008, and a possible solution: creation and intermediation of money should be done by separate...

Read More »Risk Appetites Improve Ahead of the Weekend

Overview: Equities are higher and bonds lower as the week's activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong and South Korea. Japan's Nikkei rallied more than 1%, as did China's CSI 300. Most of the large markets but South Korea and Taiwan advanced this week, though only China and Hong Kong are up for the month. Europe's Stoxx 600 is up 1.3% through the European morning, its biggest advance of the week and what looks like...

Read More »Ukrainian students adjust to life in Switzerland

The Lucerne School of Art and Design has taken in 29 Ukrainian students as exchange students rather than refugees. This means their time in Switzerland counts towards their degree. The 29 students come from the Lviv National Academy of Arts, a partner university. They came by bus via Warsaw, Poland, and then through Germany and on to Lucerne shortly after the war started in Ukraine. Monika Gold, head of the Bachelor’s Programme in Graphic Design, was the driving force behind the...

Read More »Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount. As of 27 June 2022, adults with protection status S will be able to make a one-off exchange of up to UAH 10,000 at selected UBS and Credit Suisse branches. This currently corresponds to a value of approximately CHF 300. The exchange...

Read More »Investments, Speculations and Money by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals. In light of the recent rise in interest rates,...

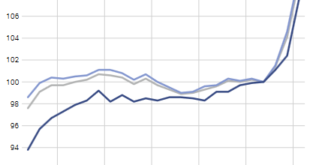

Read More »Construction prices rose by 4.9% in April 2022

24.06.2022 – The construction output price index recorded a rise of 4.9% between October 2021 and April 2022, reaching 109.2 points (October 2020 = 100). This result reflects an increase in building and civil engineering prices. Year on year, construction prices increased by 7.7%. These are some of the findings of the Federal Statistical Office (FSO). Development of the construction price index in Switzerland - Click to enlarge Download press release:...

Read More » SNB & CHF

SNB & CHF