The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own %excerpt%.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4 pic.twitter.com/tmLhSsuFDG — Jeffrey P. Snider (@JeffSnider_AIP) March 16, 2022 In one key sense, markets already don’t even though policymakers committed to a steady series of hiking the federal funds range. They’ve indicated it will be one after another, 25 bps each and every FOMC meeting into the foreseeable

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Consumer Confidence, currencies, economy, eurodollar futures, eurodollar futures curve, Featured, Federal funds, Federal Reserve/Monetary Policy, FOMC, frbny, inflation expectations, jay powell, Markets, newsletter, rate hikes, U.S. Treasuries, university of michigan surveys of consumers, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end.

We shouldn’t care much about the Fed.

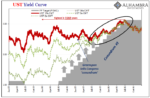

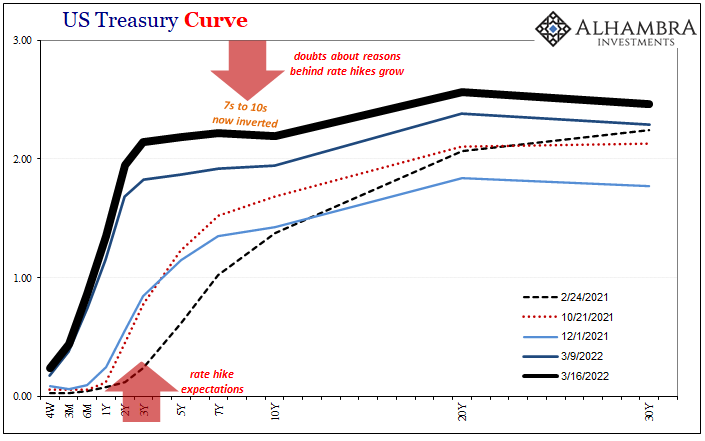

Snider (@JeffSnider_AIP) March 16, 2022 In one key sense, markets already don’t even though policymakers committed to a steady series of hiking the federal funds range. They’ve indicated it will be one after another, 25 bps each and every FOMC meeting into the foreseeable future. That much markets have agreed to price. It’s everything else, all that which really matters, where the whole regime falls down. Literally, in the case of curves. To begin with, the yield curve which had since last Friday fractionally inverted in the 7s to 10s calendar spread went much further, at one point today being as much as 5 bps more at the 7-year than the 10-year. Even by the close, after markets calmed down from their knee-jerk frenzy, the 7s were still up by three over the 10s. |

|

| Perhaps more importantly, I think so, the yield for the 5-year note spent almost the entire post-announcement afternoon also at a higher rate than the one indicated at the 10-year benchmark (CMT). This further inversion had widened at one point to more than a basis point, before closing fractionally lower – though many pricing services have these two dead even.That probably won’t last too long, given the established trend in each of these curves going all the way back to the first one, eurodollar futures on December 1, where they begin fractionally small and only expand with enough time.

And it doesn’t matter what happens in between. |

|

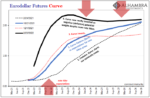

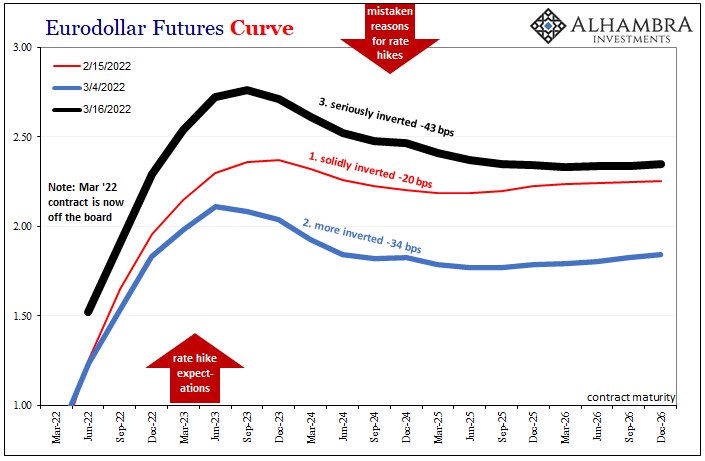

| That’s the primary take-away from the eurodollar futures curve, not just in today’s action. Once again, the front gyrates up and down for various perceptions as the weeks roll by, and still the inversion remains, in fact gets bigger (both dimensions, depth and breadth) whichever way the front goes.

When fears over Russia were the big news of the day back at the end of February, fewer rate hikes were put in the curve’s front end (as if spillover might be the one thing to deter the FOMC), yet very inverted at the back. Since early March, less Russia, more rate hikes confirmed today, still the back end inversion has only gotten worse. Much worse. Back and forth current perceptions change, yet this long run worry refuses to go away no matter what goes on today and tomorrow. The Fed hikes, the Fed hikes less, maybe more, none of it seems to make any difference to where the inverted outer contracts are placed. |

|

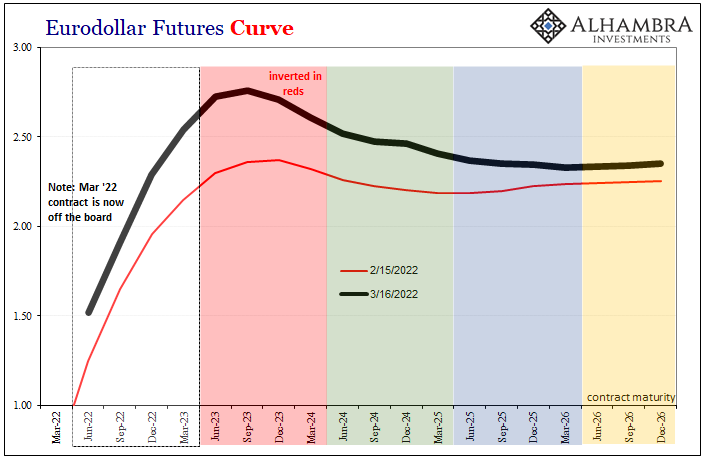

| Those “outer” contracts nowadays aren’t actually so far down the curve; suspiciously more front than back themselves. The previous front of March 2022 has gone off the board, meaning the colors shift with the current quarterly front of June 2022. This leaves the reds – which are supposed to be solidly Fed – even more steeply inverted, too.

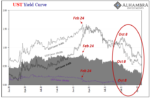

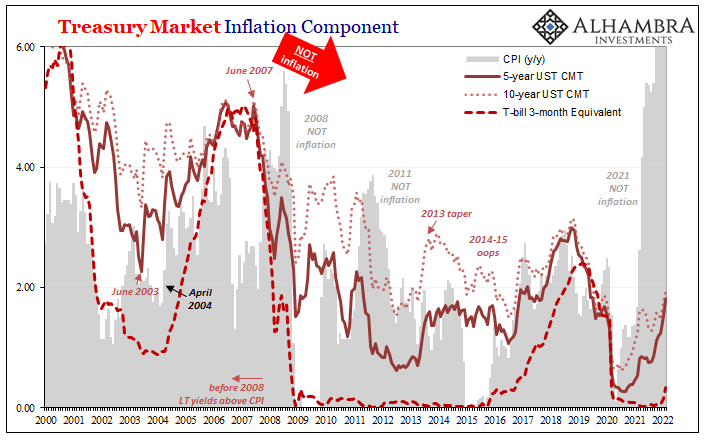

Critics of the “central bank” quite often accuse it of being behind the curve when it comes to inflation. This is quite literally the case in the two most important of those, the most consequential curves which exist in all money and finance. Only, when the FOMC’s detractors say this, they mean policymakers have fallen behind inflation and need to catch up to consumer prices. Not this time (or any time since the seventies). |

|

| What the markets here instead are blatantly depicting, however, is that Jay Powell’s group (especially Mr. Bullard’s dissent in favor of a 50 bps hike today) is so far behind the real world curve officials have gotten themselves entirely backward.

Upside-down is again ahead. |

|

|

|

|

|

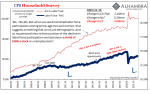

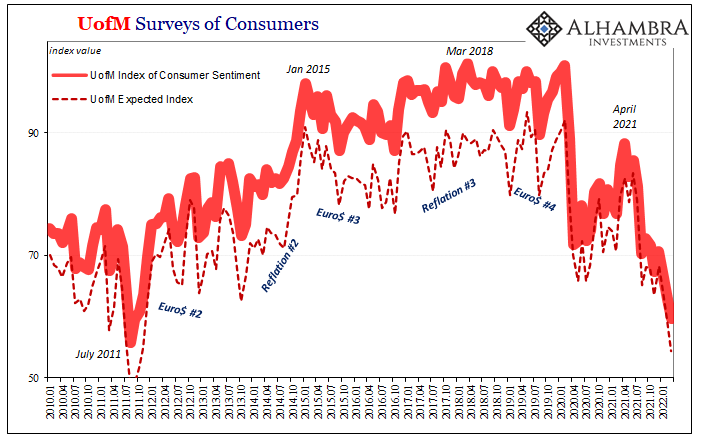

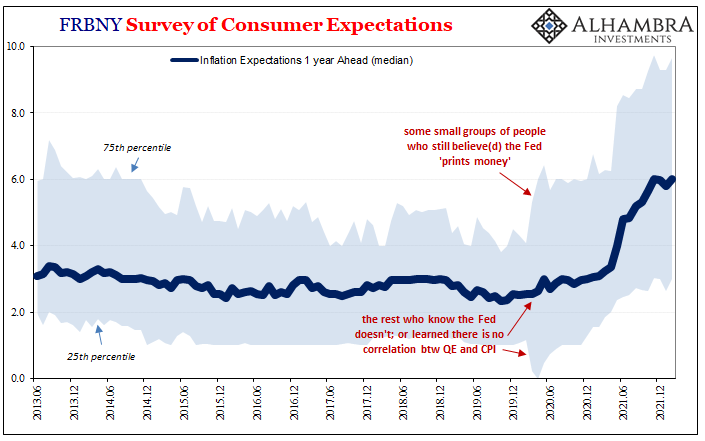

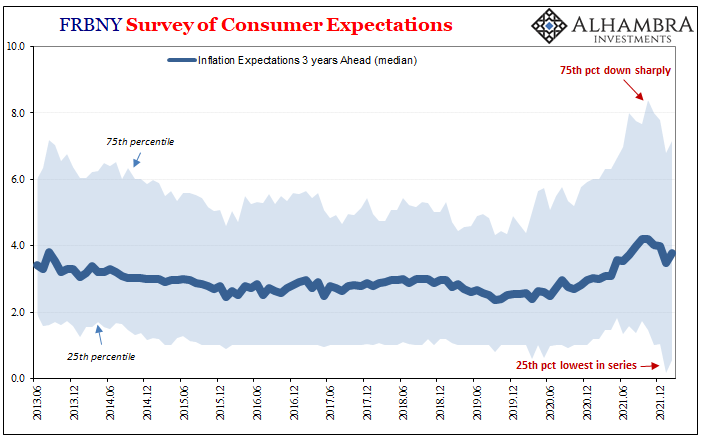

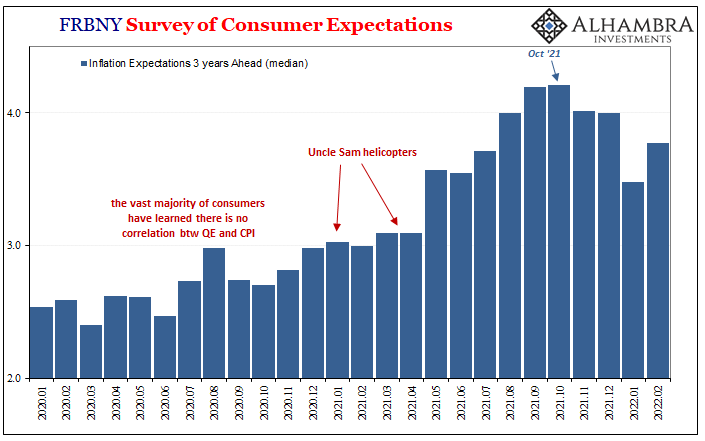

| Even consumers appear to agree with markets over how consumer prices may be the current form for prominent economic pain, yet more and more likely this instead means price resolution of the kind typically associated with inverted curves.

As is their usual bend, the FOMC has already and will certainly continue to ignore these well-established and historically-validated market signals. They did so in 2006 and early 2007, before again from 2015 right on into 2018 then 2019’s embarrassing and confused turnaround. By perhaps nothing other than random chance, those at the Federal Reserve seem to be hoping that one day, someday, markets will end up agreeing with their position rather than, as always before, curves accurately predicting what these “best and brightest” will end up doing in the future that they don’t today believe there’s any way it could happen. |

|

Tags: Bonds,Consumer Confidence,currencies,economy,eurodollar futures,eurodollar futures curve,Featured,federal funds,Federal Reserve/Monetary Policy,FOMC,frbny,inflation expectations,jay powell,Markets,newsletter,rate hikes,U.S. Treasuries,university of michigan surveys of consumers,Yield Curve