What I, Max Sirius, think the Powers That Be or Deep State (which includes the Federal Reserve, the Biden Administration) or whatever you want to call it or them, want and will do now. Very big picture view. In order to save the global economic system, which is still more or less controlled by the United States, has the United States Dollar as its reserve currency, and which many of the United States based but globally acting mega corporations operate in and profit from (many big United...

Read More »„Bitcoin is Dead“ mit neuem Spitzenwert in Google Suche

Nach dem spektakulären Absturz in der letzten Woche, verlor der BTC zum Wochenende nochmals und stürzte sogar unter die Marke von 20K. Auf Google wurden darauf Höchstwerte für den Suchbegriff „Bitcoin is Dead“ registriert. Doch ist der BTC wirklich tot? Bitcoin News: „Bitcoin is Dead“ mit neuem Spitzenwert in Google SucheGegen Samstag kam es zum Jahrestiefstwert mit nur noch 17.700 US-Dollar pro BTC. Viele Kritiker hatten sich bestätigt gefühlt, als der Markt in den...

Read More »Equities Jump, Dollar Slips, and European Yields Drop

Overview: Stocks are rallying. Nearly all the large bourses in the Asia Pacific region rose with China being the noted exception. In Europe, the Stoxx 600 is up over 1% to post gains for the third consecutive session, the longest advance this month. US futures are up around 2% as they return from yesterday’s holiday. While the US 10-year yield has edged up 3.26%, European yields are mostly softer, with the peripheral premiums falling more than core rates. The US...

Read More »The Swiss army: your questions answered Part 1

In Switzerland, all able-bodied men complete compulsory military service, while others opt for a civilian service. But how useful is a conscript army in light of what Russia did to Ukraine? This is one of many questions SWI readers sent to us. Daniel Reist, head of media relations for the Swiss armed forces, takes a shot at answering them. Our first question is can a small army be effective? More questions and answers are to follow in the coming weeks. --- swissinfo.ch is the...

Read More »Long shadow of Russian money raises tricky questions for Swiss bankers

‘You don’t have dozens and dozens of people employed on your Russia desks if you are not making money in Russia,’ says one senior private banker in Switzerland Keystone / Yuri Kochetkov January used to be a big month for Swiss bankers and their Russian clients. Many of the Moscow elite had made a tradition of coming to the Alps for the orthodox new year, skiing with their families, then catching up with their financial consiglieri. In St Moritz, one banker recalls...

Read More »SNB hebt Leitzinsen um 0,5 Prozentpunkte an

Etwas überraschend hebt die SNB den Leitzins deutlich an. (Shutterstock.com/Distinctive shots) Die Schweizerische Nationalbank (SNB) hebt etwas überraschend den Leitzins deutlich an. Das letzte Mal hat sie das vor 15 Jahren getan, zu Beginn der Finanzkrise im September 2007. Die Nationalbank erhöht den SNB-Leitzins und den Zins auf Sichtguthaben bei der SNB um 0,50 Prozentpunkte auf -0,25%, wie sie an ihrer geldpolitischen Lagebeurteilung am Donnerstag bekannt gab....

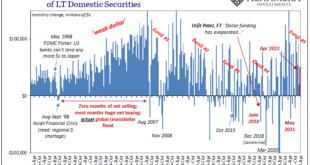

Read More »Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system. This much was apparent right from the start, with financial markets gone haywire three months ago (mid-March seasonal bottleneck), and then more of the same into April right to now. The updated TIC data for the month of...

Read More »Die neue Zweiklassengesellschaft

Der Zweiklassengesellschaft kommt im sozialistischen Denken eine wichtige Funktion zu. Eingriffe in das Privateigentum bis hin zur kompletten Enteignung – gern auch als „Vergesellschaftung“ begrifflich verschleiert – erscheinen vor diesem Hintergrund in anderem Licht. Karl Marx‘ widerlegte Zweiklassen-Theorie Nach Marx stehen sich Arbeiter und Kapitalisten mit ihren jeweiligen Interessen diametral gegenüber. Demnach beuten die Kapitalisten als Eigentümer der...

Read More »How Money Printing Destroyed Argentina and Can Destroy Others

The most dangerous words in monetary policy and economics are “this time is different.” Argentine politicians’ big mistake is to believe that inflation is multicausal and that everything is solved with increasing doses of interventionism. The consumer price index in Argentina experienced a year-on-year rise of 58 percent in April 2022, which means 2.9 percentage points above the variation registered last March. A real catastrophe. Inflation in Argentina is more than...

Read More »US Holiday Facilitates Consolidative Tone

Overview: Most equity markets in the Asia Pacific region lost ground today. China’s Shenzhen, Hong Kong, and India were notable exceptions. The MSCI Asia Pacific Index is at its lowest level since June 2020. Europe’s Stoxx 600 is forging a base ahead of 4000 and is trading quietly with a small upside bias. The French stock market lagging after Macron lost his parliamentary majority, is raising questions about his reform agenda. US equity futures are firm, but the...

Read More » SNB & CHF

SNB & CHF