We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections. This gave an indication of where the committee members view economic indicators going forward. FOMC Summary of Economic Projections There are a few of the FOMC projections that we want to point out in the table below. The first is that the FOMC participants are now projecting U.S. GDP growth this year

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Business News, Commentary, Economics, Featured, Financial News, Geopolitics, Gold, inflation, invest, Jerome Powell, Market Crash, News, newsletter, Precious Metals, Russia, silver, the fed, the Federal Reserve, Ukraine

This could be interesting, too:

finews.ch writes Migration der Superreichen: Die Dominanz Europas schwindet

finews.ch writes Zurich macht Ergänzungsakquisition in Down Under

finews.ch writes Veit De Maddalena: «Nach der Transformation sind wir jetzt im Übergangsjahr»

finews.ch writes Tessiner Privatbank ernennt neuen Leiter für Zürich

was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections. This gave an indication of where the committee members view economic indicators going forward. |

|

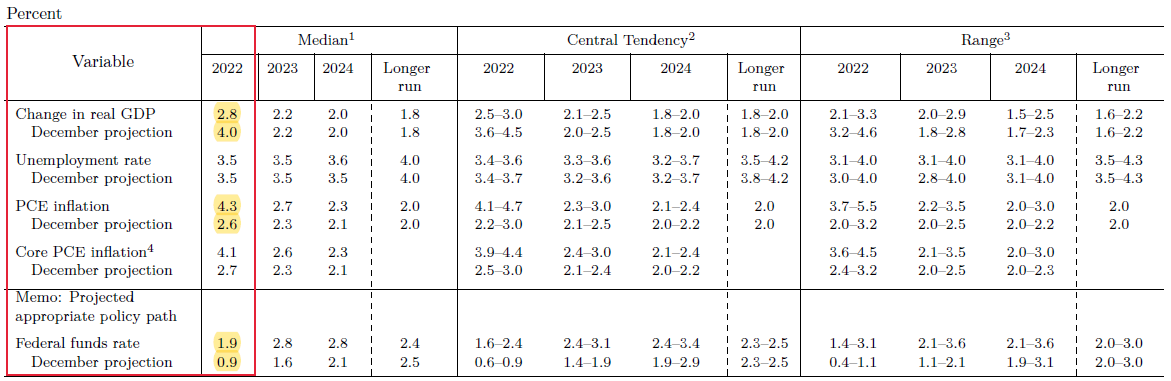

FOMC Summary of Economic ProjectionsThere are a few of the FOMC projections that we want to point out in the table below.

The first of these is the revised down U.S. GDP projection, as Chair Powell pointed out 2.8% is still a solid GDP projection. To put it in perspective – real GDP growth averaged 2.25% from 2010. After the Great Financial Crisis, through 2019, before the start of widespread Covid-lockdowns wreaked havoc on economies. |

|

|

|

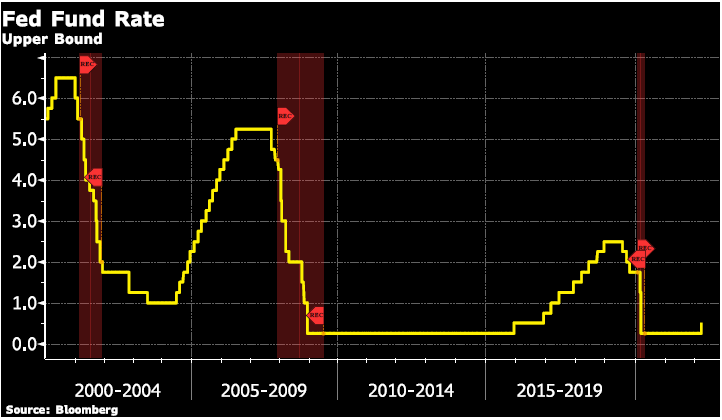

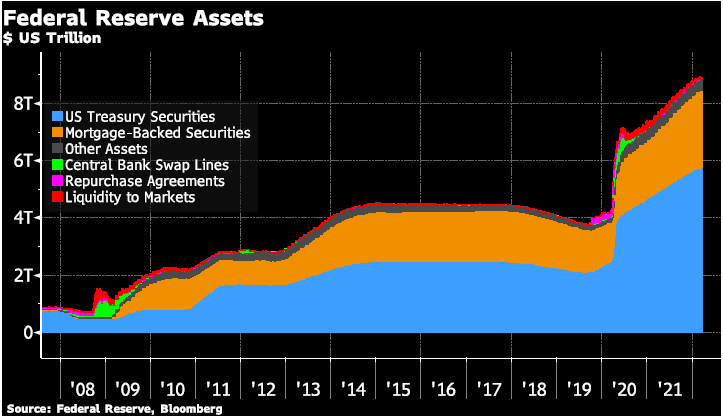

The Fed Is Stuck Between a Rock and a Hard PlaceAnd with PCE inflation coming in at 6.6% in January. This was before the rise in commodity prices and additional supply constraints and issues due to the war were even a factor. This was compounded by the rise in wages that has still not peaked we think that the 4.3% projection for this year is low. The Fed is still between a rock and a hard place. It is only getting tighter for them to maneuver. The geopolitical uncertainty not only with the invasion of Ukraine by Russia but now with China. Also, the increased push for de-dollarization after sanctions are all adding to an already uncertain outlook. Then on top of that, there is the LME not only halting trading on nickel after the price surged on March 7, but also canceling contracts. And the reopening of trading on March 16 did not go smoothly – although this is not a direct impact on the Fed. Lost trust in market infrastructures is certainly a factor for them to consider. Remember when markets lost trust in counterparties in 2008-09 – the Fed (and other central banks) stepped in with massive asset purchases to stabilize markets. Those asset purchases continued until 2014 – and then started again on an even grander scale in 2020 and have now expanded the Fed’s balance sheet to around US$9 trillion. In respect to the balance sheet, the March 16 Fed statement said,

and Chair Powell only elaborated on this plan in the press conference saying,

What the pace of reduction remains to be seen – but knowing that the Fed is hesitant to disrupt markets when reducing its balance sheet, it can’t ‘sell’ assets very quickly. By buying these assets the Fed has already disrupted the market and changed/removed pricing and risk mechanisms. Markets don’t believe the Fed’s projections When the statement and economic projections were first released markets reacted to the tighter policy as expected – i.e. U.S. equities declined, the gold price declined, and the U.S. 10-year yield rose. However, by the time that Chair Powell’s press conference was over, all this reversed as markets digested the information that the Fed has no idea what comes next and is not seriously going to raise rates past the rate of inflation – keeping real interest rates negative and policy somewhat accommodative for now. Which is positive for gold and silver investors. |

Tags: Business News,Commentary,Economics,Featured,financial news,Geopolitics,Gold,inflation,invest,Jerome Powell,Market Crash,News,newsletter,Precious Metals,Russia,silver,the fed,the Federal Reserve,Ukraine