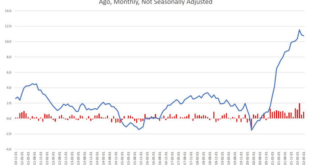

Year-over-year PPI growth came in at over 10 percent for the sixth month in a row. This will put more pressure on the Fed to “do something.” Original Article: “Wholesale Prices Rise More than 10 Percent, Pointing to Continued Price Hikes” The US Bureau of Labor Statistics released new Producer Price Index (PPI) data today, and it’s not good news for consumers. The PPI is a measure of prices at the production phase of goods and services, and is often an indicator...

Read More »The Return of the Anguish of Central Banking: Why the Fed and Inflation Go Hand in Hand

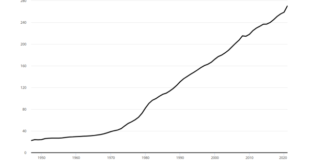

(The following text is a revised update of an article that was first published in 2005.) The recent outbreak of price inflation with the jump to an annual rate of 8.6 percent in May 2022 came as a surprise to the US central bank (the Federal Reserve). Having ignored the warnings of the Austrian school economists, the policy makers were paralyzed in the face of a phenomenon they deemed impossible to happen. None of their forecasting models had triggered an inflation...

Read More »Business cycle signals: SNB regional network

Second quarter of 2022 Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 12 April and 30 May. . Key points •...

Read More »Interview with Macro Alf: Is it Time to Buy Bonds? [Eurodollar University, Ep. 253]

How does a former bank trader with billions of euros in assets react to an impending recession? Is the inflection in bond yields (back down) and prices (back up) starting right now? Did the European Central Bank just warn of a re-run of the 2011-12 European Sovereign Debt Crisis? ----EP. 253 REFERENCES---- Alfonso Peccatiello's Substack: https://TheMacroCompass.substack.com/ Alfonso Peccatiello's Twitter: https://twitter.com/MacroAlf Time To Buy Bonds?: https://bit.ly/3QNP7zP Jeff's...

Read More »Gesunkene Mining Einnahmen lassen Ethereum Hashrate abstürzen

Die Mining Hashrate ist im Monatsvergleich um ganze 10 Prozent gesunken. Ein Problem für das ETH-Projekt, welches weiterhin mit der Scalability und den damit verbundenen Gebühren zu kämpfen hat. Kommt nun auch noch ein Exodus der Miner hinzu? Ethereum News: Gesunkene Mining Einnahmen lassen Ethereum Hashrate abstürzenAuch der ETH-Preis hat im vergangenen Monat einen Absturz erlebt – ungefähr ein Drittel des Werts ging verloren. Offenbar haben infolgedessen viele...

Read More »The End Game Approaches

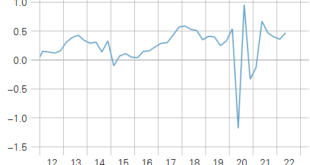

The pendulum of market sentiment swings dramatically. It has swung from nearly everyone and their sister complaining that the Federal Reserve was lagging behind the surge in prices to fear of a recession. On June 15, at the conclusion of the last FOMC meeting, the swaps market priced in a 4.60% terminal Fed funds rate. That seemed like a stretch, given the headwinds the economy faces that include fiscal policy and an energy and food price shock on top of monetary...

Read More »Our No-Win “Kobayashi Maru” Economy

It’s time to reprogram the conditions of the economy to serve the many rather than the few. Star Trek’s Kobayashi Maru training exercise tests officer candidates’ response to a no-win scenario:any attempt to rescue the crippled ship’s crew results in the destruction of the candidate’s ship, while standing by and taking no action results in the loss of the Kobayashi Maru’s crew. Captain Kirk famously defeated this no-win scenario by reprogramming the simulation to...

Read More »Back to the Future: Progressives Imagine the Good Old Days of Price Controls

When the Bourbon dynasty was restored to power in France in the early 1800s after Napoleon’s abdication, the French statesman Charles-Maurice de Talleyrand famously said of that family: “They had learned nothing and forgotten nothing.” In modern economic parlance, one can say the same thing about progressives, who once again are demanding price controls to “fight inflation.” Not surprisingly, Sen. Elizabeth Warren is leading the way. She recently introduced a bill...

Read More »Switzerland details revenue split for global corporate tax rate

Switzerland, home to many big multinationals, has an average corporation tax rate of just under 15%, but some of its individual low-tax cantons such as Zug (in photo) have lower rates again. Keystone / Alessandro Della Bella Switzerland will implement from 2024 the minimum tax rate for large multinational firms under a global tax deal. The federal government will get a quarter and regional and local authorities three-quarters of revenue, it said on Thursday,...

Read More »Quarterly Bulletin 2/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 16 June 2022’) is an excerpt from the press release published following...

Read More » SNB & CHF

SNB & CHF