In Switzerland, all able-bodied men complete compulsory military service, while others opt for a civilian service. But how useful is a conscript army in light of what Russia did to Ukraine? This is one of many questions SWI readers sent to us. Daniel Reist, head of media relations for the Swiss armed forces, takes a shot at answering them. Our second question is how would Switzerland defend itself, faced with a large-scale attack? --- swissinfo.ch is the international branch of the...

Read More »US Economic Data Keeps Suggesting Recession Coming [Eurodollar University, Ep. 254]

The latest purchasing manager surveys (services, manufacturing, composite) and manufacturing index (Kansas City Fed) suggest the United States is heading towards a recession, soon (maybe already?). ----EP. 254 REFERENCES---- Alhambra Investments Blog: https://bit.ly/3wh01G2 RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf -------THE EPISODES------- YouTube: https://bit.ly/310yisL Vurbl: https://bit.ly/3rq4dPn Apple: https://apple.co/3czMcWN...

Read More »Die Zentralbanken sind schachmatt

Seit Jahrzehnten senken die Notenbanken ihre Leitzinsen bei jedem Anzeichen einer wirtschaftlichen Korrektur. Sie versuchen damit, das Problem der sich von den Konsumentenbedürfnissen entfernenden Produktionsstruktur («Zombifizierung») mit billigem Geld zuzudecken. Dabei wären laufende Anpassungen der Angebotsseite an die sich wandelnden Bedürfnisse der Nachfrager eine zentrale Voraussetzung für eine sich langfristig gesund entwickelnde Wirtschaft. Aufgrund der immer...

Read More »Markets Promote Real Equality Much More Than Progressive (and Conservative) Critics Claim

The economy consists of a huge chain of the division of labor that is interlocked to such a limit where there exists hardly any single individual or firm that produces the whole of the product alone. This is famously illustrated in the essay “I, Pencil,” by Leonard Read. Each element of this complex chain is a firm that consists of many individuals, therefore one of the first questions one might ask is, “Why do individuals engage in these complex economic...

Read More »Unit of Account and Current Valuations by Paul Belanger

We’re pleased to republish this guest post by Paul Belanger. Paul is the author and owner of the website, Evidence Based Wealth, and the YouTube channel belangp, where he’s published over 10 years of research and analysis of gold. He’s also the author of Evidence Based Wealth: How to Engineer Your Early Retirement, available for purchase at Amazon.com. This post does not necessarily reflect the views of Monetary Metals. In my last article and video I discussed the...

Read More »Nasty Number Five, Not Hawk Hiking CBs

It’s not recession fears, those are in the past. For much if not most (vast majority) of mainstream pundits and newsmedia alike, unlike regular folks this is all news to them (the irony, huh?) Economists and central bankers everywhere had said last year was a boom, a true inflationary inferno raging worldwide. For once, CPIs (or European HICPs) seemed to have confirmed the narrative. Unlike 2018 when inflation indices kept policymakers and their forecasts out in the...

Read More »SWISS plans more flight cancellations into autumn

Lufthansa, the German parent company of SWISS international airlines, does not expect operations to return to normal until 2023. © Keystone / Christian Beutler Additional cancellations of SWISS flights are “unavoidable” because of staff shortages, a company spokesperson told the Keystone-SDA news agency on Sunday. Scheduled flights between August and October would be affected by the latest announcement, which was originally reported by the news portal blick.ch. It...

Read More »Higher federal tax deductions for health insurance announced

Photo by Nataliya Vaitkevich on Pexels.com The cost of Swiss health insurance has risen sharply over the years. However, the amount that can be deducted from income to calculate federal taxes has remained comparatively low. This week, Switzerland’s parliament voted in favour of closing the gap between the standardised health insurance tax deductions and what people actually pay, reported RTS. The current deductions are CHF 1,700 for an adult, CHF 3,500 for a married...

Read More »The Dollar: Don’t Get too Far Ahead of the Story

The most important development in foreign exchange probably took place in the interest rate market last week. A series of disappointing US economic data and the Fed's "unconditional" commitment to rein in inflation have heightened concerns that economic weakness will limit the Fed's ability to hike rates. Specifically, for the first time, the implied yield of the December 2023 Fed funds futures contract is below the December 2022 yield. In fact, the gap implies a...

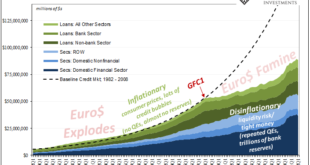

Read More »The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was. What data? The “everything” data, the most comprehensive financial and monetary compendium yet available: The Financial Accounts of the United States, or Z1. While this doesn’t quite...

Read More » SNB & CHF

SNB & CHF