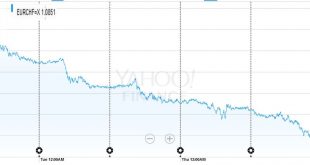

EUR/CHF The SNB has about 280 billion CHF in euro. Hence the loss of 2% in the EUR/CHF rate will cost the SNB around 14 billion Swiss francs.We explained that the main reason for the stronger CHF was the bad Non Farm Payrolls Report in the United States. FX Rates June 06 to June 10, 2016 click to enlarge USD/CHF As Marc explains, the dollar recovered a bit in the second part of the week. Still enough so that the...

Read More »Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

On the Swiss Franc: Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. Chandler: “Although Swiss franc speculative position adjustment was not large, it was counterintuitive. The market has been rife with talk of Swiss franc buying, and the euro-franc cross has fallen...

Read More »Faber: “Switzerland is doing much better than any other country in Europe. So maybe Britain would do the same?”

The European Union is an “empire that is hugely bureaucratic,” warns Marc Faber, telling CNBC that he thinks that “a Brexit would be bullish for global economic growth,” because “it would give other countries incentive to leave the badly organized EU.” The Gloom, Boom & Doom-er explained that Brexit is a risk Britain should be willing to take, and that it would not be a disaster, “on the contrary, it would be the...

Read More »FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Swiss Franc Once again, CHF is one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular “Weekly SNB sight deposits” report. See the Dukascopy Video FX Rates The US dollar weakened in the first half of the week as participants continued to react to the shockingly poor jobs report and shift in Fed expectations. However, it...

Read More »Chart up-date: Stocks, Bonds, Copper, Bonds

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25% Oman issued its first global bond since 1997 Polish President Duda softened his CHF loan conversion plan Central Bank of Russia resumed its easing cycle with a 50 bp cut to 10.5% There appears to have been a significant change in FX strategy from the...

Read More »A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. Quite frankly, keeping tabs on it all is beyond human capacity. This also goes for the federal government. Even with all their data gatherers and number crunchers they are incapable of...

Read More »Politics and Economics

Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed to think that politics comes from the ancient Greek “poly”...

Read More »With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates. 10-year Gilt yield, Close on 06/12 Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global...

Read More » SNB & CHF

SNB & CHF