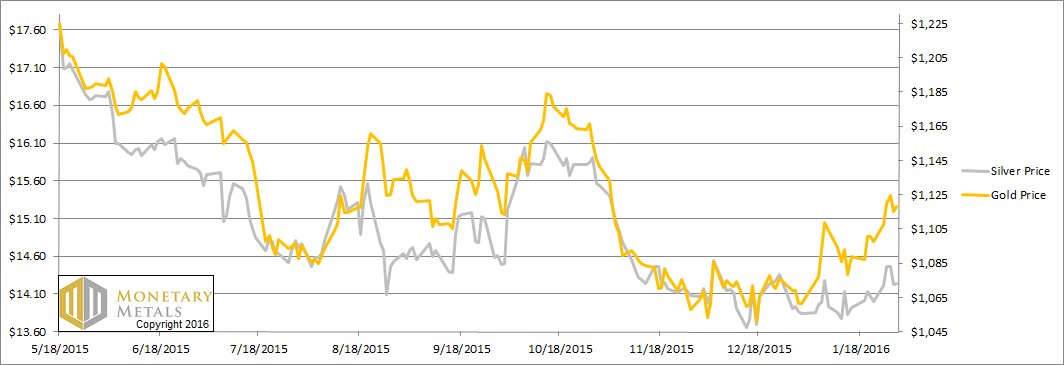

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, pound, franc, yen, and yuan. In the common tongue, gold was up and silver rose 25 cents. More importantly, we want to know what happened to the fundamentals. Read on for the only proper fundamental analysis of the gold and silver markets… But first, here’s the graph of the metals’ prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding. One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Topics:

Keith Weiner considers the following as important: Current Market News, Featured, Gold, Monetary Metals, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, pound, franc, yen, and yuan.

In the common tongue, gold was up $20 and silver rose 25 cents.

More importantly, we want to know what happened to the fundamentals. Read on for the only proper fundamental analysis of the gold and silver markets…

But first, here’s the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

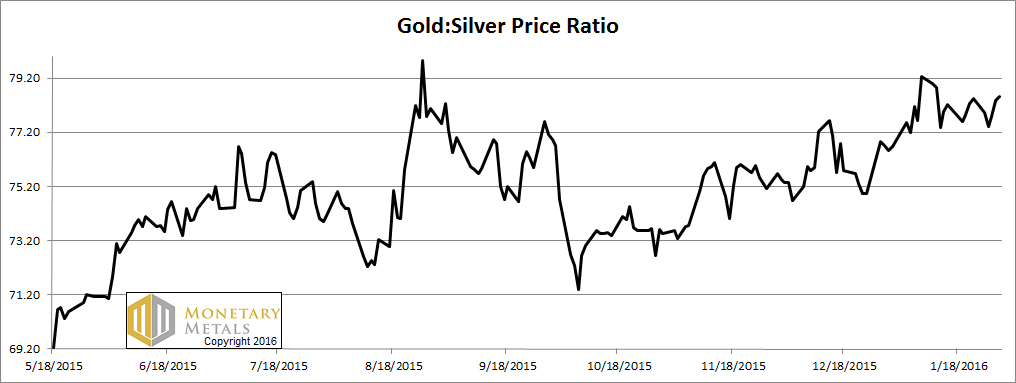

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio went sideways this week.

The Ratio of the Gold Price to the Silver Price

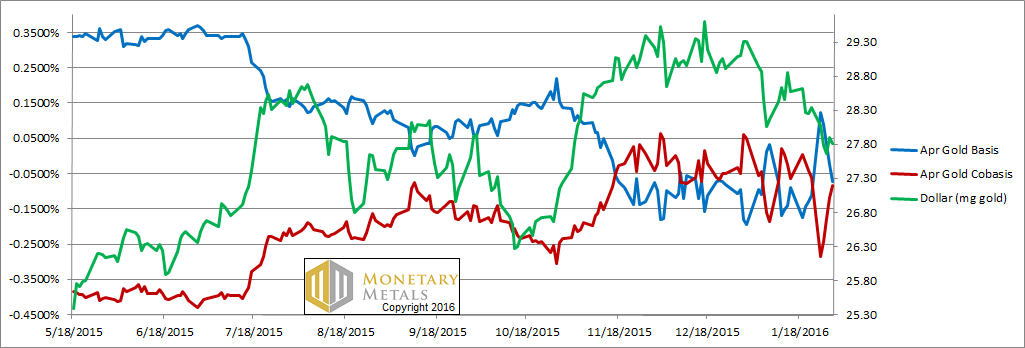

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The cobasis (i.e. scarcity) moved around and ended pretty close to where it started. What’s notable is that this occurred when the price of gold was rising. What you can’t see on this chart, is that in farther contract months the cobasis fell a bit more.

The fundamental price of gold didn’t move much this week. In other words, speculators pushed up the price but the fundamentals are holding.

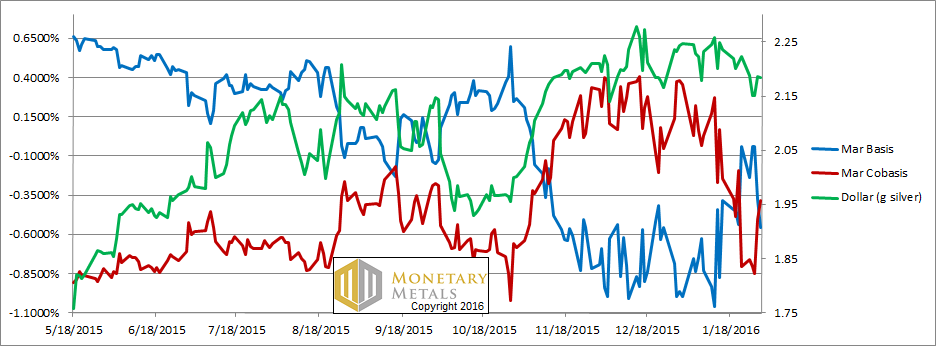

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, you can see that as the price of the dollar fell (i.e. the price of silver rose) in the first part of the week, the cobasis went sideways to down. But in the last part of the week, the cobasis shot up while the price of silver fell a little.

It’s far too early to call a bottom in the silver price. However, the movement on Thu and Fri is the sort of action we should expect to see more of if silver is to return to a bull market. It will take more action like this before we change our position on the white metal, but it is worth reporting on what we see when we see it.

Our calculated fundamental price of silver rose 35 cents, to basically at the market price.

We plan to drill down into the extraordinary move in the silver price around Thursday’s silver fix. Look for our article this week.

© 2016 Monetary Metals