The fourth quarter 2015 earnings season is now in full swing. From what I have seen of the outstanding earnings surprises and favourable future guidance in the Grail Portfolios, there is enough thrust to propel them higher, as these three examples show. On 28 January Under Armour rose 22.6%! On 27 and 28 January Cirrus Logic climbed 29%! From 25 January Covenant has risen 21.7%! As of 29 January 110 stocks, or 37.4%, of the 294 stocks listed in Grail’s 5 principal portfolios have generated BUY? and only 31, or 10.4%, SELL? signals! Stocks must have a +4% breakout to the upside to generate a BUY? signal and a -5% breakout to the downside to generate a SELL? signal. The reason for the ? is that any new momentum or trend needs to be confirmed before stocks are issued as recommendations. These alpha-stock denominated portfolios establish large margins of safety, strong profits, and provide outstanding client retention and marketing advantages, which mediocre and passive strategies are unable to generate. As we have entered a new normal, those asset managers who do more of the same are likely to face client frustration and profit recession.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

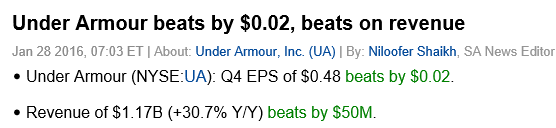

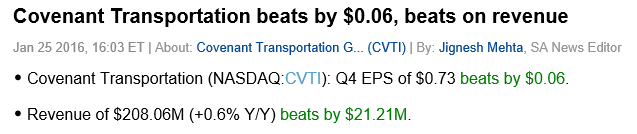

The fourth quarter 2015 earnings season is now in full swing. From what I have seen of the outstanding earnings surprises and favourable future guidance in the Grail Portfolios, there is enough thrust to propel them higher, as these three examples show.

On 28 January Under Armour rose 22.6%!

On 27 and 28 January Cirrus Logic climbed 29%!

From 25 January Covenant has risen 21.7%!

As of 29 January 110 stocks, or 37.4%, of the 294 stocks listed in Grail’s 5 principal portfolios have generated BUY? and only 31, or 10.4%, SELL? signals!

Stocks must have a +4% breakout to the upside to generate a BUY? signal and a -5% breakout to the downside to generate a SELL? signal. The reason for the ? is that any new momentum or trend needs to be confirmed before stocks are issued as recommendations.

|

|

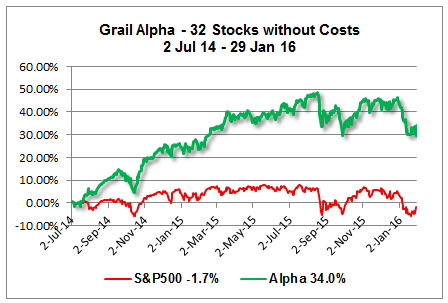

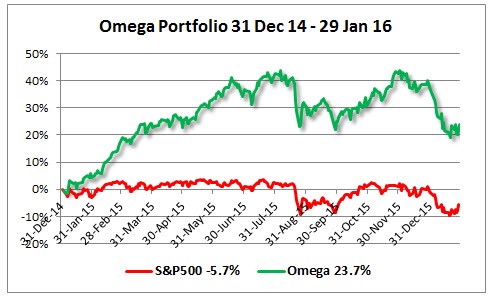

These alpha-stock denominated portfolios establish large margins of safety, strong profits, and provide outstanding client retention and marketing advantages, which mediocre and passive strategies are unable to generate. As we have entered a new normal, those asset managers who do more of the same are likely to face client frustration and profit recession.

This is the era of the Alpha Stock; ignoring it, yes, most will, but at what cost? On page 140 of ‘The Black Swan The impact of the highly improbable’, Nassim Nicholas Taleb encapsulates the case for a no-change policy:

“Epistemic arrogance bears a double effect: we overestimate what we know, and under estimate uncertainty, by compressing the range of possible uncertain states (i.e. by reducing the space of the unknown)”.

I do not rule out that this may even apply to me – that I’ve got it wrong, and mediocre performance will flourish on the false premise that such products as index funds, and other similar portfolios, are inherently safer and offer commensurate returns. But on the other hand these graphs show that benchmarking produces its own sour fruits shown in red!

The Grail Equity Management System (GEMS) is an advanced Alpha Stock and effective Risk Management System offered as an advisory service and because of its analysis methodologies identifies high-quality high-growth stocks.

Market Comment

The market is now in a confirmed uptrend (again), because it made its first weekly gain this year of 1.7%! Undoubtedly, the upbeat earnings season is so far producing better than expected earnings, especially by bellwether companies, such as Face Book (FB), and Microsoft (MSFT), which both gapped up, although Amazon (AMZN) gapped down. More rally fuel was provided from sources you would not expect if you subscribe to the view that the stock market reflects the progress of the real economy. It was in fact more of the same we saw last year, namely that ‘Bad news is good news’!

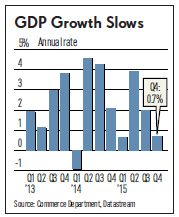

And the bad news of first instance was that the fourth quarter GDP disappointingly grew only at an annual rate of 0.7%, down from gains of 2.0% in Q3, and 3.9% in Q2. Why should this be a factor to push up the market? Because of the view that it is less likely that the stock market would be exposed to further interest rate increases this year, since GDP is signalling an economic slowdown. The consensus is however that it will not bloat into a fully-fledged recession. Another engine of the rally was that Japan is introducing negative interest as a means of stimulating its listless economy. The third economic factor was the crude oil rally, which bounced off a 12-year low. Brent Crude rose 7.9% during the week, while U.S. oil settled up 4.4%, as America’s production edged lower. The Russian Initiative to discuss with OPEC production cuts also was positively received.

And the bad news of first instance was that the fourth quarter GDP disappointingly grew only at an annual rate of 0.7%, down from gains of 2.0% in Q3, and 3.9% in Q2. Why should this be a factor to push up the market? Because of the view that it is less likely that the stock market would be exposed to further interest rate increases this year, since GDP is signalling an economic slowdown. The consensus is however that it will not bloat into a fully-fledged recession. Another engine of the rally was that Japan is introducing negative interest as a means of stimulating its listless economy. The third economic factor was the crude oil rally, which bounced off a 12-year low. Brent Crude rose 7.9% during the week, while U.S. oil settled up 4.4%, as America’s production edged lower. The Russian Initiative to discuss with OPEC production cuts also was positively received.