The risk that similar attacks to the ones seen this weekend in Saudi Arabia could disrupt oil supplies, but it does not fundamentally change our medium-term scenario. We still forecast USD50 per barrel for Brent in 2020.After this weekend’s drone attack on the world’s most important crude oil facility, the Saudi Arabian authorities have announced that 5.7 million barrels per day (mbd), half of its daily oil production and 5% of the world total, will be taken off-line. Iran-aligned Houthi rebels in Yemen have claimed responsibility. Brent futures jumped by 20% to USD72 at the opening today in response to this news, the biggest intraday advance on record! (As we write, prices looked like settling around USD66.)Saudi Arabia has announced that it can restart a significant volume of oil

Read More »Articles by Jean-Pierre Durante

Oil prices and the global economy

September 11, 2019Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.

Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial production, an increase in inventories and, ultimately, a reduction in investments.

All this process takes time. Hard data remained resilient for nine months. but the first signs of capitulation are now appearing. International trade weakened by only -0.2% between September 2018

Oil prices and the global economy

September 10, 2019Low oil prices are good news for disposable income. But they also reflect the risk of oversupply in a world where growth indicators continue to point down.Events since Trump first threatened increased tariffs in 2017 provide a textbook example of how tariffs are transmitted through the global economy. First, the uncertainty they create hurts sentiment. Then, as uncertainty lasts, investments are postponed. Indeed, we are currently seeing a progressive decline in new orders, industrial production, an increase in inventories and, ultimately, a reduction in investments.All this process takes time. Hard data remained resilient for nine months. but the first signs of capitulation are now appearing. International trade weakened by only -0.2% between September 2018 and May 2019, but it dropped

Read More »World growth forecast revised down

July 24, 2019Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast.

The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data as well. In particular, fixed investment in advanced economies plunged from 9.7% year-on-year (y-o-y) growth in Q1 2018 to -1.2% y-o-y in Q1 2019.

The slowdown in domestic fixed investment hit countries and regions throughout the world at about the same time, in Q3 18. In fact, with the exception of

World growth forecast revised down

July 23, 2019Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast.The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy. Sentiment was the first to be hit, but there have been increasing signs of a marked slowdown in hard data as well. In particular, fixed investment in advanced economies plunged from 9.7% year-on-year (y-o-y) growth in Q1 2018 to -1.2% y-o-y in Q1 2019. The slowdown in domestic fixed investment hit countries and regions throughout the world at about the same time, in Q3 18. In fact, with the exception of the US, all the economies in our sample (covering 94% of advanced economies’

Read More »World trade and manufacturing hit by tariffs

July 9, 2019In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.

Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting. One needs to go back to 2012 to see something comparable.

Even if the direct impact of the trade war has been limited so far, the indirect impact is becoming more evident, with declining business sentiment eating into corporate investment plans and leading to a decline in industrial orders. The

World trade and manufacturing hit by tariffs

July 8, 2019In June, the world PMI manufacturing index recorded its second consecutive month below 50, suggesting that global manufacturing is contracting.Global manufacturing sentiment deteriorated further in June. Markit Economics’ World purchasing managers’ index for manufacturing fell to 49.4 from 49.8 in May, the second month in a row it was below the 50 threshold, suggesting that global manufacturing activity is contracting. One needs to go back to 2012 to see something comparable. Even if the direct impact of the trade war has been limited so far, the indirect impact is becoming more evident, with declining business sentiment eating into corporate investment plans and leading to a decline in industrial orders. The decline in new orders and slowdown in the growth of international trade suggest

Read More »Oil prices are reeling

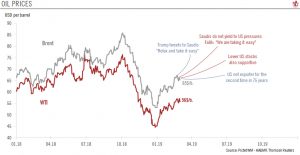

June 11, 2019The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.

The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.

Business sentiment has been deteriorating for some time. By May the world Purchasing Manager Index for Manufacturing (PMI) had recorded its longest continuous deterioration on record (13 months), even longer than that seen during the Global Financial Crisis. Indeed, world PMI fell below 50 in May (to 49.8)—the threshold between

Oil prices are reeling

June 7, 2019The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.Business sentiment has been deteriorating for some time. By May, the world Purchasing Manager Index for Manufacturing (PMI) had recorded its longest continuous deterioration on record (13 months), even longer than that seen during the Global Financial Crisis. Indeed, world PMI fell below 50 in May (to 49.8)—the threshold between expansion and contraction in activity—for the first time since February 2016.

Read More »Oil prices decline despite the end of Iran waivers

May 7, 2019We believe prices will remain volatile in the short term, before a possible oil glut becomes an issue toward year’s end.The increase in prices that followed President Trump’s 22 April decision to end waivers on Iranian oil imports did not last, with Brent prices falling from almost USD75 on 24 April to below USD70. Nonetheless, we continue to see heightened risk of oil price spikes above USD80 for Brent in the short-term.Trump’s recent threat to increase US tariffs on Chinese imports could shake global growth if implemented and, as a result, weaken oil demand. But in all eventualities, the most likely consequence is higher oil price volatility in the short term.However, over the longer term, the major risk surrounding the oil market could be a supply glut. When the new Permian pipelines

Read More »Signs of global rebound are appearing

April 10, 2019Recent data suggest the downturn in the world economy is bottoming out after a prolonged period of deterioration. We expect the world economy to expand by 3.3% this year.At its Spring Meeting, the International Monetary Fund (IMF) revised downward its 2019 global growth forecast from 3.5% to 3.3% (the same as our own forecast). The IMF left its estimate for 2020 growth unchanged at 3.6%As global growth probably slowed to 3.2% in the second half of 2018, a 3.3% growth estimate for 2019 implies that growth stabilises in H1 and firms up in H2. The latest news on global activity tends to confirm that the global economy is indeed beginning to regain momentum.For example, the global purchasing manager index (PMI) for manufacturing stabilised in March after 10 months of deterioration in a row.

Read More »Oil prices supported by OPEC+ cuts…before market risks being flooded again

April 5, 2019Increased US export capacity would probably force OPEC+ to change its current tactics.

After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.

The recent release of the International Energy Agency’s annual report is an occasion to answer this question and to reassess prospects for global oil supply and demand.

Global oil demand is expected to increase by 7 million barrels per day (mbd) between 2018 and 2024. Peak oil is still far off.

In 2019, oil will be supported by steady demand

Oil prices supported by OPEC+ cuts…before market risks being flooded again

March 29, 2019Increased US export capacity would probably force OPEC+ to change its current tactics.After last year’s collapse, oil prices have found support since the beginning of this year for several reasons. At this stage, the main question is whether the recent surge in prices is sustainable or whether we will see renewed oil price volatility, with the possibility of a repeat of 2018.The recent release of the International Energy Agency’s annual report is an occasion to answer this question and to reassess prospects for global oil supply and demand.Global oil demand is expected to increase by 7 million barrels per day (mbd) between 2018 and 2024. Peak oil is still far off.In 2019, oil will be supported by steady demand from emerging economies and a stronger-than-expected uptick in demand from

Read More »Global indicators: manufacturing sentiment declines

March 12, 2019With declining manufacturing sentiment and recent downward revisions to our US and euro area GDP forecasts, we have revised down our world real GDP growth forecast for 2019. A US-China trade agreement will be key to avoiding further growth deterioration. After recent downward revisions to our US and euro area GDP forecasts and against a backdrop of declining global manufacturing sentiment, we have revised our world real GDP growth forecast for 2019 to 3.3% from 3.5% previously.Manufacturing sentiment in all regions deteriorated in February, with the exception of emerging economies, where sentiment recorded a small rebound. Deterioration in sentiment is progressively translating into a marked downturn in hard data. International trade contracted for the second month in a row at the end

Read More »Oil market update

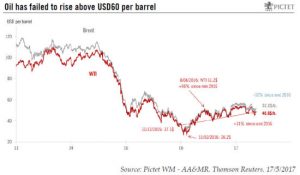

March 5, 2019Brent price finds support between USD60 and USD70Increased pressure from President Trump on the Saudis to halt oil production cuts last week had only a temporary impact. Brent prices are currently being underpinned by several factors, including hopes of a US-China trade deal and OPEC+ production cuts, in particular. The Saudis have been aggressively cutting their production recently. With output of 10.1m barrels/day (mbd) in February, they are already below their 10.3mbd agreed target. In so doing, they are fully exploiting a window of opportunity, as US oil supply response capacity is capped due to current pipeline bottlenecks.This context offers support for the Brent price to navigate in the USD60-70 corridor. H2 2019 is likely to prove less supportive for oil prices, as increased

Read More »GLOBAL INDICATORS

February 12, 2019With further deterioration in the global manufacturing Purchasing Manager’s Index (PMI) to 50.7 in January, the global economy is flirting with recession.January’s deterioration in sentiment was widespread, with the notable exception of the US. However, it is possible that January pessimism was largely caused by December’s poor financial markets. If this is indeed the case, it is likely that we will see a bounce in sentiment in the months ahead, following January’s rebound in markets.The latest global activity hard data were also poor. International trade contracted in November in large part due to a marked deterioration in Asian trade, which had recently been the last remaining pillar of trade expansion.The trade dispute first knocked sentiment but is now also progressively

Read More »OPEC+ discipline will be key for oil prices in 2019

February 5, 2019An extension of the December agreement to cut production, plus a slight increase in demand, could potentially bring the oil market into balance this year.Global oil supply is undergoing a structural shift. The US oil industry is growing in importance relative to the OPEC. As a result increased production from non-OPEC producers more than compensated for the output collapse among important OPEC producers such as Iran and Venezuela in 2018.Slowing global growth, and new US pipelines facilities in H2 2019, as well as the diminished importance of OPEC, have raised concerns around a potential oil glut. At the same time, we believe that financial markets may be overestimating the risks of a global recession. Moreover, lower oil prices – prices were between 14% and 18% lower in January than

Read More »Oil prices close to fair value

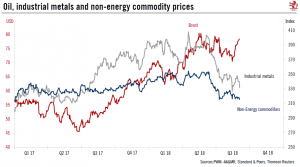

September 5, 2018Oil prices are caught between concerns that trade disputes will dent demand, and the risk of supply shortages due to production shortfalls and capacity constraints. We think that these combined factors justify our estimated fair value for oil.In light of the OPEC + Russia decision to increase output, oil prices declined from the end-June to mid- August. This decline is not limited to oil: all commodities have been affected. Industrial metals declined by 12%, and non-energy commodities by 5%, as fears rose that international trade disputes will dent global demand for commodities.But we believe that these concerns are exaggerated. For one, tariffs implemented so far are expected to have a mere 0.1 % impact on world GDP growth. Instead, we are sticking to the view that the oil market is

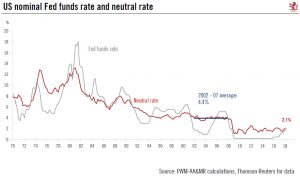

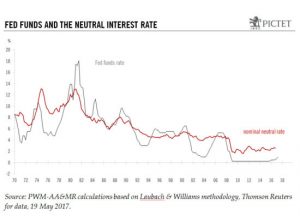

Read More »Close to neutral

July 10, 2018We are now very close to the neutral rate of interest in the US, meaning Fed policy is ceasing to be expansionary.After seven quarter-point rate hikes in the US since the end of 2015, we reckon we are close to a neutral rate of interest – the rate of interest consistent with trend growth, stable prices and full employment. We calculate that the current neutral rate is 2.1%, compared with a Fed funds rate of 2.0%.A neutral rate of 2.1% is considerably lower than the 4.4% rate that prevailed before the global financial crisis, underlining that event’s enduring impact. Only a lasting period (which we think unlikely) of sustained growth and inflation would push the neutral rate back up to pre-crisis levels. Instead, in our baseline scenario of decent economic growth and inflation, we expect

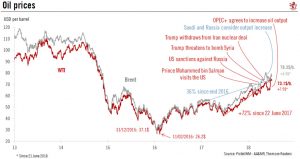

Read More »Oil prices: the summer will be hot

July 6, 2018Spare capacity is tight, so oil prices could spike higher.The June OPEC agreement to increase oil output provided only a brief respite to oil consumers. After a temporary dip, prices started to rise steadily again, with Brent gaining USD4 per barrel and WTI more than USD7 between 22 June and 6 July. The larger rise in the West Texas Intermediate (WTI) price was due to a Canadian oil-sands outage that drained stockpiles in North America.Taking into account falling oil output in Venezuela, the risk to Iranian output from sanctions and the bottlenecks facing US production, the world supply-demand balance relies on OPEC’s spare capacity of just over 2 million barrels per day. This is a very small cushion to deal with demand and is vulnerable to supply disruption. There is a marked risk we

Read More »Global business survey heralds inflection in economic activity

June 6, 2018A slowdown in global business sentiment is not too worrying at this stage, but further deterioration will trigger downward revisions to GDP projections.Markit’s world manufacturing purchasing managers index (PMI) dropped from 53.5 in April to 53.1 in May. All in all, the world PMI declined in four of the first five months of 2018. No region has been spared the decline in business sentiment. Nonetheless, the index is still well above the 50 threshold that separates expansion from contraction.International trade statistics are also showing early signs of deterioration, starting in advanced economies and spreading progressively to emerging ones. Sentiment deteriorated in all five BRICS economies in May (Brazil, Russia, India, China and South Africa). Moreover, sentiment in Russia and South

Read More »Oil price forecast revised up

May 22, 2018Tensions surrounding oil supplies from Iran and Venezuela are destabilising the supply/demand balance.The decision by Donald Trump to withdraw from the nuclear agreement with Iran in early May constitutes a major geopolitical shift. Iran is the world’s seventh-largest world oil producer, exporting 1.1 million barrels per day (mbd). At this stage, it is unclear how Iranian exports will be affected, but taken together with the crisis in Venezuelan oil production, it could cause significant destabilising of supply.Combining supply and demand scenarios gives us an indication of price pressures for the years to come. In our baseline scenario, one that excludes a reduction in Iranian production or further falls in Venezuelan production, we still see 2018 as a difficult year, with a 0.2mbd

Read More »Where next for oil prices?

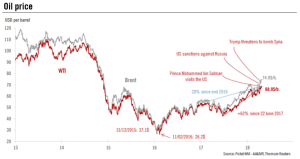

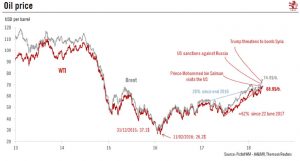

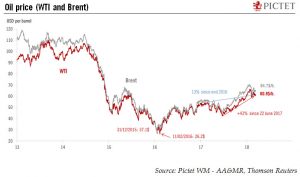

May 3, 2018On 19 April, the price of a barrel of oil reached USD69.56 for West Texas Intermediate (WTI) and reached USD75.27 for Brent, today, the highest price since 2014. Since 9 April, oil prices have been significantly above their longterm fundamental equilibrium value. Three factors explain what has happened:

Geopolitics. Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against Russia and western airstrikes against Syria, geopolitical developments have been to the fore in recent weeks. As a result, worries about Middle East stability have resurfaced. In particular, Iranian supply could be cut if a breakdown in the nuclear agreement leads to fresh sanctions.

Financial market

Where next for oil prices?

April 25, 2018Oil prices are significantly above their long-term equilibrium, but should converge towards their equilibrium in the coming months.Oil prices have surged to their highest levels since 2014 (USD69.56 for West Texas Intermediate (WTI) on 19 April and USD75.27 for Brent on 24 April ). They are now USD6 to USD9 above our calculation of their long-term fundamental price equilibrium.Three factors explain the current price premium:Geopolitics: Between Saudi Arabia’s Prince Mohammed bin Salman visit to the US at end March, new US sanctions against Russia and western airstrikes against Syria, geopolitical developments have been to the fore in recent weeks. Worries about Middle East stability have resurfaced. In particular, Iranian supply could be cut if a breakdown in the nuclear agreement leads

Read More »Limited upside potential for oil

March 15, 2018The current spot price is already close to oil’s upwardly revised equilibrium price.Strong global growth, a substantial US fiscal stimulus, signs that reflation is taking hold in the US and a relatively weak US dollar all should represent a favourable environment for commodities, and for oil in particular, for the rest of this year. However, our analysis suggests that oil is now close to its long-term equilibrium price, offering limited upside potential.Now that markets have fully taken on board the impact of the latest US fiscal stimulus (which led us to revise our forecast for real global GDP growth in 2018 up from 3.7% to 3.9%), the potential for further upwards revisions is limited, in our view. In addition, recent leading indicators suggest that economic activity may have peaked in a

Read More »Oil market tilted towards oversupply

December 13, 2017The same discipline shown by OPEC and Russia in 2017 will be required to support prices at their current level. After the 30 November agreement between OPEC and Russia to extend oil production cuts until the end of 2018, it is worth looking again at the balance between oil supply and demand. The most recent data indicate that without continued willingness from OPEC to limit supply, the market will be naturally tilted towards oversupply in 2018 and 2019. Non-conventional production, in particular US shale oil, is expected to continue to play an important role. Oil prices in 2018 will largely depend on OPEC members and Russia remaining disciplined enough to keep production slightly below demand. In this context, we are sticking with our forecast, based on long-term fundamentals, which

Read More »Upward potential for oil prices is limited

November 8, 2017Various factors have contributed to the oil price rally since August, but while a further short-term surge is possible the fundamental long-term equilibrium price for WTI remains USD55-USD58.Recent developments have brought noticeable changes to the outlook for the supply-demand balance. First of all, the steady decline in the value of the US dollar since the end of 2016 has been stopped. In fact, the dollar appreciated by 4% between end September and 7 November.Second, world economic activity has gained steam. In its last update, the International Monetary Fund revised its world GDP growth forecast up to 3.6% in 2017 and 3.7% in 2018. Third, US oil production has hit some obstacles. The number of rigs has declined after an impressive 143% increase in in the 16 months to August 2017. As a

Read More »Fed funds rate back to 3%?

May 24, 2017Analysis of the ‘neutral’ rate of interest suggests there is considerable market complacency surrounding the potential for further hikes in the Fed funds rate.Janet Yellen refers regularly to the concept of ‘neutral’ interest rate as a reference point for monetary policy. The neutral rate is very helpful in determining whether the Fed’s monetary stance is relaxed or restrictive and can also provide insight into the Fed’s next possible moves.The financial crisis has had a considerable impact on the neutral rate. It is currently estimated at 2.6% and has not been showing many signs of bouncing back towards pre-crisis levels (4.5%). But this could change.The ‘neutral’ rate can be understood as the interest rate expected to prevail when economic growth is in line with long-term potential prices are stable, and full employment has been achieved. Historically, the Fed funds rate tends to hover around the neutral rate, although gaps can open up between the two, most notable in 2001-2006, when the Fed funds rate was much lower than the neutral rate.Pictet Wealth Management’s baseline scenario is that US GDP will grow by 2.2% in 2017 and 2.3% in 2018, and that headline inflation will reach 2.4% in 2017 and 2.5% in 2018.

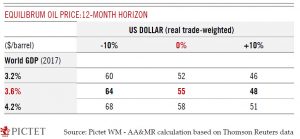

Read More »Oil prices: limited upside potential

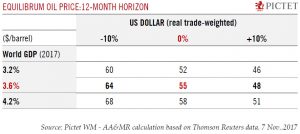

May 18, 2017Having faltered this year, predictions of prices above USD60/b in 2017 appear premature.The market was highly optimistic about oil price at the beginning of this year, with oil analysts expecting that prices would have recovered to USD60-65 by now. These hopes have clearly been dashed, as WTI prices have fluctuated in a range of USD45-55 since January 1.We have been much less optimistic than the market, based on our own modelling of the equilibrium oil price, which has proved a reliable indicator of oil price trends in the past. The equilibrium oil price has informed our forecast over the past two years that spot oil prices would remain close to USD50 per barrel. In addition, the current price (USD48.6/b for the spot WTI on 16 May) is very close to the equilibrium price of USD44/b Taking into account our economic scenario (world GDP growth of 3.3% in 2017 and 3.6% in 2018, US inflation of 2.4% in 2017), the oil price equilibrium may shift only slightly higher, to USD51/b over the next 12 months, assuming the trade-weighted US dollar rate remains unchanged.For the price to go higher, we would need much stronger economic growth or a weaker US dollar. If the US dollar were to weaken by 10% in real trade-weighted terms over the coming 12 months (not our core scenario), then equilibrium oil prices could rise to USD59/b.

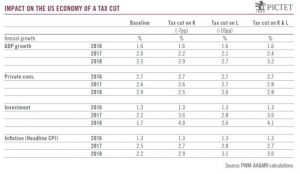

Read More »The potential impact of a Trump fiscal stimulus

February 8, 2017Using in-house modelling, we are able to assess the broad consequences of a much-mooted fiscal stimulus on the US economy and the main asset classes.Our core scenario for the US is for real GDP growth of 2% in 2017 and 2.3% in 2018. This assumes that fiscal policy will be only modestly stimulative. However, with the election of Donald Trump as US president, the possibility of a radical change in public policy has increased markedly—possibilities, which enter into our alternative scenarios for the US economy, range from a large fiscal stimulus to trade protectionism. We use our in-house models to assess the potential impact of the first alternative scenario, a substantial fiscal stimulus.We estimate that Trump’s proposal to cut the top marginal rate of corporate tax from 35% to 20% could be very effective in boosting GDP growth. The changes would likely take time to implement, limiting their impact in 2017. But in 2018, US GDP could jump to 2.9%. The main driver would be increased investment.Trump is also considering reducing taxes on labour. The economic impact of a 10 percentage point cut in the average tax on labour would be less impressive, although still significant, boosting real GDP growth in the US to 2.7% in 2018. A combination of corporate and labour tax cuts would be most effective, raising GDP growth to 3.

Read More »