While we believe upcoming elections are unlikely to shake the European edifice, investors are turning cautious, if only because opinion poll accuracy has proved questionable over the past year.There are good reasons for investors to worry about political risks in Europe. The most legitimate concerns, in our view, come from the timing of elections this year in the largest euro area countries. They are coming against the backdrop of a broad shift towards protectionism, and at a time when ECB support is being reduced before, potentially, being unwound in 2018.At the same time, we see little evidence of political uncertainty weighing on growth. If anything, economic momentum in Europe has improved since the US elections of November, partly due to global fiscal stimulus and reflation hopes, and partly due to domestic improvements. Better-than-expected data have pushed our forecast for euro area growth mechanically higher, to 1.5% in 2017 (from 1.3%). The biggest risk, in our view, is that corporate investment spending – the single most important driver for a sustained and sustainable recovery – weakens ahead of the elections.Our baseline scenario remains constructive and we expect pro-European, pro-business governments to be elected in all.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: Euro political risk, euro sceptics, European elections, European politics, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

While we believe upcoming elections are unlikely to shake the European edifice, investors are turning cautious, if only because opinion poll accuracy has proved questionable over the past year.

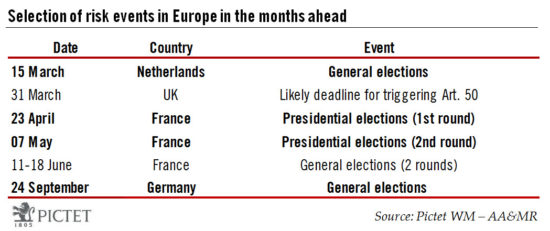

There are good reasons for investors to worry about political risks in Europe. The most legitimate concerns, in our view, come from the timing of elections this year in the largest euro area countries. They are coming against the backdrop of a broad shift towards protectionism, and at a time when ECB support is being reduced before, potentially, being unwound in 2018.

At the same time, we see little evidence of political uncertainty weighing on growth. If anything, economic momentum in Europe has improved since the US elections of November, partly due to global fiscal stimulus and reflation hopes, and partly due to domestic improvements. Better-than-expected data have pushed our forecast for euro area growth mechanically higher, to 1.5% in 2017 (from 1.3%). The biggest risk, in our view, is that corporate investment spending – the single most important driver for a sustained and sustainable recovery – weakens ahead of the elections.

Our baseline scenario remains constructive and we expect pro-European, pro-business governments to be elected in all. We reiterate our view that even if, contrary to our expectations, a Eurosceptic party were to win in the Netherlands, France, Germany or Italy, institutional and legal obstacles would make an exit process from the EU or EMU very unlikely.

The state of play

The general election in the Netherlands on March 15 will be the first key political test in 2017. The score obtained by the far-right, Eurosceptic Party of Freedom (PVV) will be watched very closely. We believe it is probable that pro-EU parties will work together to rule out a coalition with the PVV, which would remain the largest opposition party.

In France, the voting arithmetic remains very unfavourable to the far-right Front National (FN) barring an unprecedented (and improbable) collapse in participation. Our assumption remains that a pro-European, pro-business president will be elected. In Germany, we are sceptical that Martin Schulz’s personal popularity will be enough for the SPD to win the election and form a stable coalition without the CDU, although a lot could happen before the federal elections on 24 September.

In Italy, the main parties are split on the issue of early elections. We believe they are likely to work to try to come up with a new electoral law that harmonises the electoral system beforehand. Ultimately, the decision on new elections belongs to the president of the republic. He may feel that stability is best served by keeping the caretaker government in place until the legislative elections scheduled for 2018.

Amid bailout talks, political tensions in Greece have intensified and early elections cannot be discounted. Current polls suggest very strong voter preference for centre-right opposition party New Democracy. Meanwhile, the Catalonian question is likely to continue to contribute to political uncertainty in Europe, with the Catalonian government vowing to hold a referendum on secession from Spain by September.