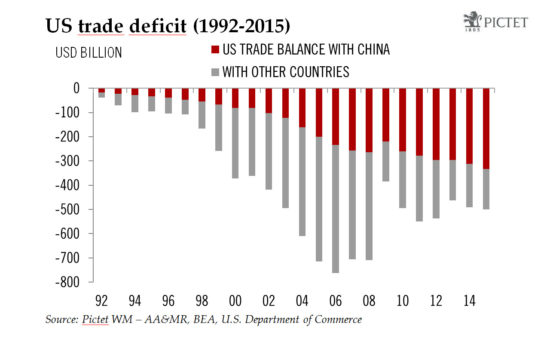

There is a high risk that tensions between the US and China over the latter’s rise are set to come to a head under Trump’s presidency and become an important source of market volatility.The relationship between the US and China is of vital importance for the world both from an economic and a geopolitical perspective. Competition between the two powers could be set to come to a head under Donald Trump’s presidency. First, the trade relationship with China is a central issue in the Trump administration’s apparent intention to redraw global trade in a manner more favourable to the US. Second, the Trump administration is also signalling a more confrontational approach to China over competition for territorial dominance—notably over the South China Sea.Increasing evidence suggests that Trump will likely follow through with at least some of the protectionist policies that he threatened during his election campaign, and that China will top his list of targets.He could name China a currency manipulator and impose punitive tariffs on Chinese goods. China might be willing to make concessions, but there are major risks. A full-scale trade war between the two nations cannot be ruled out, although it is not part of our base-case scenario.

Topics:

Dong Chen considers the following as important: Geopolitics, Macroview, US China confrontation, US foreign policy, US-China relations

This could be interesting, too:

Marc Chandler writes Ueda Lifts Yen, Leaving Euro and Sterling Pinned Near Lows

Marc Chandler writes US CPI, New Security Initiatives with Tokyo and Manila, Bank of Canada Meeting

Claudio Grass writes 2024 outlook: Gold Shines Bright in the Gathering Storm

Claudio Grass writes 2024 outlook: Gold Shines Bright in the Gathering Storm

There is a high risk that tensions between the US and China over the latter’s rise are set to come to a head under Trump’s presidency and become an important source of market volatility.

The relationship between the US and China is of vital importance for the world both from an economic and a geopolitical perspective. Competition between the two powers could be set to come to a head under Donald Trump’s presidency. First, the trade relationship with China is a central issue in the Trump administration’s apparent intention to redraw global trade in a manner more favourable to the US. Second, the Trump administration is also signalling a more confrontational approach to China over competition for territorial dominance—notably over the South China Sea.

Increasing evidence suggests that Trump will likely follow through with at least some of the protectionist policies that he threatened during his election campaign, and that China will top his list of targets.

He could name China a currency manipulator and impose punitive tariffs on Chinese goods. China might be willing to make concessions, but there are major risks. A full-scale trade war between the two nations cannot be ruled out, although it is not part of our base-case scenario.

The Trump administration has signalled that it could take a more confrontational approach to China’s island-building in disputed waters in the South China Sea. Vital strategic interests are at stake on both sides, and there is no sign that China is willing to compromise. If the Trump administration follows through, there will be a considerable risk of conflict.

Investment conclusions

The risk of competition between the US and China escalating into a damaging confrontation should be of grave concern for markets. It poses major downside risks to our benign baseline scenario for the global economy in 2017 and beyond, and to expected returns. Even assuming conflict is avoided, the Trump administration’s more confrontational approach risks periods of sharply escalating tension, creating volatility on financial markets. In this environment, it will remain important to maintain well-diversified portfolios and to find smart ways to protect them.