Given a widening real yield differential, we see the dollar continue to rise, especially against the yen, while further sterling downside looks limited.Our latest forecasts for individual currencies in 2017 can be summarised as follows:US dollar. The USD is likely to remain strong on the back of an improving US growth and inflation outlook as well as continued monetary policy divergence. Our base case scenario is for a Trump administration that puts the emphasis on growth without too much by way of disruptive protectionist policies, thus supporting the USD against low-yielding developed-market currencies. A tough protectionist stance would likely boost core inflation, supporting the USD, but would also hurt risk appetite, thus weighing on emerging-market currencies with important external exposure.Euro. In December, the ECB announced it was extending QE at least to the end of 2017, although with monthly purchases reduced from April onwards. At its January policy meeting, the ECB signalled it was in no hurry to start proper tapering by setting out a number of criteria in terms of inflation dynamics that it wants to see before adjusting its monetary stance. Coupled with the option to purchase assets below the deposit rates, introduced in December, the ECB’s monetary policy should put added downward pressure on rates in the euro area and hence on the euro.

Topics:

Luc Luyet considers the following as important: currencies, Currency fluctuations, Currency outlook, Dollar strength, Macroview

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

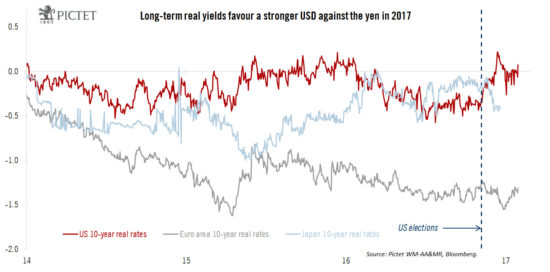

Given a widening real yield differential, we see the dollar continue to rise, especially against the yen, while further sterling downside looks limited.

Our latest forecasts for individual currencies in 2017 can be summarised as follows:

US dollar. The USD is likely to remain strong on the back of an improving US growth and inflation outlook as well as continued monetary policy divergence. Our base case scenario is for a Trump administration that puts the emphasis on growth without too much by way of disruptive protectionist policies, thus supporting the USD against low-yielding developed-market currencies. A tough protectionist stance would likely boost core inflation, supporting the USD, but would also hurt risk appetite, thus weighing on emerging-market currencies with important external exposure.

Euro. In December, the ECB announced it was extending QE at least to the end of 2017, although with monthly purchases reduced from April onwards. At its January policy meeting, the ECB signalled it was in no hurry to start proper tapering by setting out a number of criteria in terms of inflation dynamics that it wants to see before adjusting its monetary stance. Coupled with the option to purchase assets below the deposit rates, introduced in December, the ECB’s monetary policy should put added downward pressure on rates in the euro area and hence on the euro. That said, the euro area’s large positive current account should continue to provide some support to the euro.

Swiss franc. The uncertainties surrounding Brexit and the Trump presidency are expected to further discourage recycling of the Switzerland’s large current account surplus, supporting the CHF. The Swiss National Bank (SNB) is expected to continue to rely on FX intervention to curb unwanted CHF appreciation, but a rate cut remains unlikely. However, the SNB seems to be becoming more focused on the CHF’s fluctuations against a basket of currencies rather than against the EUR alone, suggesting that CHF appreciation against the EUR could be tolerated if it is offset by CHF weakness against the USD.

British pound. Although political uncertainties are likely to remain elevated, the UK government’s position, as outlined by prime minister Theresa May, tends to confirm that Britain is heading for a hard Brexit, which does not bode well for the UK’s growth outlook or for the GBP. Barring a sharp slowdown in growth, the Bank of England’s limited tolerance of above-target inflation will likely reduce the downside potential for sterling.

Japanese yen. The Bank of Japan’s new framework for monetary policy (yield-curve control) highlights the limitations of its quantitative easing programme and its concerns about the health of the banking sector. Consequently, the bar is set high for any further lowering of short-term interest rates. Without deeper co-ordination between fiscal and monetary policies, the attractiveness of the JPY (in terms of real rates) relies mostly on external factors such as long-term yields in other countries, the Fed’s monetary policies and oil prices. In that regard, the current global tendency towards higher yields makes the JPY particularly unattractive.