The difference in macro outlooks means prospects are brightening for the New Zealand dollar against its Australian equivalent.At their February monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at 1.50% and 1.75% respectively.However, given our view that New Zealand’s economic fundamentals are better than Australia’s, the temporary weakness of the New Zealand dollar that stemmed from the forward guidance the RBNZ provided at the February meeting could be an opportunity for exposure to the New Zealand dollar against the Australian dollar.The RBA remains relatively tolerant of low inflation, as the recent weakness in growth is seen as temporary. Indeed, Australian tradable inflation should gain a more substantial boost from global reflation than New Zealand. However, the tightening of monetary conditions in China (a major destination for Australian raw material exports) could test the tolerance of the RBA for low inflation and therefore weigh on the AUD. In Australia, the ongoing transition away from mining is likely to further weigh on the growth outlook, while the housing market there is showing some signs of stress.At the same time, the RBNZ shifted from an easing bias to a neutral stance.

Topics:

Luc Luyet considers the following as important: Australian Dollar, currencies, currency strength, Macroview, New Zealand dollar

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Joseph Y. Calhoun writes Weekly Market Pulse: Monetary Policy Is Hard

The difference in macro outlooks means prospects are brightening for the New Zealand dollar against its Australian equivalent.

At their February monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at 1.50% and 1.75% respectively.

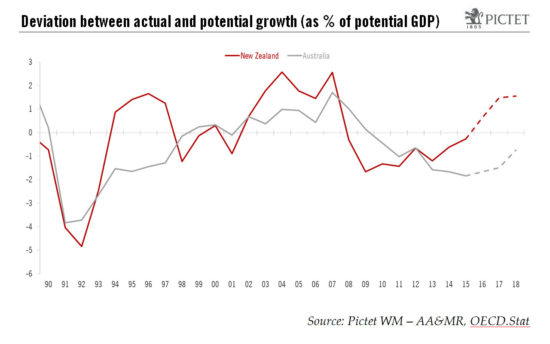

However, given our view that New Zealand’s economic fundamentals are better than Australia’s, the temporary weakness of the New Zealand dollar that stemmed from the forward guidance the RBNZ provided at the February meeting could be an opportunity for exposure to the New Zealand dollar against the Australian dollar.

The RBA remains relatively tolerant of low inflation, as the recent weakness in growth is seen as temporary. Indeed, Australian tradable inflation should gain a more substantial boost from global reflation than New Zealand. However, the tightening of monetary conditions in China (a major destination for Australian raw material exports) could test the tolerance of the RBA for low inflation and therefore weigh on the AUD. In Australia, the ongoing transition away from mining is likely to further weigh on the growth outlook, while the housing market there is showing some signs of stress.

At the same time, the RBNZ shifted from an easing bias to a neutral stance. However, the RBNZ governor signalled that market expectations for a rate hike in 2017 were premature, even though the New Zealand economy is in relatively fine fettle and the macro outlook in New Zealand seems more positive than in Australia.

At the same time, currency strength is a key concern for both the RBA and the RBNZ. While the bar is high for another rate cut, forward guidance on the timing of the start of the tightening cycle could be used to curb unwanted appreciation of both the Australian and New Zealand dollar. Indeed, with its February meeting the RBNZ is already having this effect. And there are compelling reasons for the RBA to be even more patient about raising rates. As a result, the rate differential between the two Antipodean countries on the one hand and the US on the other should narrow further, especially as the Fed moves into tightening mode.

Coupled with expensive valuations against the USD (the NZD is 20% overvalued against the USD on CPI-based purchasing power parity and the AUD is 12% overvalued), the NZD and the AUD should depreciate against the greenback.