Growth in the euro area outstripped growth in the US last year, while the latest indicators suggest 2017 has gotten off to a strong start. Our GDP forecasts are pushed up mechanically. Euro area real GDP expanded by 0.5% q-o-q in the fourth quarter, marking an acceleration from Q3’s 0.4% gain. The euro area economy grew at an annual average of 1.7% in 2016, compared with 1.9% in 2015. Last year was the first time since 2008 that real GDP growth in the euro area was above that of the US.Today’s GDP report mechanically pushes up our GDP forecast for 2017 from 1.3% to 1.5%. But it is worth mentioning that this does not change our central scenario for the euro area this year, as we are keeping unchanged our forecast for the pace of growth for the rest of the year.As for 2017, the first set of euro area sentiment indicators together with hard data point to a pretty strong first quarter. In particular, January’s composite purchasing manager index from Markit was consistent with GDP growth of 0.5% q-o-q in Q1. The European Commission business indicator also rose strongly in January.Overall, today’s GDP report, including revisions, mechanically pushes up our GDP forecast for 2017 from 1.3% to 1.5%. It is worth mentioning that it does not change our central scenario for the euro area, as we have kept unchanged our forecast for the pace of growth for the rest of the year.

Topics:

Nadia Gharbi considers the following as important: euro area GDP, euro area growth forecast, Euro area growth indicators, Euro area growth momentum, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Growth in the euro area outstripped growth in the US last year, while the latest indicators suggest 2017 has gotten off to a strong start. Our GDP forecasts are pushed up mechanically.

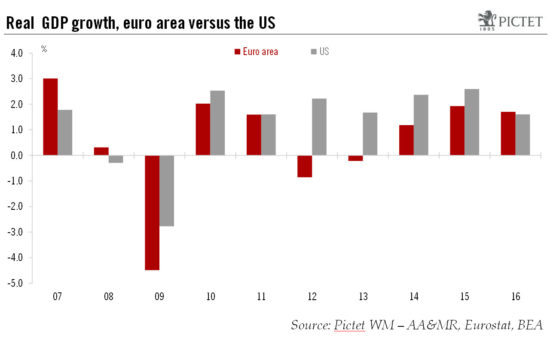

Euro area real GDP expanded by 0.5% q-o-q in the fourth quarter, marking an acceleration from Q3’s 0.4% gain. The euro area economy grew at an annual average of 1.7% in 2016, compared with 1.9% in 2015. Last year was the first time since 2008 that real GDP growth in the euro area was above that of the US.

Today’s GDP report mechanically pushes up our GDP forecast for 2017 from 1.3% to 1.5%. But it is worth mentioning that this does not change our central scenario for the euro area this year, as we are keeping unchanged our forecast for the pace of growth for the rest of the year.

As for 2017, the first set of euro area sentiment indicators together with hard data point to a pretty strong first quarter. In particular, January’s composite purchasing manager index from Markit was consistent with GDP growth of 0.5% q-o-q in Q1. The European Commission business indicator also rose strongly in January.

Overall, today’s GDP report, including revisions, mechanically pushes up our GDP forecast for 2017 from 1.3% to 1.5%. It is worth mentioning that it does not change our central scenario for the euro area, as we have kept unchanged our forecast for the pace of growth for the rest of the year.

The breakdown of GDP by expenditure component is not yet available for the fourth quarter, but evidence from high-frequency data suggests that domestic demand was the main engine of growth again. At a country level, France and Spain rose by 0.4% q-o-q and 0.7% q-o-q respectively in Q4. We expect French GDP to average 1.2% in 2017, only slightly above 2016’s 1.1% and still below the euro area average, while we expect growth in Spain to moderate to an annual average of 2.4% in 2017 after 3.2% in 2016.