Using in-house modelling, we are able to assess the broad consequences of a much-mooted fiscal stimulus on the US economy and the main asset classes.Our core scenario for the US is for real GDP growth of 2% in 2017 and 2.3% in 2018. This assumes that fiscal policy will be only modestly stimulative. However, with the election of Donald Trump as US president, the possibility of a radical change in public policy has increased markedly—possibilities, which enter into our alternative scenarios for the US economy, range from a large fiscal stimulus to trade protectionism. We use our in-house models to assess the potential impact of the first alternative scenario, a substantial fiscal stimulus.We estimate that Trump’s proposal to cut the top marginal rate of corporate tax from 35% to 20% could be very effective in boosting GDP growth. The changes would likely take time to implement, limiting their impact in 2017. But in 2018, US GDP could jump to 2.9%. The main driver would be increased investment.Trump is also considering reducing taxes on labour. The economic impact of a 10 percentage point cut in the average tax on labour would be less impressive, although still significant, boosting real GDP growth in the US to 2.7% in 2018. A combination of corporate and labour tax cuts would be most effective, raising GDP growth to 3.

Topics:

Jean-Pierre Durante considers the following as important: Macroview, Trump tax proposals, US economic scenarios, US fiscal stimulus, US growth projections

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Using in-house modelling, we are able to assess the broad consequences of a much-mooted fiscal stimulus on the US economy and the main asset classes.

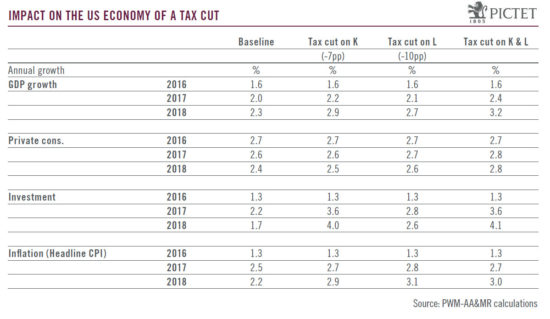

Our core scenario for the US is for real GDP growth of 2% in 2017 and 2.3% in 2018. This assumes that fiscal policy will be only modestly stimulative. However, with the election of Donald Trump as US president, the possibility of a radical change in public policy has increased markedly—possibilities, which enter into our alternative scenarios for the US economy, range from a large fiscal stimulus to trade protectionism. We use our in-house models to assess the potential impact of the first alternative scenario, a substantial fiscal stimulus.

We estimate that Trump’s proposal to cut the top marginal rate of corporate tax from 35% to 20% could be very effective in boosting GDP growth. The changes would likely take time to implement, limiting their impact in 2017. But in 2018, US GDP could jump to 2.9%. The main driver would be increased investment.

Trump is also considering reducing taxes on labour. The economic impact of a 10 percentage point cut in the average tax on labour would be less impressive, although still significant, boosting real GDP growth in the US to 2.7% in 2018. A combination of corporate and labour tax cuts would be most effective, raising GDP growth to 3.2% in 2018, in our simulation, with more balance between private consumption and investment as drivers. Inflation would also rise, to 3% on our estimates, from 2.2% in the baseline.

Our simulations suggest fiscal stimulus would be favourable for equities, as a stronger improvement in nominal GDP growth would provide a further boost to US companies’ earnings. Sovereign bonds on the other hand, would risk being hurt by the rise in inflation. This would further reinforce our current investment policy bias towards equities over bonds, and our preference for high yield corporate credit within fixed income. The main economic impact would not be felt until 2018, but markets could start pricing in the impact of a stimulus from the second half of 2017 onwards.