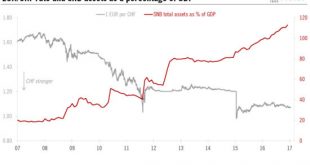

The Swiss economy has proved more resilient than expected to the sudden appreciation of the Swiss franc in January 2015, but negative deposit rates could remain in place through 2017.On 15 January 2015, the Swiss National Bank (SNB) decided to discontinue the minimum exchange rate of CHF1.20 per euro introduced in September 2011. The SNB’s announcement came as a shock for the Swiss economy, and resulted in a sharp appreciation of the Swiss franc. But two years later, the Swiss economy has...

Read More »A unique asset class which is here to stay

Published: Monday January 16 2017Klaus Hommels, founder of a leading European venture fund, explains his approach to investing in tech start-ups, the qualities he looks for in entrepreneurs and how he identifies new opportunities.As one of Europe’s leading business angels, Klaus Hommels has established a remarkable success record with investments in some of the largest European and worldwide internet start-ups. They include Skype, Facebook, Airbnb, King, QXL/Tradus, Xing and Spotify (where...

Read More »Using AI to forecast financial markets

Prof. Qiang Yang, founding head of Huawei Technologies' AI research lab, believes that big data paves the way for greater use of artificial intelligence in finance. Extracts from a recent interview.What’s the next step for AI?Artificial Intelligence has been successful mostly in fairly limited and well understood domains. A prime example is Go, where the rules are set and the range of data is confined to predetermined board locations. In the area of chatbots, the best chatbot today can do...

Read More »Superior returns from intelligent machines

Published: Thursday January 12 2017As technological advances and new business models drive strong growth in robotics, artificial intelligence and industrial automation, these sectors are becoming increasingly attractive to investors.Since its early days in the 1960s, robotics has marched steadily into the mainstream, and is now launching disruptive innovations which are permeating the business world and people’s daily lives. The development of artificial intelligence (AI), in particular, is...

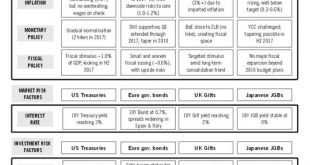

Read More »Sovereign yields to rise as reflation takes hold

Total returns from government bonds could come under pressure in 2017.Our central scenario for developed markets sovereign bond yields in 2017 is based on our in-house risk-factor analysis, which is leading us to conclude that there is a 65% probability that 2017 will be a year of reflation (see table).Underpinning the economic environment will be the following three macroeconomic factors:Inflation, which should accelerate in the US, the euro area, the UK and Japan.Monetary policy, which...

Read More »The crisis in the Middle East and oil prices

We expect oil prices broadly to stabilise in 2017—but prices will continue to be affected by geopolitical shocks in the region, which will also create tremors on financial markets.Oil currently seems to have reached its fair value at around USD50 per barrel for Brent crude. We expect prices to average around USD55/b in 2017, while supply continues to adapt to sluggish demand. The agreement between OPEC members on 30 November and with non-OPEC producers a week later should reinforce the trend...

Read More »Robo-advisors in financial institutions

Published: Monday January 09 2017The development of deep learning AI programmes allows robots to emulate back-up staff in financial institutions, says leading computer scientist Qiang Yang – but they will not completely replace human decision-making.In many financial institutions, expert advisors rely on trading data, company reports and news stories to detect minute market signals and provide clients with investment recommendations. Their work is often supported by teams of interns who...

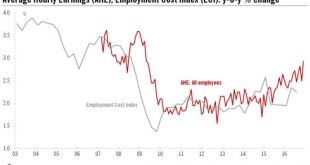

Read More »Solid US job figures, wages accelerate

The US jobs market ends 2016 in good shape and wage growth reaches a new cyclical high.Non-farm payroll employment in the US rose by 156,000 month on month in December, slightly below consensus expectations of 175,000, while payroll growth figures for the previous two months were raised by 19,000. The unemployment rate rebounded slightly to 4.7% in December, only partly reversing the sharp decline of the previous month. The broader U6 unemployment rate fell to a new low of 9.2%.Looking...

Read More »Autonomous decision-making using AI

Published: Friday January 06 2017Antoine Blondeau, co-founder of a pioneering artificial intelligence company, believes that there are no limits on what can be achieved by scaling up and distributing AI on a truly vast scale.When Antoine Blondeau and three collaborators co-founded Sentient Technology in 2007, they had an ambitious vision. They wanted to help solve some of the world’s most complex problems by harnessing the world’s computer capacity to develop artificial intelligence on a...

Read More »Geopolitics and investing: assessing rising instability

With the rise of emerging powers and the relative decline of the US, geopolitical instability is increasing and the world is moving out of a unipolar order towards a predominantly one.We believe US-China competition will be the overriding geopolitical issue in the coming years. History suggests there is a strong chance that China’s rise will not be incorporated peacefully. Three forms of geopolitical competition between China and the US could dominate the next decade: over international...

Read More » Perspectives Pictet

Perspectives Pictet