Speculators appeared mostly interested in reducing exposure in the run-up to the US jobs data and the Italian referendum. They liquidated gross longs in the currency futures market and covered shorts. Of the eight currencies we track there were two exceptions, the Japanese yen and the Swiss franc. Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K...

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Week December 09, 2016 Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later. This implies that speculators are long the dollar and short the Swiss franc and the euro. Last week’s ECB meeting showed that the ECB might be dovish for a...

Read More »FX Weekly Preview: What the FOMC Says may be More Important than What it Does

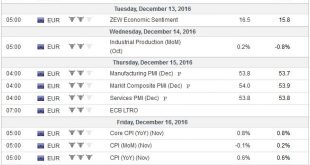

Summary: FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM. Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and...

Read More »FX Weekly Preview: What the FOMC Says may be More Important than What it Does

Summary: FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM. Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also...

Read More »Credit Suisse planning more Swiss job cuts

© Pincasso | Dreamstime.com - Click to enlarge Credit Suisse Group AG is preparing a new cost-savings program that puts as many as 1,300 jobs in Switzerland on the line, according to Schweiz am Sonntag. The plan will be announced Wednesday, when the lender holds its investor day in London, the newspaper said, without saying where it got the information. Credit Suisse’s Swiss unit may slash an additional 1,000 to 1,300...

Read More »Credit Suisse planning more Swiss job cuts

© Pincasso | Dreamstime.com - Click to enlarge Credit Suisse Group AG is preparing a new cost-savings program that puts as many as 1,300 jobs in Switzerland on the line, according to Schweiz am Sonntag. The plan will be announced Wednesday, when the lender holds its investor day in London, the newspaper said, without saying where it got the information. Credit Suisse’s Swiss unit may slash an additional 1,000 to 1,300...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More » SNB & CHF

SNB & CHF