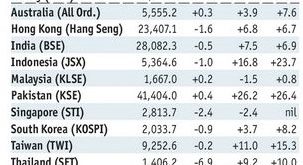

Summary Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program. Chile’s ruling center-left coalition lost municipal elections. Stock Markets In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary...

Read More »Swiss Producer and Import Price Index, September 2016: 0.3% rise in Producer and Import Price Index

Comments by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs The Producer Price Index (PPI) or officially named "Producer and Import Price Index" describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and...

Read More »The Point of War Is Not to Win

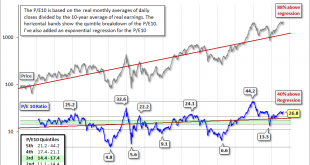

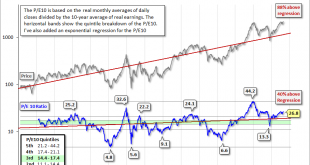

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past...

Read More »The Point of War Is Not to Win

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past...

Read More »FX Weekly Review, October 24-28: October Surprise Pushes Open Door

Swiss Franc Currency Index The Swiss Franc showed some improvement at the end of the week, when recovered some of the losses seen this month. Trade-weighted index Swiss Franc, October 28, 2016(see more posts on Swiss Franc Index, ) - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three...

Read More »UBS reports drop in wealth profit as Ermotti lowers costs

© Hai Huy Ton That | Dreamstime.com - Click to enlarge UBS Group AG Chief Executive Officer Sergio Ermotti pledged to continue cost cuts after profit at the wealth-management business fell and the securities unit was hurt by a slump in equities trading. Pretax profit rose 11 percent to 877 million Swiss francs ($883 million) from 788 million francs a year earlier on lower expenses, the Zurich-based bank said in a...

Read More »Weekly Speculative Positions: Bottom-Picking Sterling, Swiss Franc Even More Net Short

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Swiss Franc and Euro In both euro and Swiss Franc, the net short position expanded. Speculators are now net short the euro with 124K contracts and net short Swiss Franc by 18.7K contracts against the US Dollar. Register for an OANDA forex trading...

Read More »Riksbank and Norges Bank Policy Meetings

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Six major central banks meeting over the next six sessions. Sweden’s Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting....

Read More »Canada Renews Inflation Target, but Tweaks Core Measures

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Canada maintains inflation target of the middle of a 1-3% band. Adopts a trimmed and median core measure like Australia. Market seems to be under-estimating the risk of a BoC rate cut next year. The Canadian government renewed the Bank of Canada’s...

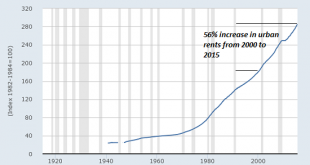

Read More »Could Inflation Break the Back of the Status Quo?

Political resistance to the oligarchy’s financialization skimming operations will eventually cripple central bank giveaways to the financial sector and corporate oligarchs. That inflation and interest rates will remain near-zero for a generation is accepted as “obvious” by virtually the entire mainstream media. The reasons for this are equally “obvious”: central banks have the power to suppress interest rates...

Read More » SNB & CHF

SNB & CHF