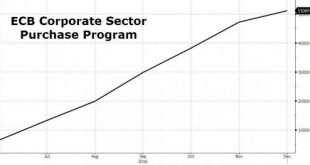

The ECB’s nationalization of the European corporate bond sector continues. In the ECB’s latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding. For the week ending 27th January, the bond purchases stood at €1.9bn across sectors. This increases the number of...

Read More »Silver Speculators Gone Wild – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Silver Gets Frisky Last week, the prices of the metals had been up Sunday night but were slowly sliding all week — until Friday at 7:00am Arizona time (14:00 in London). Then the price of silver took off like a silver-speculator-fueled-rocket. It went from $16.68 to $17.25, or 3.4% in two hours. What does it mean? We...

Read More »Ending Taxation on Monetary Metals

Imagine if you asked a grocery clerk to break a $20 bill, and he charged you $1.40 in tax. Silly, right? After all, you were only exchanging one form of money for another. But try walking to a local precious metals dealer in more than 25 states and exchanging a $20 bill for an ounce of silver. If you do that kind of money exchange, you will get hammered with a sales tax. That’s the price you can pay for bucking the...

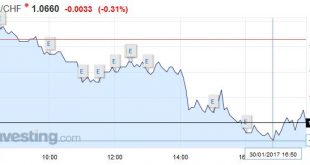

Read More »FX Daily, January 30: EUR/CHF falls further to 1.650

Swiss Franc The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 – 1.0700 that constituted the previous intervention area. Reasons can be found in the weak U.S. GDP weak, in Trump’s foreign trade policy and in the strong Swiss trade balance. Who has understand the principles of the balance of payments, knows that private investors and the SNB must export the equivalent of the current account...

Read More »KOF Economic Barometer: Soft Drop

The KOF Economic Barometer dropped slightly in January 2017. Compared to its December 2016 value it is now standing at 101.7 points. The standing at a level slightly above the long-term average indicates stable perspectives for the Swiss economy in the near future. In January 2017, the Economic Barometer reached a score of 101.7 points. This relates to a slight downward revision by 0.4 points compared to its...

Read More »Why 2017 Could See the Collapse of the Euro – Stiglitz

2017 could be the year that the euro collapses according to Joseph Stiglitz writing in Fortune magazine and these concerns were echoed over the weekend by former Bundesbank vice-president and senior European Central Bank official, Jürgen Stark, when he said that the ‘destruction’ of the Eurozone may be necessary if countries are to thrive again. Stark and Stiglitz are too of many respected commentators, from both the so...

Read More »Adventures in Currency Debasement

Rekindling the Dollar Debasement Strategy The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value. Between July 30, 2014 and December 28, 2016, the dollar’s value,...

Read More »Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

Headlines Week January 30, 2017 Recently inflation rose more quickly in the euro zone, but this was mostly caused by a temporary oil price effect. Therefore the ECB might be dovish for a longer period than the SNB. Consumer price inflation will decide who is more dovish. Ultimately inflation will depend on the two key parameters wages and rents. Rents will rise first in Switzerland, while the Euro zone has downwards...

Read More »Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Summary: Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China’s PMI are among the data highlights. Three major central banks meet in the week ahead, and there are several important reports due out that will give investors more insight into how the...

Read More » SNB & CHF

SNB & CHF