A Swiss man (centre, between his lawyers) has confessed to spying on the tax authorities in the German state of North Rhine-Westphalia. (Keystone) - Click to enlarge A Swiss man accused of spying on the German state of North Rhine-Westphalia’s (NRW) tax authority has confessed and named names. In a Frankfurt court on Thursday, the 54-year-old man, identified only as Daniel M., explained via his defence team...

Read More »Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

– Gold is better store of value than bitcoin – Goldman Sachs report– Gold will continue to perform well thanks to uncertainty and wealth demand– Bitcoin’s volatility continues to impact its role as money– Gold up 12% in 2017, bitcoin over 600% – BTC is six times more volatile than gold – see chart– Gold’s history and physical property shows it meets requirements as a medium of exchange and store of value Bitcoin Price...

Read More »An Unexpected (And Rotten) Branch of the Maestro’s Legacy

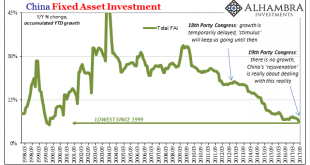

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection,...

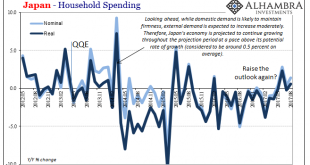

Read More »Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of...

Read More »CHARLES HUGH SMITH Central Banks will close and Currency will change

and

Read More »Swiss industry has learned to live with strong franc

An employee of MAN Diesel & Turbo Switzerland grinds turbine blades of a turbo compressor in Zurich in 2015 (Keystone) - Click to enlarge The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency. This is the overall...

Read More »Switzerland drops in international pension ranking

Silver generation: the Swiss pension system remains strong, despite some issues. (Keystone) - Click to enlarge The Swiss pension system has ranked eighth in an annual international study looking at the sustainability and efficiency of retirement schemes. This represents a drop of four places in the past two years, largely driven by sustainability issues. The Global Pension Indexexternal link, published by...

Read More »Emerging Markets: What has Changed

Summary President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa’s mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to...

Read More »Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors Julie Cchatterley, ScarletFu, and Joe Weisenthal on the set of “What’d You Miss” today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility. The anchors were patient and gave me time to provide a sketch of the thesis of my book, Political Economy of Tomorrow, where I suggest a under appreciated factor in the low price of capital is...

Read More »Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class. And once we know what sort of...

Read More » SNB & CHF

SNB & CHF