The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied. Without any objection, the final approval was given for “Xi Jinping Thought on Socialism with Chinese Characteristics for the New Era.” Elevating the current General Secretary to a level equal with Mao, the practical, political effect is to quash all possible dissent. To challenge Xi after this is be to challenge Chinese

Topics:

Jeffrey P. Snider considers the following as important: $CNY, China, China Fixed Asset Investment, China Industrial Production, china's hard landing with reality, currencies, economy, EuroDollar, Featured, Federal Reserve/Monetary Policy, fixed asset investment, industrial production, Markets, newsletter, PBOC, pboc balance sheet, political risk, stimulus, U.S. Gross Domestic Product, U.S. Treasuries, Xi Jinping

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Without any objection, the final approval was given for “Xi Jinping Thought on Socialism with Chinese Characteristics for the New Era.” Elevating the current General Secretary to a level equal with Mao, the practical, political effect is to quash all possible dissent. To challenge Xi after this is be to challenge Chinese Communism itself. For totalitarian states this is the standard order (and for a good deal too many “democracies”, too). A leader is always looking to tighten his grip on political power because despite the love affair for authoritarianism (especially in the form of technocracy) in the West that kind of system is uniquely fragile. Like an organized criminal operation, the real danger is most often from within the power base rather than from the people outside of it. |

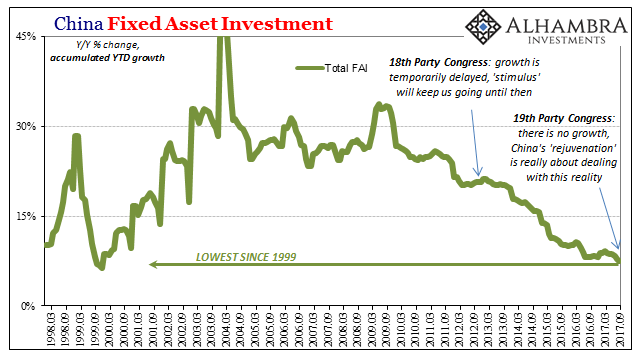

China Fixed Asset Investment, March 1998 - Sep 2017(see more posts on China Fixed Asset Investment, ) |

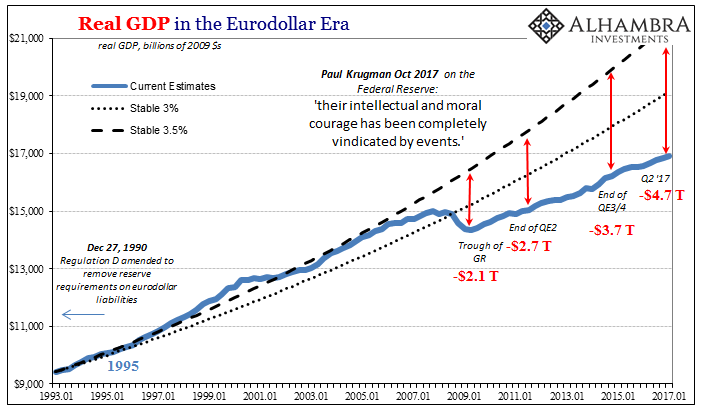

| I can’t help but wonder, however, if what we are seeing here in the 19th Congress is designed instead for that latter case. China’s great challenge has been for the last quarter-century to modernize not just as a matter of economics but more so social progress; to take the peasants out of their subsistence lives and given them a shot at middle class progress and even luxury. Economically satisfied citizens are a far better long-term proposition than a politically unstable peasantry prone to fits of righteous anger.

The Chinese system of just such transformation has been partially successful (thanks in huge part to the eurodollar, when it was working). In terms of human history, it has been wildly so, for no nation has ever undergone such massive transformation in such a condensed fashion. But it isn’t yet enough, or so we think – or so China’s politician’s think? |

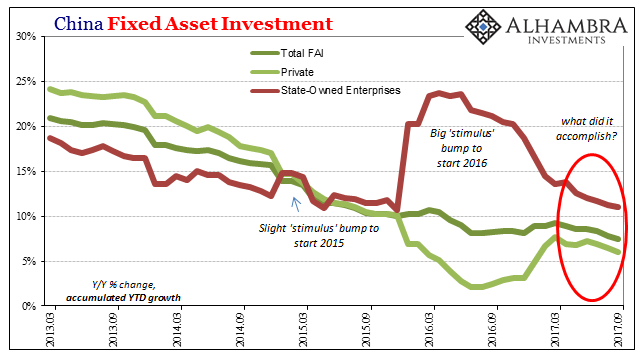

China Fixed Asset Investment, March 2013 - Sep 2017(see more posts on China Fixed Asset Investment, ) |

When China faced the Great “Recession” in 2009, legitimate questions arose as to how one-party rule might fare without the hope created in China’s “miracle” economy. Dissatisfaction is hard to gauge, given the structure of information there, but anecdotally there was every reason to believe these fears were real. It never really manifested at the time because China’s experience with the global contraction was unusually brief. |

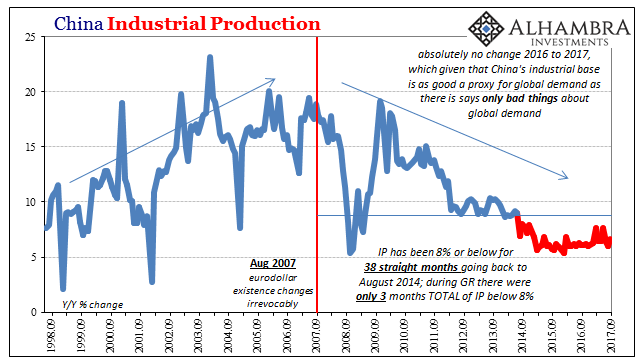

China Industrial Production, Sep 1998 - Sep 2017(see more posts on China Industrial Production, ) |

| That’s not the case now. There is every reason to suspect that Chinese officials are increasingly accepting of a no-growth paradigm, and therefore it would be prudent (from the Communist perspective) to get ahead of any potential fault-lines that may develop in response to China without any “miracle(s).” With an end to the labor market transformation in sight, as indicated most spectacularly by FAI, it just might get a little dicey out in rural China.

To forbid political challenge to the country’s leadership is one (potential) method for at least raising the costs of turning grave economic dissatisfaction into something more substantial. It seems more and more that authorities over there are battening down the hatches, not opening themselves up in a way that a more optimistic and bright future would lead. |

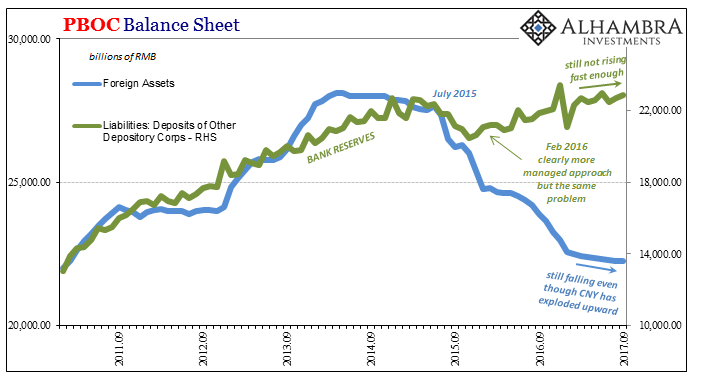

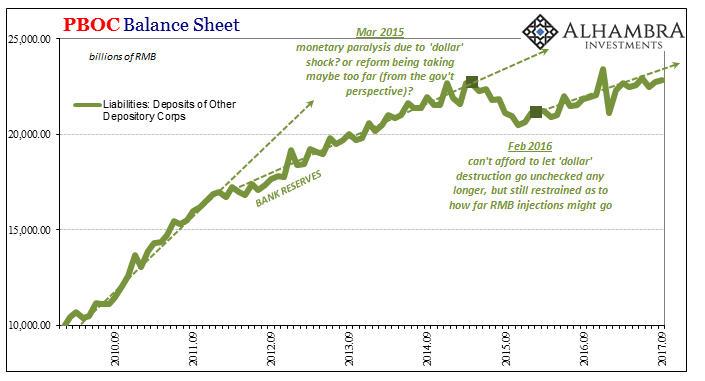

PBOC Balance Sheet, Sep 2011 - 2017(see more posts on pboc balance sheet, ) |

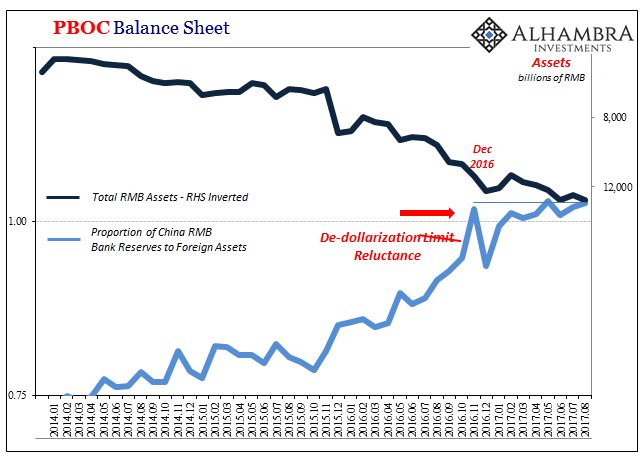

| This doesn’t mean that they have given up on a way out; rather it suggests that Chinese officials are being realistic about the bind that they find themselves in. Though it is and was a trap of their own making, embracing the eurodollar so thoroughly, there is the non-trivial risk that it all goes wrong before they might happen upon a way that it could all go right. |

PBOC Balance Sheet, Sep 2010 - 2017(see more posts on pboc balance sheet, ) |

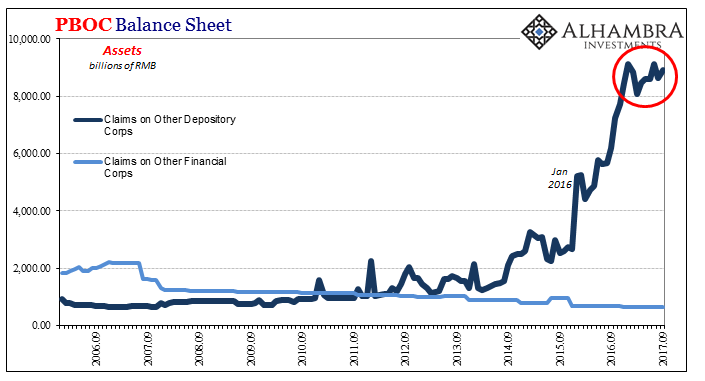

| I have to believe that is where they are right now, coincident to the 19th Party Congress. The government has been trying, often desperately, to figure out something workable. They haven’t yet developed a method to do so, particularly via the central bank.

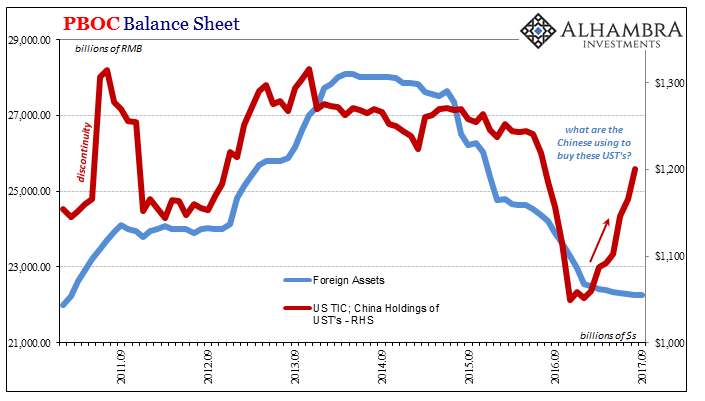

The “dollar” problem has not ended, leaving the PBOC with fewer and fewer options. They chose in 2015 a more passive approach, to let the market absorb (via RRR and rate cuts) eurodollar destruction. It nearly led to disaster. They followed that in 2016 with a direct RMB approach, which may have helped (arguably) end the “rising dollar”, but did no more than that. In 2017, rather than give in to the next “ticking clock”, they altered monetary behavior in Hong Kong so as to give CNY the best possible chance at stability, even appreciation. |

PBOC Balance Sheet, Sep 2011 - 2017(see more posts on pboc balance sheet, ) |

| The verdict hasn’t been rendered yet on this approach, but since early September it seems reasonable to suspect the Chinese ran into the same kinds of problems as all the rest. In other words, it doesn’t appear as if the third time holds any charm. |

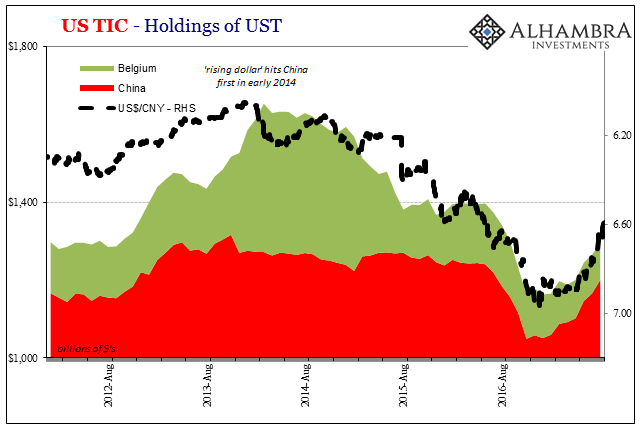

US Treasuries Holdings, Aug 2012 - 2016(see more posts on U.S. Treasuries, ) |

| What options are left for China (assuming CNY doesn’t work out)? The remaining possibilities are increasingly radical (the CNY stability idea was itself quite a departure). |

PBOC Balance Sheet, Sep 2006 - 2017(see more posts on pboc balance sheet, ) |

| At the end of that shrinking list is de-dollarization, a truly drastic departure that is probably the last entry on it. |

PBOC Balance Sheet, Jan 2014 - Aug 2017(see more posts on pboc balance sheet, ) |

| Thus, if faced with only bad and worse options, at least preparing for all possible fractures from a deteriorating situation is prudent. Economic risk in the form of prolonged stagnation is huge political risk. If you can’t do much about the former, then you better start to think and act as to the latter. | |

| In the West, “we” can’t make out the economic risks because the political class has forbidden it as a legitimate topic. And so in that respect the world over here is perhaps further along in the wrong direction politically than even China. To be clear, I’m not suggesting authoritarianism is the answer, only that the Chinese at the very least appear to be approaching the world as it is from a far less idealized, imaginary even, perspective. |

US Banking Data, Aug 1978 - 2017 |

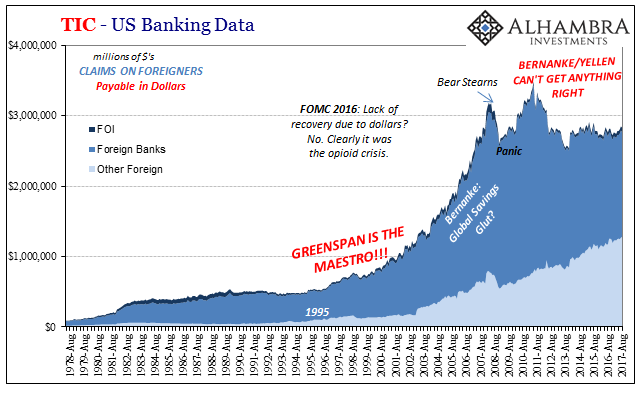

| Then again, that’s to be expected. The Communists in China know and have known more about the real dollar (credit-based reserve currencies, as Zhou Xiochian noted in March 2009) than any officials in America. The devastating technical incompetence displayed these last ten years really boil down to that one factor. I have to believe the Chinese truly, deeply regret, as many Americans and Europeans will in the coming years, ever believing so thoroughly in the Maestro. |

U.S. Gross Domestic Product, Jan 1993 - 2017(see more posts on U.S. Gross Domestic Product, ) |

Tags: $CNY,China,China Fixed Asset Investment,China Industrial Production,china's hard landing with reality,currencies,economy,EuroDollar,Featured,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,newsletter,PBOC,pboc balance sheet,political risk,stimulus,U.S. Gross Domestic Product,U.S. Treasuries,Xi Jinping