My advice is this: Settle! That's right. Don't worry about passion or intense connection. Don't nix a guy based on his annoying habit of yelling Bravo! in theaters. Overlook his halitosis. Spread the word about PropellerAds and earn money! YouTube Tips and Triks to make real dollers: The Best Portable Bluetooth Speaker (.

Read More »Emerging Markets: What Changed

Summary China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year. Hungary announced general elections on April 8....

Read More »Swiss companies leaking executives abroad

The Ammann Group is one of many Swiss companies to recently announce it will be moving jobs abroad (Keystone) Multinational companies based in Switzerland are increasingly moving experienced executives abroad to run production sites in lower-cost countries, according to a jobs placement company. The trend has been blamed on regulatory uncertainty in the Swiss marketplace. There have been concerns at Swiss companies...

Read More »Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February. The $1.26 area also corresponds to a 61.8%...

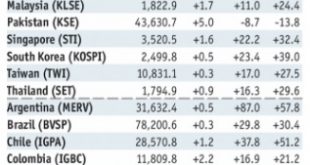

Read More »Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies – Gold at all time in eight major emerging market currencies– A stronger performance than seen when priced in USD, EUR or GBP– As world steps away from US dollar hegemony expect new gold highs in $, € and £ – Gold is a hedge against currency debasement and depreciation of fiat currencies Gold Prices in Emerging Markets Currencies, 2010 - 2018(see more posts...

Read More »2018: The Weakest Year in the Presidential Election Cycle Has Begun

The Vote Buying Mirror Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency. The market was e.g. just as...

Read More »MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doome

MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doomed. Thank you for listening. Follow us on . Thank you for listening. Follow us on . MUST LISTEN Charles Hugh Smith Can Trump pull a Rabbit out of a Hat or is US Economy Doomed. ALERT! Can Trump pull a Rabbit out of a Hat or is US Economy Doomed Charles Hugh Smith NOV 2017.. ALERT! Can Trump pull a Rabbit out of a Hat or is US Economy Doomed Charles Hugh Smith NOV 2017.

Read More »FX Daily, January 12: Euro Jumps Higher

Swiss Franc The Euro has risen by 0.45% to 1.1735 CHF. EUR/CHF and USD/CHF, January 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There is one main story today and it is the euro’s surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month’s ECB meeting surprised the market with its seeming willingness to change the...

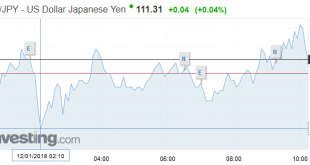

Read More »Is the BOJ Tapering?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017. While some observers are talking about a rate hike late this year, it seems highly unlikely. The ECB has been clear that the...

Read More »Trump to attend WEF gathering in Davos

US President Donald Trump attends the College Football Playoff National Championship game between the University of Alabama and the University of Georgia in Atlanta, Georgia, on January 8, 2018 (marketing) United States President Donald Trump plans to attend the World Economic Forum (WEF) in Davos, Switzerland later this month, his spokeswoman said on Tuesday. In a statement, Sarah Huckabee Sanders, the White House...

Read More » SNB & CHF

SNB & CHF