Summary President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa’s mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to cut funding for Turkish banks. Argentina President Macri’s Cambiemos alliance was the winner of the congressional mid-term elections. Argentina central bank unexpectedly hiked rates by 150 bp. Brazil’s lower house voted not to advance the corruption charges against President Temer. Banco de Mexico

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

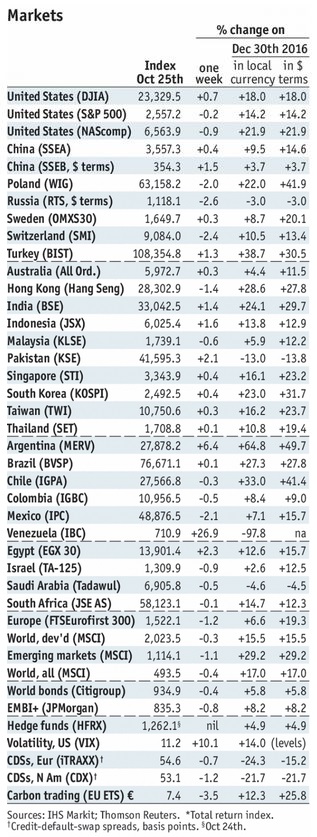

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (+2.5%), Korea (+2.1%), and Hungary (+2.0%) have outperformed this week, while Colombia (-3.7%), Mexico (-3.2%), and Brazil (-2.4%) have underperformed. To put this in better context, MSCI EM fell -0.8% this week while MSCI DM fell -0.3%. In the EM local currency bond space, Hungary (10-year yield -5 bp), Czech Republic (flat), and India (+1 bp) have outperformed this week, while South Africa (10-year yield +29 bp), Turkey (+29 bp), and Argentina (+18 bp) have underperformed. To put this in better context, the 10-year UST yield rose 4 bp to 2.43%. In the EM FX space, KRW (+0.1% vs. USD), CZK (flat vs. EUR), and INR (flat vs. USD) have outperformed this week, while TRY (-3.6% vs. USD), ZAR (-3.5% vs. USD), and COP (-2.6% vs. USD) have underperformed. |

Stock Markets Emerging Markets, October 28 Source: Economist.com - Click to enlarge |

ChinaPresident Xi Jinping’s concepts of socialist thinking were written into China’s constitution. He joins Mao and Deng as the only leaders to be honored in this way. Xi also broke with convention by unveiling a new leadership lineup with no successor anointed. These moves suggest that Xi will still yield considerable influence after his second term as president ends in 2022. MalaysiaMalaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. The 2018 budget deficit is set at -2.8% of GDP vs. -3.0% in 2017. Infrastructure spending will be boosted, with focus on building and expanding airports, rail lines, and buses. He also included tax cuts for middle-class Malaysians earning MYR70,000 or less per annum, as well as more GST exemptions and a MYR1500 one-time payout to government workers. Czech RepublicCzech billionaire Andrej Babis’ ANO party won the elections. ANO won 29.6% of the vote, which gives it 78 seats in the 200-seat parliament. The Civic Democrats came in second with 25 seats, followed by two anti-establishment parties, the Pirates and the anti-Muslim SPD, which secured 22 seats each. Because Babis is facing corruption charges, his current coalition partners, the Social Democrats and the Christian Democrats, will not rejoin the coalition as long as the case remains open. A minority government seems likely. South AfricaSouth Africa’s mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. The deficit for FY2017/18 was raised to -4.3% of GDP from -3.1 while the 2017 growth forecast was cut to 0.7% from 1.3%. Indeed, the Finance Ministry raised its deficit and cut is growth forecasts for the next three years. We still think at least one of the agencies will downgrade South Africa after the November 24 reviews. GermanyPress reports suggest Germany is working to cut funding for Turkish banks. Tighter restrictions are being pushed not only on state-owned German banks, but also on the multilateral EBRD. Last week, Chancellor Merkel said she will seek to curtail pre-accession EU funding for Turkey. The news comes on top of unverified reports that the US is investigating several Turkish banks for dealings with Iran. Turkey is becoming increasingly isolated even as it becomes more dependent on hot money flows. ArgentinaArgentina President Macri’s Cambiemos alliance was the winner of the congressional mid-term elections. Preliminary results showed Cambiemos winning the five largest electoral districts, including important Buenos Aires province. There, Macri’s ally Esteban Bullrich defeated ex-President Cristina Fernandez de Kirchner in a victory that should help Macri’s reform agenda continue. At the national level, Cambiemos won 12 out of 24 provinces with 41-42% of the total vote. Argentina central bank unexpectedly hiked rates by 150 bp. The benchmark repo rate was raised to 27.75%, as the central bank said that it wanted to counter the gasoline price hikes that went into effect this week. CPI is already running at 24.2% y/y in September, and further acceleration is likely. The last hike was 150 bp back in April. BrazilBrazil’s lower house voted not to advance the corruption charges against President Temer. The vote was 251-233 in favor of Temer, with 25 absent and 2 abstentions. This was worse than the 263 votes Temer received for similar charges back in August, and suggests he is losing support for structural reforms. Indeed, reports suggest that the government is significantly downsizing its proposed pension reforms. MexicoBanco de Mexico announced it would increase its FX hedge auctions by $4 bln. We don’t think the bank is trying to protect any particular level in the midst of a broad-based EM FX selloff, but instead is merely acting to prevent excessive MXN underperformance. Still, this was a rare sliver of good news in EM and has helped USD/MXN stabilize. |

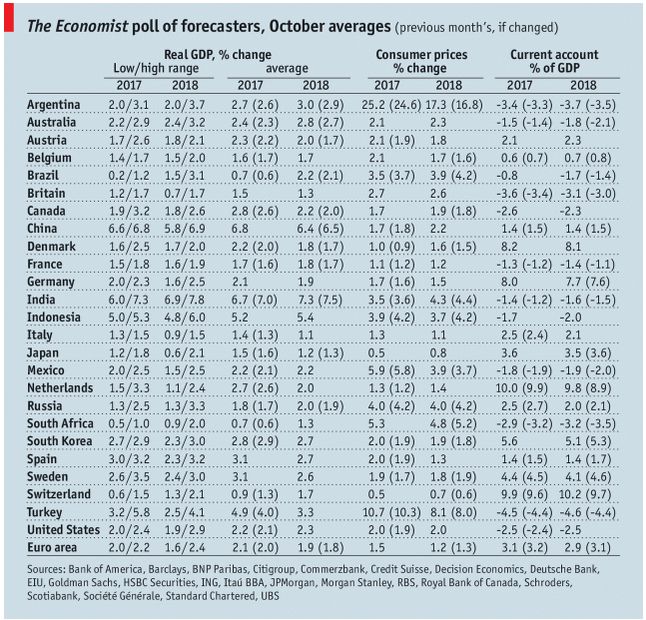

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, October 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin