Avant-propos: Le texte de la conférence de M Jordan de 2011 semble ne plus être disponible sur le net. Du coup, nous le publions ici malgré le Copyright. Ce genre de documents doit être connu du grand public, puisqu’il est le garant de cette institution privée (société anonyme cotée en bourse, soumise à une loi fédérale. L’actionnariat est réparti ainsi: https://www.snb.ch/fr/iabout/snb/org/id/snb_org_stock ), qu’est...

Read More »Marc Chandler on Global Monetary Policy

Jan.08 -- Marc Chandler, global head of markets strategy and FX at Brown Brothers Harriman, discusses monetary policy from the Federal Reserve and other central banks. He speaks on "Bloomberg Daybreak: Americas."

Read More »FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

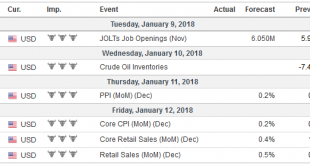

Swiss Franc The Euro has risen by 0.04% to 1.1753 CHF. EUR/CHF and USD/CHF, January 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar’s upticks are understood to be corrective in nature. The Canadian dollar appears...

Read More »Swiss Consumer Price Index in December 2017: Up +0.8 percent against 2016, remained unchanged against last month

The consumer price index (CPI) remained unchanged in December 2017 compared with the previous month, reaching 100.8 points (December 2015=100). Inflation was 0.8% compared with the same month of the previous year. Average annual inflation reached 0.5% in 2017. These are the results of the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, Dec 2017(see more posts on Switzerland Consumer Price...

Read More »FX Weekly Preview: Accommodative Officials and Synchronized Upturn Drive Markets

The investment climate is being shaped by two powerful forces. First is the very accommodative policy stance. This includes the United States, where despite delivering the fifth rate hike in the cycle, adjusted by headline CPI, remains negative. The balance sheet has begun being reduced, financial conditions in the US are easier now than a year ago. The ECB’s bond purchase program, which has been cut in half to 30 bln...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks. Stock Markets Emerging Markets, January 03 Source: economist.com - Click...

Read More »Keith Weiner: People Weren’t Buying Paper Gold & Silver Last Week – They Were Buying Actua

Please click above to subscribe to my channel Thanks for watching! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist News Greg Mannarino Rob Kirby Reluctant

Read More »Italian Election–Two Months and Counting

- Click to enlarge Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members. And yet it is Italian politics...

Read More »Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

– Palladium prices surge to new record high over $1,100/oz today – Palladium surges past record nominal price seen in 2001 after 55% surge in 2017– Best-performing precious metal and commodity of 2017 is palladium – Palladium prices top platinum prices for first time in 16 years– Strong Chinese car demand and switch from diesel to petrol cars sees demand surge– Supply crunch as six year supply deficit & 2017...

Read More »If Bitcoin Is A Bubble…

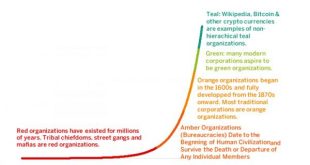

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More » SNB & CHF

SNB & CHF