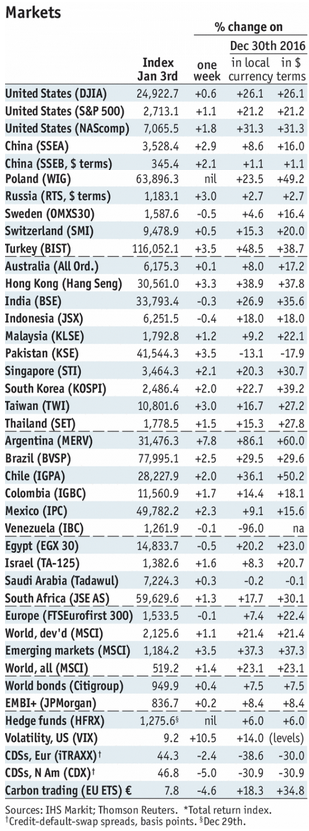

Stock Markets EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks. Stock Markets Emerging Markets, January 03 Source: economist.com - Click to enlarge Turkey Turkey reports November IP Monday, which is expected to rise 7.0% y/y vs. 7.3% in October. Current account data will be reported Friday, and a deficit of -.85 bln is expected. If so, the 12-month total would rise to -.5 bln, the highest since December 2014. The external

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks. |

Stock Markets Emerging Markets, January 03 Source: economist.com - Click to enlarge |

TurkeyTurkey reports November IP Monday, which is expected to rise 7.0% y/y vs. 7.3% in October. Current account data will be reported Friday, and a deficit of -$3.85 bln is expected. If so, the 12-month total would rise to -$43.5 bln, the highest since December 2014. The external accounts are worsening at a time when financing them will become more difficult. Czech RepublicCzech Republic reports November construction and industrial output (5.7% y/y expected), and trade (CZK5.3 bln expected) Monday. December CPI will be reported Wednesday and is expected to rise 2.4% y/y vs. 2.6% in November. If so, it would still be above the 2% target and supports modest tightening ahead. Next policy meeting is February 1 and we expect another 25 bp hike to 0.75%. Retail sales will be reported Thursday, and are expected to rise 3.8% y/y vs. 7.0% in October. HungaryHungary reports November IP and retail sales Monday. The former is expected to rise 7.2% y/y WDA and the latter by 5.5% y/y. Trade will be reported Tuesday. Central bank minutes will be released Wednesday. December CPI will be reported Friday, which is expected to rise 2.3% y/y vs. 2.5% in November. If so, inflation would still be below the 3% target though within the 2-4% target range. Next policy meeting is January 30 and further easing via unconventional measures are possible. TaiwanTaiwan reports December trade Monday. Exports are expected to rise 9.4% y/y and imports by 9.1% y/y. Export orders have remained fairly robust, driven by the stabilizing mainland economy. BrazilBrazil reports November retail sales Tuesday, which are expected to rise 2.8% y/y vs. 2.5% in October. December IPCA inflation will be reported Wednesday, which is expected to remain steady at 2.8% y/y. COPOM left open the possibility for further easing. Next policy meeting is February 7 and the CDI market is pricing in another 25 bp cut to 6.75%. MexicoMexico reports December CPI Tuesday, which is expected to rise 6.75% y/y vs. 6.63% in November. If so, inflation would be at a new high and further above the 2-4% target range. Next policy meeting is February 8 and we think another 25 bp hike to 7.5% is likely. November IP will be reported Thursday, which is expected at -0.9% y/y vs. -1.1% in October. ChinaChina reports December CPI and PPI Wednesday. The former is expected to rise 1.9% y/y and the latter by 4.8% y/y. Trade will be reported Friday. Exports are expected to rise 10.0% y/y and imports by 14.8% y/y. Money and loan data could be reported this week, but no date has been set. For now, markets are comfortable with China’s macro outlook. IsraelBank of Israel meets Wednesday and is expected to keep rates steady at 0.10%. Inflation was 0.3% y/y in November, well below the 1-3% target range. However, the bar to further easing is very high and we see no further measures. December trade will be reported Thursday. PolandNational Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. CPI eased to 2.0% y/y in December, below the 2.5% target but within the 1.5-3.5% target range. For now, the central bank’s pledge to keep rates steady through 2018 remains in effect but this may be tested if inflation starts rising again. MalaysiaMalaysia reports November IP Thursday, which is expected to rise 4.9% y/y vs. 3.4% in October. CPI rose 3.4% y/y in November, the lowest rate since July. Bank Negara does not have an explicit inflation target, but easing price pressures should allow it to remain on hold for much of 2018. Next policy meeting is January 25 and rates are likely to be kept at 3.0%. South AfricaSouth Africa reports November manufacturing production Thursday. The economy remains weak while inflation has been falling. With the rand remaining firm, we believe this gives the SARB an opening to resume the easing cycle. Next policy meeting is January 18 and we expect another 25 bp cut to 6.5%. PeruPeru central bank meets Thursday and is expected to cut rates 25 bp to 3.0%. CPI rose 1.4% y/y, well below the 2% target but within the 1-3% target range. We think the central bank will continue easing at its current pace of 25 bp every other month, which calls for a move this week. IndiaIndia reports December CPI and November IP Friday. CPI rose 4.9% y/y in November, the highest rate since August 2016. Inflation is above the 4% target but within the 2-6% target range. While the economy is sluggish, high price pressures should preclude any near-term easing by the RBI. Next policy meeting is February 7 and rates are likely to be kept steady. |

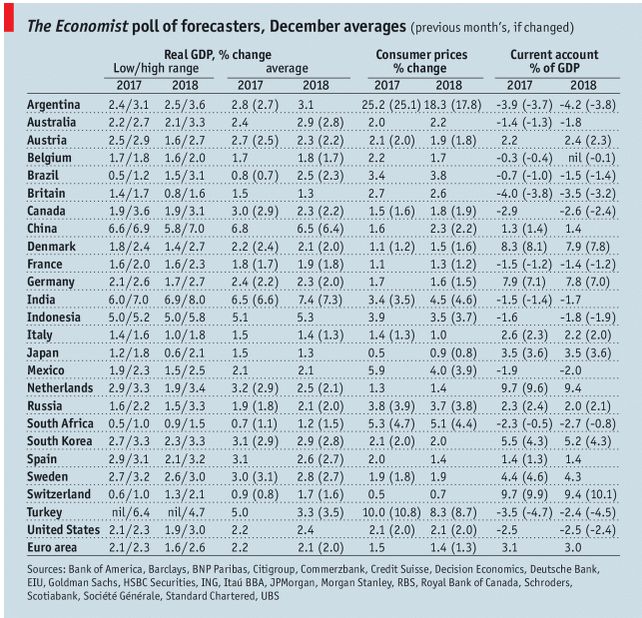

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, December 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter