Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on QE (which we still expect to be delayed to July). First, although the May HICP report cannot yet be described as a genuinely clean picture of underlying inflation, it is reasonable to assume that a large part of the volatility induced by transitory factors and the timing of Easter has faded. At 1.1%

Topics:

Frederik Ducrozet considers the following as important: 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

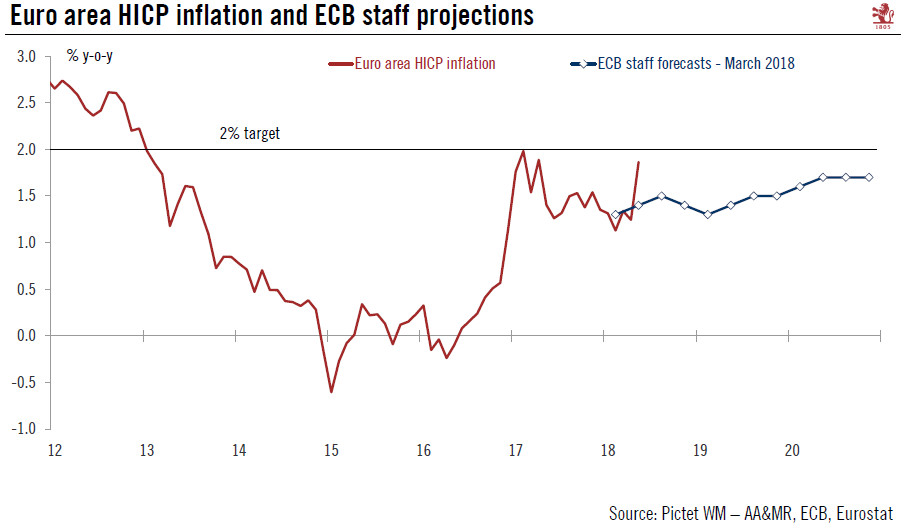

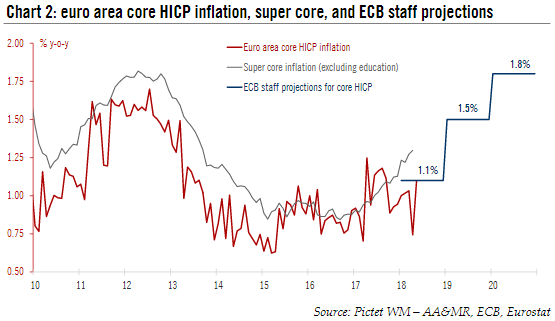

Euro Area HICPToday’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on QE (which we still expect to be delayed to July). First, although the May HICP report cannot yet be described as a genuinely clean picture of underlying inflation, it is reasonable to assume that a large part of the volatility induced by transitory factors and the timing of Easter has faded. At 1.1% y-o-y in May, core HICP finally rebounded closer to other measures of underlying inflation, including the ECB’s super core indices which are currently running at around 1.2-1.4%. As a result, the ECB will likely conclude that we are getting closer to the so-called Sustained Adjustment in the Path of Inflation (SAPI), a necessary prerequisite to end QE this year. Second, the fact that headline HICP inflation has risen close to the 2% mark in several countries, including Germany, and is expected to remain close to 2% in the next few months, will create some (headline) risks with the usual suspects calling for swift normalisation in the ECB’s policy rates and balance sheet. Although economic conditions would indeed justify faster monetary tightening in Germany, the ECB is likely to resist such pressure at the aggregate level, sticking with its gradualism doctrine. The economic soft patch and the political situation in Italy might strengthen the case for patience, although not to the point of challenging the ECB’s plans. Latest figures may increase the ECB’s confidence that inflation will get to 2% in the medium term, but its gradualist approach to policy normalisation should continue We continue to expect the ECB to wait until July before announcing that QE will be terminated in December, following a three-month tapering of EUR15bn of asset purchases per month. There is, however, an outside chance that a majority of the ECB’s Governing Council will reach a consensus on QE tapering at the 14 June meeting. Notwithstanding a likely downward revision to economic growth, ECB staff projections should be consistent with inflation converging toward the 2% target over the medium term. If a QE end-date were to be announced in June after all, we would expect the announcement to come with some dovish sweeteners. As we have argued in the past, one option would be for Mario Draghi to endorse market expectations of a somewhat later lift-off during the press conference.. |

Euro Harmonised Index of Consumer Prices Inflation and ECB Staff Projections |

Below, but close to SAPIThe ECB has repeatedly indicated that meeting its so-called SAPI criteria (Sustained Adjustment in the Path of Inflation) is the main prerequisite for ending its asset purchase programme. SAPI criteria define the conditions for QE tapering based on convergence of inflation to the ECB’s 2% target over the medium term, confidence in the convergence process, and its resilience to the withdrawal of monetary support. The rebound in core inflation post-Easter will help increase the ECB’s ‘confidence in convergence’ along with recent positive news in terms of wage growth. In fact, core HICP could have been stronger were it not for another disappointment in terms of core goods (Non-Energy Industrial Goods) which eased by 3 basis points, to 0.24% in May, and could potentially fuel concerns over lagged disinflationary effects from a stronger EUR in 2017. More importantly though, services inflation jumped to 1.61% post Easter. Although we forecast core HICP to hover around 1% in the next few months, stronger base effects and a narrowing of the output gap are expected to push core inflation higher by Q4 2018, to around 1.3-1.4%, in our view. |

Euro Area Core Inflation, Super Core and ECB Staff Projections |

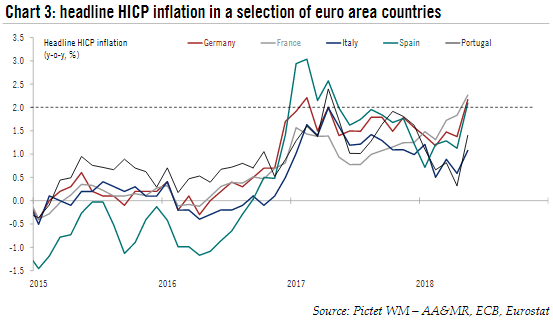

| In terms of breakdown across countries, headline HICP inflation surged to 2.2% in Germany (from 1.4% in April), 2.3% in France (from 1.8%), 1.1% in Italy (from 0.6%), 2.1% in Spain (from 1.1%), and 1.4% in Portugal (from 0.3%), all above expectations. The boost from higher energy and food prices was broad-based if only on the back of statistical base effects, but the rise in inflation was also fueled by a rebound in services in most countries largely related to transportation and traveled-related costs post Easter.

At 1.9% in May, euro area headline inflation is back close to the ECB’s target of 2%. Importantly, it was not only energy and food prices that pushed inflation higher, but also core consumer prices (up 1.1% y-o-y). As a result, headline HICP inflation was 1.9% or higher in more than two thirds of euro area member states in May (weighted by their share in the HICP index). Looking ahead, we forecast euro area headline inflation to remain close to, if not slightly above 2% in the next few months, depending on developments in oil prices in EUR terms. |

Harmonised Index of Consumer Prices Inflation in Selection Euro Area Countries |

Looking ahead, headline inflation is likely to remain close to 2% for most of the rest of the year. Core inflation is expected to hover around 1% before stronger base effects and a narrowing of the output gap provide another push higher in Q4 2018, to around 1.3-1.4%. On a forward-looking basis, the ECB is likely to conclude that we are getting closer to a sustained adjustment in inflation that is a necessary condition for ending QE this year.

On balance, the ECB is still likely to wait until the 26 July meeting to announce its looming decisions on QE and forward guidance. We continue to expect QE to end in December 2018 and a first rate hike to be delivered in September 2019.

Tags: Featured,Macroview,newsletter