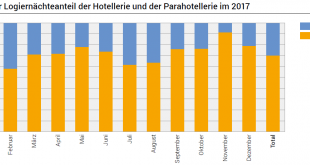

Neuchâtel, 18 June 2018 (FSO) – In 2017, supplementary accommodation posted a total of 15.9 million overnight stays, i.e. an increase of 6.9% compared with 2016. With 10.8 million units, Swiss visitors represented more than two-thirds of demand (68.3%), i.e. a rise of 7.0%. Foreign visitors registered a 6.6% increase with 5.0 million units. Among this clientele, European visitors generated the most overnight stays with...

Read More »Rail workers stand against proposed cuts

Swiss Federal Railways workers releasing balloons and demands in Zurich. Some 1,400 rail workers took to the streets across the country on Monday to protest a package of cuts and reforms planned by the Swiss Federal Railways. The demonstrations, called for by the Union for public transport workers (SEV), were spread across several Swiss cities: Geneva, Lausanne, Olten, Bern, and Zurich, where the largest event brought...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May...

Read More »Lift-Off Not (Yet) – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Wrong-Way Event. Last week we said something that turned out to be prescient: This is not an environment for a Lift Off Event. An unfortunate technical mishap interrupted the latest moon-flight of the gold rocket. Fear not true believers, a few positive tracks were left behind. [PT] Fundamental Developments The price of...

Read More »Keith Weiner – Update on Gold and Silver and Debt #3930

Keith offers a fresh look at some of those “oft-repeated yet difficult to get your mind around” macro problems with the dollar and our monetary system. Of particular interest is Keith's concept of Yield Purchasing Power the Marginal Productivity of Debt. They help shed light on where the economy really is. The value of each dollar of additional debt undertaken is helping economic activity less and less, until the system collapses.

Read More »Keith Weiner – Update on Gold and Silver and Debt #3930

Keith offers a fresh look at some of those “oft-repeated yet difficult to get your mind around” macro problems with the dollar and our monetary system. Of particular interest is Keith's concept of Yield Purchasing Power the Marginal Productivity of Debt. They help shed light on where the economy really is. The value of each dollar of additional debt undertaken is helping economic activity less and less, until the system collapses.

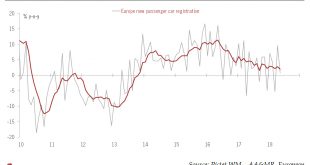

Read More »European cars at a crossroad

Falling momentum in new car sales, together with the threat of US tariffs is adding to the uncertainty facing the European car industry. The motor vehicle industry is of major importance to the EU economy and to global trade. According to Eurostat, total exports (to countries outside the EU) amounted to EUR205bn in 2017. Germany accounted for 52% of total motor exports. The US was the largest destination for EU motor...

Read More »Swiss Offshore Wealth Management Sector still World’s Largest by far

A report by The Boston Consulting Group highlights the size of Switzerland’s personal offshore wealth management sector. ©-Valeriya-Potapova-_-Dreamstime.com_ - Click to enlarge Total personal offshore wealth grew by 6% to reach US$8.2 trillion in 2017. US$2.3 trillion (28%) of this was managed in Switzerland. The top three offshore centres: Switzerland ($2.3 trillion), Hong Kong ($1.1 trillion) and Singapore ($0.9...

Read More »FX Daily, June 18: Politics and Economics Weigh on European Currencies

Swiss Franc The Euro has fallen by 0.40% to 1.1533 CHF. EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is rising against most of the major and emerging market currencies. The prospects of escalating trade tensions and the divergence of policy that was confirmed by the major central banks are disrupting the markets. Norway’s...

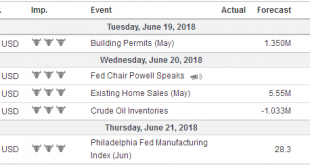

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More » SNB & CHF

SNB & CHF