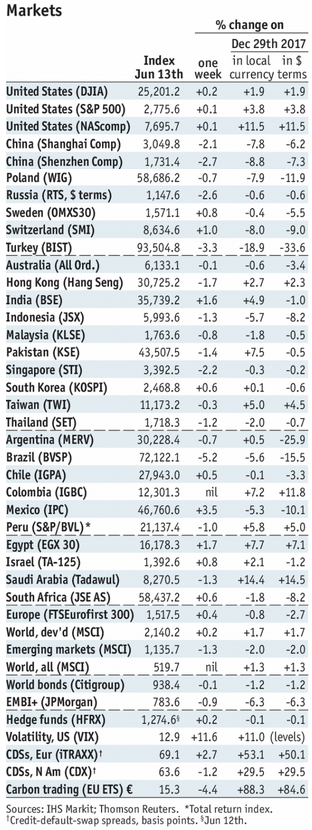

Stock Markets EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. Stock Markets Emerging Markets, June 13 - Click to enlarge Singapore Singapore reports May trade Monday, with NODX expected to rise 4.6% y/y vs. 11.8% in April. Retail sales came in much weaker than expected for April, with headline rising 0.4% y/y and ex-autos 0.7% y/y. The October MAS policy meeting is still a few months away, but recent softness in the economy supports our view that it will

Topics:

Win Thin considers the following as important: 5) Global Macro, Brazil, emerging markets, Featured, Hungary, Malaysia, Mexico, newsletter, Philippine, Poland, Singapore, South Africa, Taiwan, Thailand

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term. |

Stock Markets Emerging Markets, June 13 |

SingaporeSingapore reports May trade Monday, with NODX expected to rise 4.6% y/y vs. 11.8% in April. Retail sales came in much weaker than expected for April, with headline rising 0.4% y/y and ex-autos 0.7% y/y. The October MAS policy meeting is still a few months away, but recent softness in the economy supports our view that it will not tighten again this year. PolandPoland reports May industrial and construction output Tuesday. The former is expected to rise 3.6% y/y vs. 9.3% in April, while the latter is expected to rise 17.8% y/y vs. 19.7% in April. Real retail sales will be reported Thursday, which are expected to rise 6.0% y/y vs. 4.0% in April. Central bank minutes will be released Thursday. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.9%. Deputy Governor Nagy said the bank is prepared to tighten monetary conditions if the weak forint endangers its inflation target. Before, the bank had shown little concern with the exchange rate and so it is moving away from its ultra-dovish bias. MalaysiaMalaysia reports May CPI Wednesday and is expected to rise 1.8% y/y vs. 1.4% in April. Bank Negara does not have an explicit inflation target. However, low price pressures should allow it to remain on hold this year. Next policy meeting is July 11, rates are likely to remain steady at 3.25%. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.5% y/y in May, the highest since January 2017 but still near the bottom of the 1-4% target range. Bank officials have shown no urgency to tighten, and we see steady rates this year. South AfricaSouth Africa reports May CPI Wednesday and is expected to rise 4.6% y/y vs. 4.5% in April. If so, inflation would move into the top half of the 3-6% target range. Next policy meeting is July 19, rates are likely to remain steady at 6.5%. Q1 current account data will be reported Thursday, and the deficit is expected to widen to -4.0% of GDP from -2.9% in Q4. PhilippinePhilippine central bank meets Wednesday and is expected to hike rates 25 bp to 3.5%. However, the market is split. Of the 8 analysts polled by Bloomberg, 3 see steady rates and 5 see a 25 bp hike. CPI rose 4.6% y/y in May, well above the 2-4% target range. The bank started the tightening cycle with a 25 bp hike last month, and we expect it to continue with another 25 bp hike this month. BrazilBrazil COPOM meets Wednesday and is expected to hike rates 50 bp to 7.0%. Brazil reports mid-June IPCA inflation Thursday, which is expected to rise 3.33% y/y vs. 2.70% in mid-May. If so, inflation would be the highest since mid-June 2017. Whilst still within the 2.5-6.5% target range, we think rising inflation and pressure on the currency will lead to the start of a tightening cycle this month. TaiwanTaiwan central bank meets Thursday and is expected to keep rates steady at 1.375%. That same day, May export orders will be reported. The central bank does not have an explicit inflation target, but low price pressures should allow it to remain on hold this year. MexicoBanco de Mexico meets Thursday and is expected to hike rates 25 bp to 7.75%. Mexico reports mid-June CPI Friday, which is expected to rise 4.59% y/y vs. 4.46% in mid-May. If so, inflation would continue moving away from the 2-4% target range after several months of heading towards it. |

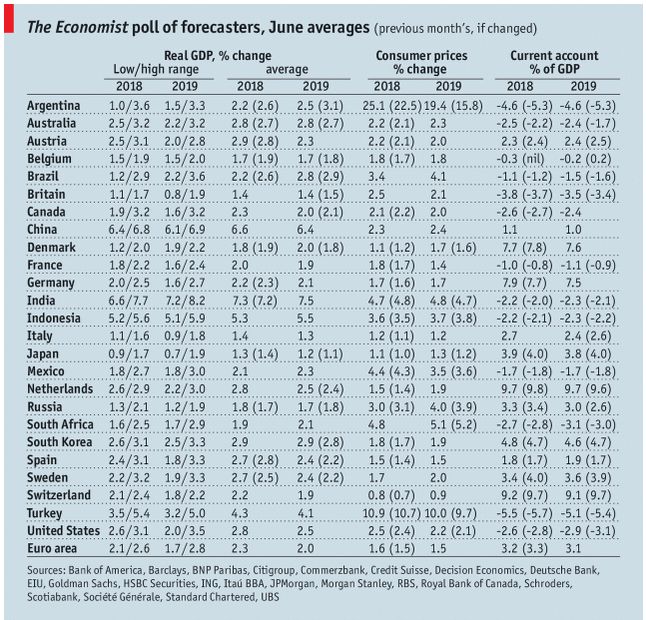

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Tags: Brazil,Emerging Markets,Featured,Hungary,Malaysia,Mexico,newsletter,Philippine,Poland,Singapore,South Africa,Taiwan,Thailand