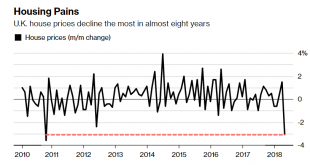

Halifax index shows property values plunged 3.1% in April Less volatile three-month measure also shows a decline U.K. home prices plunged the most in almost eight years in April, adding to signs of weakness in Britain’s property market. Values dropped 3.1 percent from March to an average 220,962 pounds ($299,140), mortgage lender Halifax said in a report Tuesday. That’s the biggest drop since September 2010. While that...

Read More »Switzerland most expensive for meat

Switzerland has the world’s most expensive meat according to a survey compiled by Caterwings in Germany. The survey, which looks at meat prices in 52 countries, ranks Swiss prices at the top across all meat categories. © Marian Mocanu | Dreamstime.com - Click to enlarge On average, Swiss shoppers pay 142% more than the average across all meat categories. Chicken, the meat with the highest price premium, is 222% more...

Read More »FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro’s losses. The euro...

Read More »Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

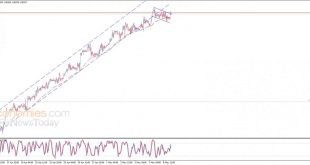

USD/CHF The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected...

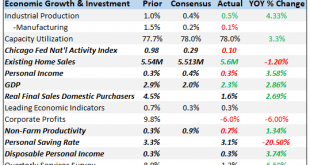

Read More »Bi-Weekly Economic Review: Oil, Interest Rates & Economic Growth

The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »The Capital Structure as a Mirror of the Bubble Era

Effects of Monetary Pumping on the Real World As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences; this distorts relative prices...

Read More »La question de Monnaie pleine induit-elle le votant en erreur?

Le peuple suisse doit, le 10 juin 2018, répondre à cette question: « Acceptez-vous l’initiative populaire « Pour une monnaie à l’abri des crises : émission monétaire uniquement par la Banque nationale ! (Initiative Monnaie pleine) » ? » Le oui à la question sous-entend que ce concept monétaire garantit la monnaie suisse et les avoirs bancaires d’une part, et d’autre part que l’ensemble des avoirs bancaires relèvent...

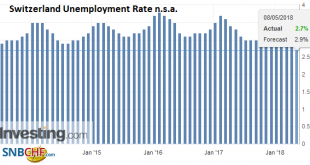

Read More »Switzerland Unemployment in April 2018: Down to 2.7 percent from 2.9 percent, seasonally adjusted decreased from 2.9 percent to 2.7 percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in April 2018 – According to the State Secretariat for Economic Affairs (SECO), at the end of April 2018, 119,781 unemployed were registered at the Regional Employment Centers (RAV), 10,632 less than in the previous month. The unemployment rate fell from 2.9% in March 2018 to 2.7% in the month under review. Compared with the same month of the...

Read More »Is Swiss inflation back to stay?

Swiss inflation reappeared in February 2018 and has continued. According to the Federal Statistical Office, inflation was 0.2% in April. Since the beginning of 2018, prices have risen 0.9%. © Björn Wylezich | Dreamstime.com - Click to enlarge Jan-Egbert Sturm of the KOF Swiss Economic Institute says it shows the Swiss economy is doing well, and that inflation is close to what is “normal” in Switzerland. When asked by...

Read More »FX Daily, May 08: Dollar Races Ahead

Swiss Franc The Euro has fallen by 0.56% to 1.1885 CHF. EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are...

Read More » SNB & CHF

SNB & CHF