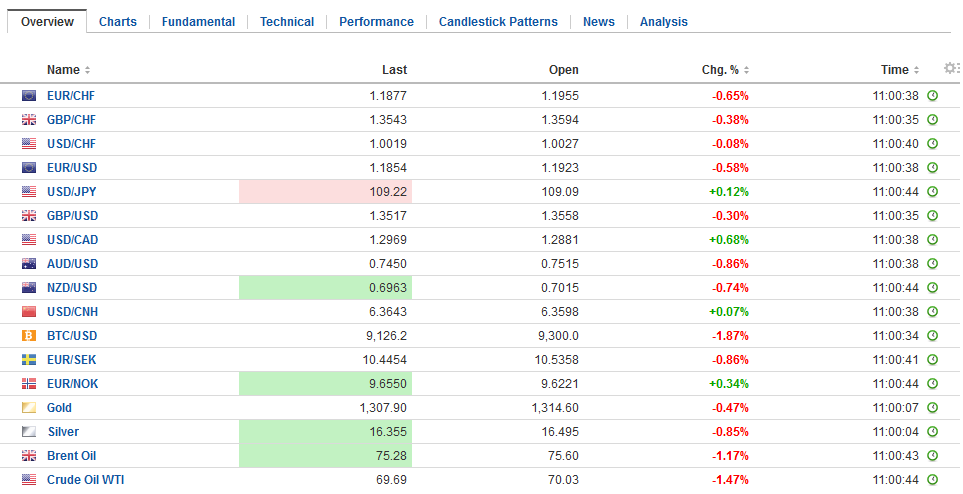

Swiss Franc The Euro has fallen by 0.56% to 1.1885 CHF. EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions. Even a rate upside surprise in European data was not sufficient to prevent the euro from plumbing to new lows for the year near .1880. There is a 1.1 bln euro option struck at .1950 that

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, China, China Exports, China Imports, China Trade Balance, EUR, EUR/CHF, Featured, GBP, Germany Exports, Germany Imports, Germany Industrial Production, JPY, newslettersent, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.56% to 1.1885 CHF. |

EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

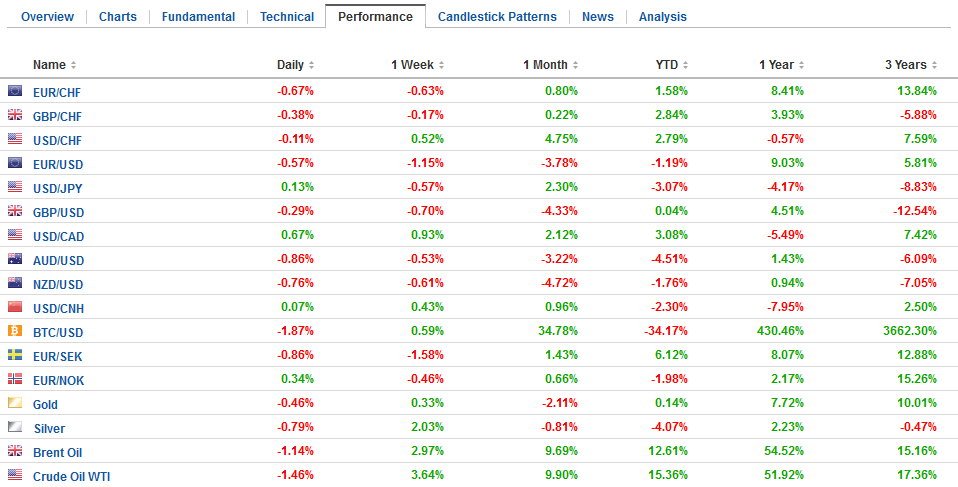

FX RatesThe US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions. Even a rate upside surprise in European data was not sufficient to prevent the euro from plumbing to new lows for the year near $1.1880. There is a 1.1 bln euro option struck at $1.1950 that expires today that may mark the cap. There is another option struck at $1.1850 for half as much that may denote the lower end of today’s range. |

FX Daily Rates, May 08 |

| The dollar bloc currencies are the weakest of the majors. The Canadian dollar is off about 0.75% against the greenback. The US dollar has been in a CAD1.28-CAD1.29 range for the most part for the past couple of weeks. Stops were triggered above CAD1.2920 that carried the US dollar approach resistance near CAD1.30. The trendline from the January 2016 high near CAD1.47 and last May’s highs near CAD1.38 and the March high near CAD1.32 comes in now near CAD1.3080.

The Australian dollar has shed a bit more than the Canadian dollar, though it had a couple of fresh fundamental developments. First, retail sales were softer than expected. March retail sales were flat after a 0.6% increase in February and amid expectations for a 0.2% gain. The average monthly gain in Q1 was 0.2%, half of the Q4 18 average. Second, the government reported its budget an debt projections. The budget deficit is projected to be a bit smaller than previously estimated, while the new net issuance is also smaller, and the net debt is now expected to peak a year early than estimated in December. While the retail sales disappointment weighed on the Aussie, sending it to new lows for the year, one would have thought the budget news was more supportive. Instead, the liquidation of stale longs was not arrested, and new lows below $0.7460 were recorded. The New Zealand dollar is falling in sympathy. It is off a little more than 0.5%. It appears to be breaking out of its week-long consolidation and is at new lows for the year. The next chart support is seen near $0.6940. The softness in Q2 inflation expectations (2.01% vs. 2.11% in Q1 on a two-year horizon) did not do Kiwi any favors. |

FX Performance, May 08 |

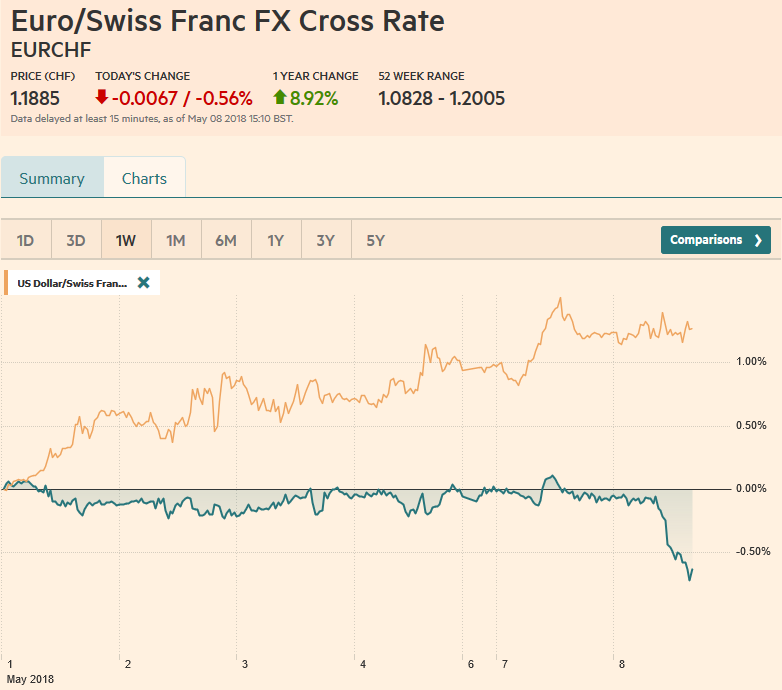

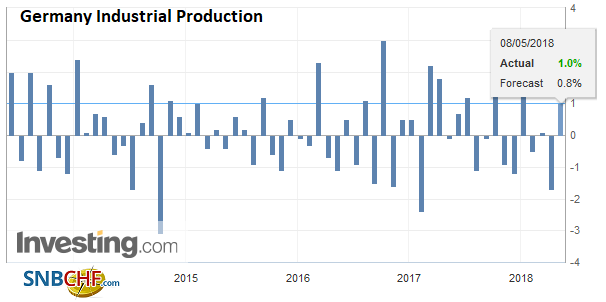

GermanyGermany reported a 1.0% rise in March industrial output compared with median forecasts for a 0.8% increase. That said, half of the overshoot was offset by the downward revision to the February series to -1.7% from -1.6%. |

Germany Industrial Production, Jun 2013 - May 2018(see more posts on Germany Industrial Production, ) Source: Investing.com - Click to enlarge |

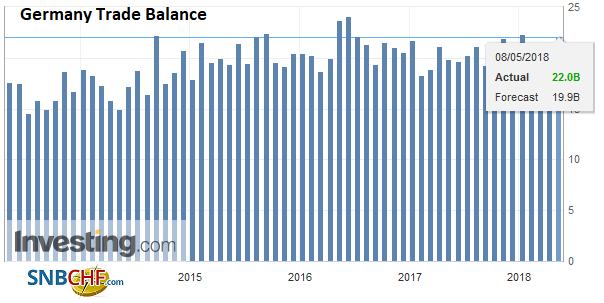

| Separately, Germany reported a larger trade and current account surplus. |

Germany Trade Balance, May 2013 - 2018(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

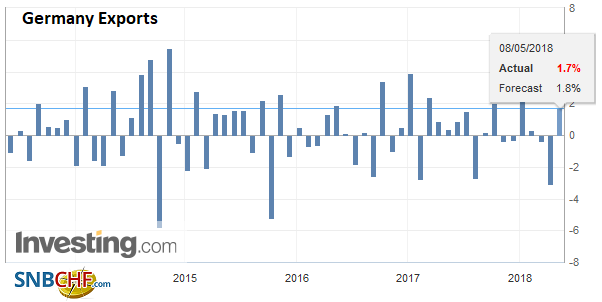

| Helped by a 1.7% rise in exports. |

Germany Exports, Jun 2013 - May 2018(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

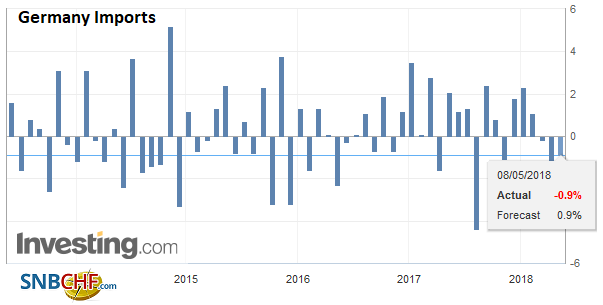

| An unexpected decline in imports, the politically-sensitive German trade surplus rose to 25.2 bln euros from 18.4 bln in February. The current account surplus jumped to 29.1 bln euros from a revised 21.7 bln. It appears to be the second large monthly current account surplus on record. |

Germany Imports, Jun 2013 - May 2018(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

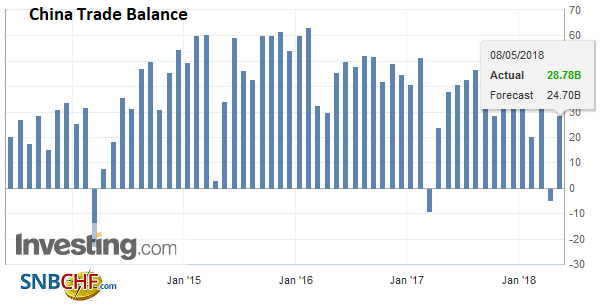

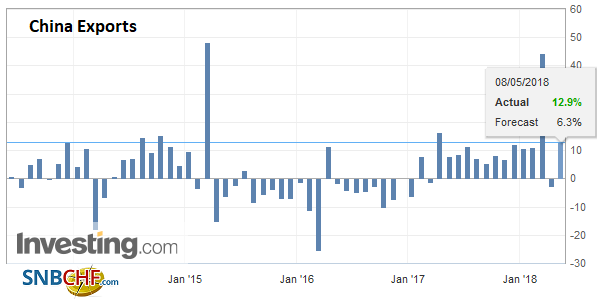

ChinaAmid the trade tensions between the US and China, China’s trade figures may not be helpful. The April trade surplus jumped to $28.8 bln from an unusual deficit in March of nearly $5 bln. |

China Trade Balance, Jun 2013 - May 2018(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

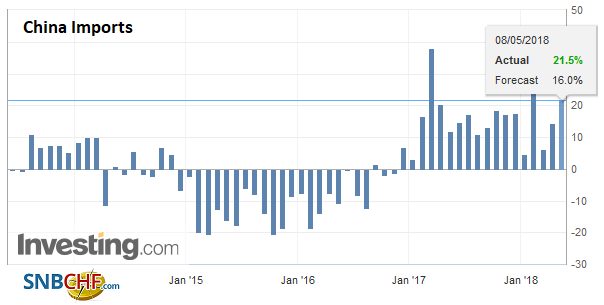

| China reported a 12.9% rise in exports and a 21.5% jump in imports. Given the kind of goods China exports, and the limited, even if rising, costs incurred in yuan, China’s sales partly a function of world growth and demand. |

China Exports YoY, Jun 2013 - May 2018(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

| China’s trade surplus with the US grew in April for the first time since last November. The anticipation of US tariffs, and other actions, like the closer inspection of US soybeans and the beginning of efforts to curtail waste imports, which we discussed yesterday, may also be impacting trade figures. |

China Imports YoY, Jun 2013 - May 2018(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

Meanwhile, the political stalemate in Italy has barely impacted the markets; until today. Italy’s stock market is off 2% (while the Dow Jones Stoxx 600 is 0.2% lower. Italy’s 10-year benchmark yield is up nine basis points.

The greenback’s recovery also is taking place as US rates stabilize. The US 10-year yield remains below 3.0%, and the volatility of the bond market (MOVE) slipped to four-month lows yesterday. The two-year note yield has been hovering about 2.50% for more than two weeks.

We suggest that the paramount macro consideration is that policymakers and investors can be more confident that the Fed’s objectives are reachable than in other major areas. This is partly true because the US expansion is sufficiently advanced that the policy goals of full employment and price stability are already at hand or nearly so. It is also partly true because of the huge fiscal stimulus in the pipeline.

At the same time, others are reporting disappointing data, which plays up a new divergence. Japan reported an unexpected drop in household spending. Economists have been looking for a recovery in the year-over-year pace to 1.0% from 0.1% in February. Instead, it fell 0.7%, the most since last April. The dollar is trading in about a 15 tick range on both sides of JPY109, where a $420 mln option is struck that expires today. Support is seen near JPY108.65 and initial resistance near JPY109.40.

Following the US delegation that went to China last week, China is sending Vice Premier Liu He to the US next week. Reports suggest that Liu had requested three things from the US at the end of last year. First, establish an economic dialogue between the two largest economies. There had a been a mechanism in place for nearly two decades that the Trump Administration ended. Second, the US should name a point person for trade issues. The US presidential system is confusing, and perhaps, more than other recent administrations, the Trump Administration seems to speak in different voices. Third, Liu wanted the US to provide a list of specific demands.

Sterling is posting an outside day, having traded on both sides of yesterday’s range. Sterling rose to almost $1.36 in early Asia but reversed lower before Europe came in and briefly dipped below $1.3500. Soft UK house prices (Halifax) was the only data of note. The Bank of England meets Thursday. Although we do not expect the BOE to hike rates given the data backdrop, we think that the odds are higher than the 10% or so being discounted. The weakness in sterling on a trade-weighted basis can be expected to boost price pressures, and at the same time, the Phillips Curve seems alive and well and with a British accent. Recall that the large double top in place points to potential toward $1.30-$1.31.

The US and Canadian economic calendars are light today. JOLTS in the US and housing starts in Canada are the main features.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China,China Exports,China Imports,China Trade Balance,EUR/CHF,Featured,Germany Exports,Germany Imports,Germany Industrial Production,newslettersent,USD/CHF