Swiss Franc The Euro has risen by 0.28% at 1.137 EUR/CHF and USD/CHF, November 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar has a heavier bias against most of the major and emerging markets currencies, but the pullback is shallow, and the greenback’s underlying strength is still evident. Asian equities were mixed. Concern that Apple may be...

Read More »Swiss Producer and Import Price Index in October 2018: +2.3 percent YoY, +0.2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »Switzerland signs up to ‘Paris Call’ for a safer internet

French President Emmanuel Macron making the call, on Monday. In Paris on Monday, several hundred governments and tech companies – and Switzerland – signed a new charter for trust and security online. In the so-called ‘Paris Callexternal link’, launched by French President Macron at the UNESCO Internet Governance Forum in Paris, signatories pledged to support “an open, safe, stable, accessible, and peaceful cyberspace”...

Read More »Cool Video: Fox Biz TV Broad Economic Discussion

I joined Charles Payne on Fox Business TV for a broad economic discussion today. Payne, like many, are concerned that the Fed continues to tighten and worries this is going to end the business cycle. He also argued that the strong dollar was a significant threat of US multinational earnings. Charles Payne on Fox Business TV In this roughly 6.5 minute clip of the entire discussion (here), I suggest that the best...

Read More »Italy’s a Low-Grade Fever Not a Crisis for EU, Strategist Chandler Says

Nov.12 -- Marc Chandler, chief market strategist at Bannockburn Global Forex, looks at issues impacting the euro and his expectations for the Italian budget. He speaks on "Bloomberg Daybreak: Americas."

Read More »Italy’s a Low-Grade Fever Not a Crisis for EU, Strategist Chandler Says

Nov.12 -- Marc Chandler, chief market strategist at Bannockburn Global Forex, looks at issues impacting the euro and his expectations for the Italian budget. He speaks on "Bloomberg Daybreak: Americas."

Read More »FX Daily, November 12: Sterling’s Losses Lead Dollar Rally

Swiss Franc The Euro has fallen by 0.20% at 1.1368 EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is enjoying broad gains against most major and emerging market currencies. Sterling, dragged down by Brexit concerns, is leading the way. With today’s losses, sterling has shed nearly 3.7 cents over the last four...

Read More »Swiss National Bank Unexpectedly Sold US Stocks In Q3, Dumping Over 1 Million Apple Shares

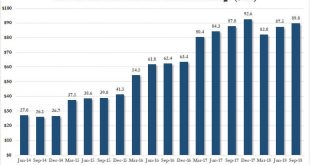

The SNB’s latest 13-F form filings (yes, the Swiss central bank lists its US equity holdings like the hedge fund that it is) to the SEC were released this week. And, like every other quarter, we take a closer look to see what stocks the world’s only hedge fund central bank that prints money out of thin air bought, and on rare occasions, sold. This was one of those rare quarters. After some modest fluctuations earlier...

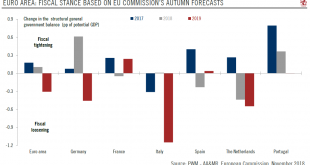

Read More »Euro area’s fiscal policy to turn supportive of growth next year

SUMMARY The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded. In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm...

Read More »Study finds ‘worrying’ suicide rates among Swiss farmers

The suicide rate among Swiss farmers is almost 40% higher than the average for men in rural areas, a study has found. The main causes are fears about the future and financial worries. A survey by the Swiss National Science Foundation (SNSF), reported in the SonntagsZeitung, found that between 1991 and 2014, 447 Swiss farmers took their lives. While the overall suicide rate among Swiss men living in rural areas has...

Read More » SNB & CHF

SNB & CHF