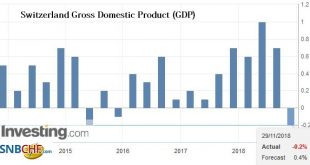

Switzerland’s GDP fell by 0.2% in the 3rd quarter of 2018 due to both the industrial and service sectors. On the expenditure side, domestic demand and foreign trade had a negative impact. Switzerland’s GDP fell by 0.2% in the 3rd quarter of 2018, after climbing by 0.7% in the previous quarter. 1 The strong, continuous growth phase enjoyed by the Swiss economy for one and a half years was suddenly interrupted....

Read More »Wage Losses for Heads of Major Swiss Firms

Not quite down-at-the-heel (© KEYSTONE / GAETAN BALLY) On average, heads of large Swiss corporations have suffered a marked drop in salary. In 2017, the median wage of the heads of 20 leading companies dropped by nearly 30%. According to the executive compensation report published by consulting firm PwCexternal link on Tuesday, the median salary of the heads of 20 firms in the leading SMI index fell from CHF7.7 million...

Read More »The Direction Is (Globally) Clear

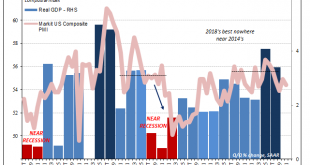

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

Read More »Charles Hugh Smith On How & Why Financial Repression Continues

Click here for the full transcript: http://financialrepressionauthority.com/2018/11/28/the-roundtable-insight-charles-hugh-smith-on-how-why-financial-repression-continues/

Read More »Santa Claus rally on the way?

Bannockburn Chief Market Strategist Marc Chandler on the outlook for stocks and the latest GDP data.

Read More »FX Daily, November 28: Powell Awaited

Swiss Franc The Euro has fallen by 0.10% at 1.1262 EUR/CHF and USD/CHF, November 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global capital markets are relatively calm as investors gird for drama. The Bank of England reports its assessment of the impact of Brexit and the stress tests a little before Fed Chair Powell speaks at midday in NY. The G20 meeting...

Read More »For The First Time In 25 Years, China Has To Make A Choice Between External Stability And Growth

Back in August 2 we reported of a historic event for China’s economy: for the first time in its modern history, China’s current account balance for the first half of the year had turned into a deficit. And while the full year amount was likely set to revert back to a modest surplus, it was only a matter of time before one of the most unique features of China’s economy – its chronic current account surplus – was gone for...

Read More »Hot weather and microbreweries boost Swiss beer sales

The brewer Christophe Haeni tastes a beer at the microbrewery “Garage”, which is part of the restaurant and bar “Barbiere” in Bern The Swiss beer market recovered last year thanks to the hot weather, as well as the continued boom in microbreweries and thirst for local craft beers. The Swiss beer market grew by 1.8% to 469 million litres (124 million gallons) between October 1, 2017 and September 30, 2018. This follows a...

Read More »FX Daily, November 27: Market Shrugs Off Latest US Tariff Provocation

Swiss Franc The Euro has fallen by 0.12% at 1.1293 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have taken the US latest tariff threats in stride. Most of the Asian equity markets advanced, including Japan, Korea, Taiwan, India, and Australia. China and Hong Kong were exceptions with marginal losses....

Read More »Swiss Among top Coffee Consumers

Two cups of coffee per day are not enough to keep the Swiss going. (Keystone) The Swiss love their coffee and knock back more than three cups per day. They came in third, behind Germans and Norwegians, in an international ranking of coffee consumers. The Swiss drank no less than 1100 cups of coffee per person per day, according to a ranking published on Monday by CafetierSuisseexternal link, a catering industry...

Read More » SNB & CHF

SNB & CHF